TestPage

What is GAP?[编辑 | 编辑源代码]

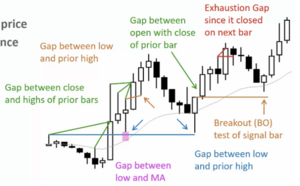

Any space between the current price and any Support/Resistance

- High, Low, Open, Close of any bar

- Moving Averages

- Trend lines

- Can be very minor

- “The air is heavy around us. The world is stifled by a thick and vitiated atmosphere — an undignified materialism which weighs on the mind and heart hindering the work of governments and individuals alike. We are being suffocated. Let us throw open the windows that God’s free air may come in, and that we may breathe the breath of heroes.

Life is stern. It is a daily battle for those not content with an unattractive mediocrity of soul. And a sad battle it is, too, for many — a combat without grandeur, without happiness, fought in solitude and silence. Weighed down by poverty and domestic cares, by excessive and senseless tasks which waste the strength to no purpose, without a gleam of hope, many souls are separated from each other, without even the consolation of holding out a hand to their brothers in misfortune who ignore them and are ignored by them. They are forced to rely on themselves alone; and there are moments when even the strongest give way under their burden of trouble. They call out — for a friend.”

Title 2[编辑 | 编辑源代码]

Title 3[编辑 | 编辑源代码]

Title 4[编辑 | 编辑源代码]

Forum: Trading Updates from Al Brooks Topic: 11-17-2009 Tuesday

AlBrooks:

1 FF, LL 5BP 8 HL but 4 bear bars 12 DT and BP2. May be HOD. 17 big RB that OLs too much. Likely bear flag 21 A2 23 W, DB, ?LOD. Mkt had DT and now DB = may be TR day. Range is about 8 pts = small, but still big enough. TR day = expect new HOD and then reversal down toward middle of day. Expect PBs on the way up. Mkt failed to go below LOY, which would have been a 2nd entry short on daily chart. If mkt cant go down, it should try up. 26 mkt keeps hitting EMA so expect it to finally move above it and then find support on PBs. When a TL or EMA gets tested so much, it usually gives way. 28 DP, HL. Hold thru PB, if any, since TR day will likely have PB and new HOD likely. 32 perfect! F L2 38 W but B BT since new HOD likely 44 BT and test of ema 49 BP 53 new HOD, bear RB, expect PB to middle of day. 61 H2 but doji SB and mkt did not test middle of range yet so more down likely 63 f H2. BW but clearly trapped longs and mkt should test 1104 or so 65 W but bigSB. 73 LH but Microchannel = only short on BP, if any 74 f MC BO 78 new HOD, W, iii but big iii bars (=TR) and late in day

mbradley: Thanks for your work Al. My question is:I identified early that it was most like a trading range today and I had success fading breakouts. As the market approached the old highs moving up from bars 66-72 I was waiting to short.I could see that there where five bull bars out of seven, so I knew to wait for a second entry.I considered bar 72 the first attempt to reverse near the highs, and then shorted below bar 73 for the second attempt to reverse the near the HOD.It only go about 2 ticks profitable.What would you see here that would make you believe that was a bad short? Best, Mike

AlBrooks: see above: 73 LH but Microchannel = only short on BP, if any

mbradley wrote (View Post): › docWrite("quote") Thanks for your work Al. My question is:I identified early that it was most like a trading range today and I had success fading breakouts. As the market approached the old highs moving up from bars 66-72 I was waiting to short.I could see that there where five bull bars out of seven, so I knew to wait for a second entry.I considered bar 72 the first attempt to reverse near the highs, and then shorted below bar 73 for the second attempt to reverse the near the HOD.It only go about 2 ticks profitable.What would you see here that would make you believe that was a bad short? Best, Mike

JoLee:

Hello Al ,

Thanks again for EOD analysis - Still puzzled why bar 1 is FF. Wasn't the flag last several bars