Trading Gap in The Open

No doubt, a gap open is the first important piece of information before the close of the first bar of the day, and it presents a great trading opportunity for most traders. Here are a few reasons why:

- When the open is a breakout of yesterday's high or low, there is a high chance of a strong trend emerging, especially in the first hour or even for the majority of the day.

- Open gaps create a stretched and swingable trading day. The open often deviates significantly from the Moving Average. If you trade it correctly, such as with an opening reversal or trade a 2nd leg in a trend, you have the potential to profit as both a bull and bear, with a favorable risk-reward ratio.

- Although a trading range day is very likely, these ranges are usually wide enough to provide opportunities for both scalpers and swing traders.

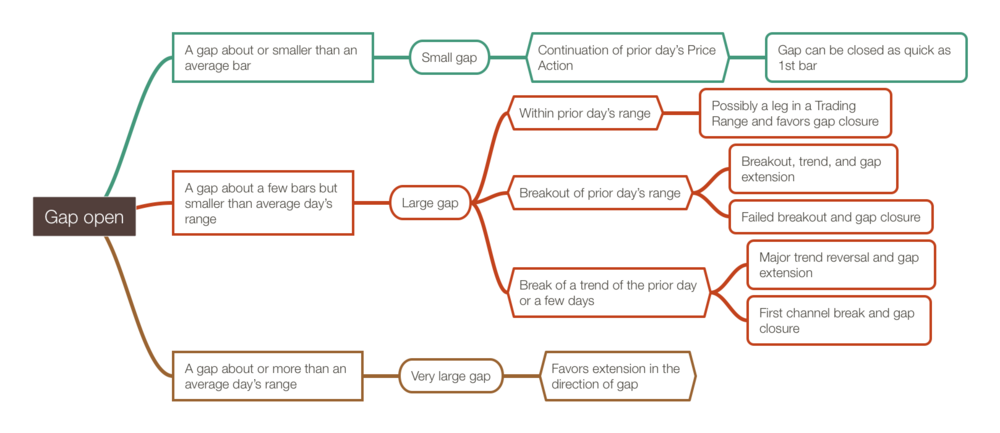

Three scenarios of gap opens[编辑 | 编辑源代码]

Whenever a gap open, two key factors need to be considered: the size of the gap and the location of the open.

For small gap opens, which are typically a continuation of the previous day's price action, we'll focus on gap opens with a range spanning at least a few average bars, i.e. large and very large gap opens shown in the figure above.

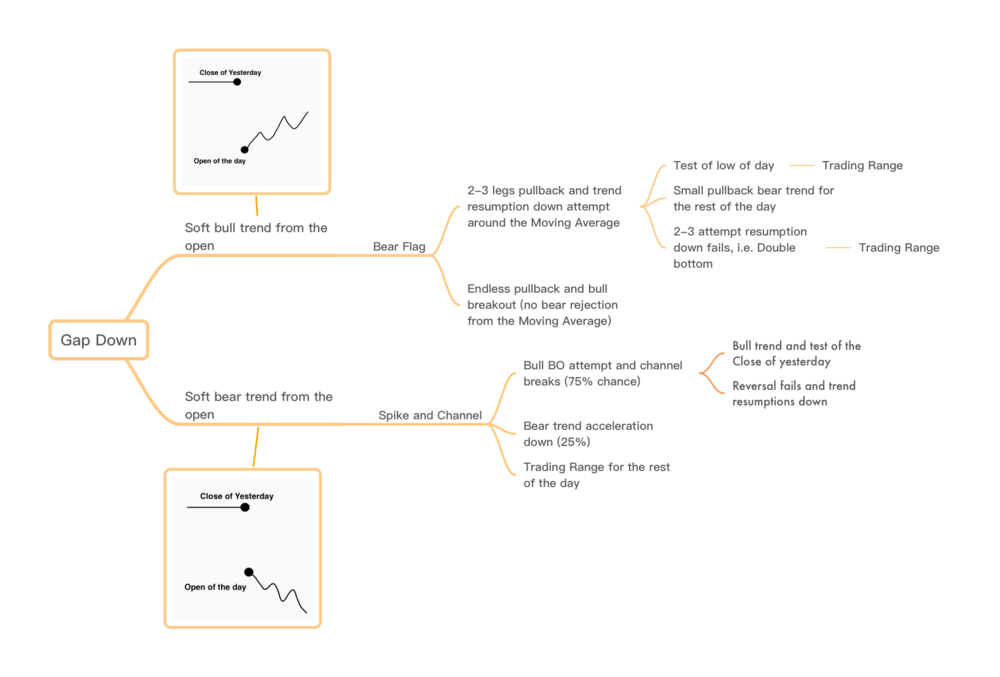

Within a few bars after the market opens, it is already possible to determine the type of opening within the first 2-3 bars. Generally, there are five types of openings after a gap: hard bull trend, hard bear trend, trading range open, soft bull trend, and soft bear trend. In most cases, regardless of the direction, the opening tends to exhibit a soft trend to some extent.

Let's take a gap down day as an example: If the market continues with a weak bear trend, the price action will exhibit a Spike and Channel, where the entire gap-down range is the spike. On the other hand, if the price action is doing a soft bull trend, then it's a pullback as a 2-3 leg bear flag (again, considering the gap distance as a large bear bar). In other words, if the soft bull trend fails, the market often continues selling-off, extending the gap and distancing itself further from the close of yesterday. As a swing trader at this point, to achieve a better risk-reward, one should anticipate the day's low point to be tested and hold onto the trend, allowing winners to run for 2-3 legs.

The Perfect Odds of 1st Reversal Setup[编辑 | 编辑源代码]

Here's an easy way to think about it: In a large gap open, traders are exposed to "price risk." In simpler terms, bulls entering after a large gap-up open may end up buying too expensive, while bears entering after a gap-down open may end up selling too cheap, right? But it's not always the case, especially the gap is one of the largest gaps in a few weeks and more than an average day's range. In this case of very large gap opens mentioned in the figure above, the market favors gap extension with a hard trend in the direction of the gap, possibly the entire day with a pause of TR around noon. So notice that the reversal setup discussed below is not for very large gap opens as they are rare.

For regular size gaps, with at least a few bars range though, it is generally reasonable to enter the market on the first reversal bar with a good-looking close (opening reversal or 1 rev setup by Cadaver). In other words, when there is a gap-down open, the first bull bar closing near its high (shaved bull bar) can be a reasonable buy signal bar with a great risk-reward ratio. Sometimes, the signal bar may appear as early as the first bar after the market opens, or it may come after several bear bars (sell climax), generally about one hour after the open. If the signal bar appears after several bear bars, the probability of success may be lower because, on the hourly chart, it's a big bar (gap) with a follow through (1st hour bar). Chances are, there are sellers around 50% of the 1st hourly bar and high of 1st hour bar, i.e. high of the day, thus TR(in gap down days). In this case, the reversal setup needs to take quick profit, probably taking out most of the positions around ema test or 50% retracement of the day.

For any swing trades, they always have a low probability of winning compared to scalpings, especially a reversal trade. Therefore, it's preferable to take profit at a 1:3 risk-reward ratio and at a minimum of 1:2. But here are a few factors you can consider to increase winning probability:

- Determine the market's open position: Is it exactly at or near a significant support or resistance level, such as yesterday's low? Has the market already tested important support/resistance levels in pre-market, indicating a reversal already in progress? If these conditions are met, entering the trade on the signal bar, even if it's the first bar, is reasonable.

- Assess the distance of the opening gap from the moving average: The greater the gap from the moving average, the higher the probability of trade success(very large gap day is an exception). This gap (to ema) represents the initial reversal "space" and provides more profit potential than 3 legs possibly. They need to climb to/around ema to find new buyers or sellers in the direction of the gap.

- Evaluate the quality of the signal bar and FT: A signal bar that fails to close near its high/low, is too small, forms an inside bar, or is excessively large can indicate a higher risk that the reversal trend will not succeed. Some smart scalpers will wait for a good signal bar and a good follow-through with both of them closing near their high/or low (1/3 of the bar) and buy pullbacks at some point where bears bailing out. For most traders, buying the close of the good FT bar is already enough to make money, plus not risking being left-out.

However, discussing the opening reversal here doesn't mean you should only look for reversals and give up a good trend from the open. If the opening reversal does happen, find weakness of the reversal around ema or 50% of the day to buy or sell again and follow the major trend. Therefore, after the market opens, the first step is to understand the market's behavior and try to catch the AM trend: Is it developing a hard buy the close/sell the close trend, a trading range, or a soft bull/bear trend after a few bars? If hard trends, fade dojis in the 1st leg; if soft trend, trade pullbacks until seeing the 3rd leg. For trading range open, consider trading a failed breakout or a failure of a failed breakout for the best probability. This major AM trend may persist for the entire day or only a few bars, depending on the context. But generally, if your trailing stops haven't been hit by the 4th or 5th leg, it can be considered a very successful swing trade.

Discussion of an example[编辑 | 编辑源代码]

I think the gap down day of April 20th, 2023 is a great example for all of the key points mentioned above.

First, bar 1 is a 1st reversal setup itself. It satisfies all three important traits of the setup: it closes above a very important support level; the distance from the bar 1 to the Moving Average is good enough to swing; it is a very good signal bar closing on its high with a good looking size. Hold on with this trend and trail stops below swing lows will give bulls 3 or 4 legs trend to ema. Another trick I noticed with gap open days is the first bar close above ema, there is always a sell the close bears, and vice versa. In this case, bar 16 is the first bar closing above ema with bar 17 is the wedge signal bar where the market gave a 1:2 swing fairly quickly. Therefore, it's always reasonable to take most of the positions out when seeing the first close above/below ema, if you traded the first reversal in a gap down/up day.

Furthermore, the reaction leg to the first close above ema matters. In this case, the follow through bar 20 closed not strong due to the tail, after the bar 19 double top signal bar. If this bar closed a medium size bear bar closing on its low, preferably with another bear bar follow though, the market would be in Always in Short instead of a trading range like this and thus most traders were willing to sell the close and willing to sell more at pullback.

On days with a large gap open, the market usually stays within a trading range at least for two hours, and it's the same case for a very large gap open(gap being more than an average day's range). After the trading range, either bulls or bears have the potential to break out, and somewhere around b40 is the key turning point (although not in this example).

The bar 54-46 already shifted the market's tone to Always In Short and signaled the failure to test the close of yesterday. This shows a shard trend instead of the AM soft trend to the ema.

Generally, hard trends have the following characteristics:

- Pullbacks in a strong trend typically result in dojis, and each bar's high is rarely tested by the next bar. For example, b57 and b59 on that day. It's quite hard for limit order scalpers to enter above bars so STC(sell the close) and sell sometimes 33% of big bars are the best options.

- Signal bars in a strong trend are strong but not excessively large (i.e. more than 2-3 average bars). For instance, bar 54 was a strong and moderately sized signal bar. Hard trends rarely have a two-leg retracement towards the moving average.

- Strong trends disregard minor support levels and focus on major ones. Buying near the moving average at b54, the retest of the b19 high, or the opening price would have been reasonable, but the market only found support until a major support level in a higher timeframe around bar 70.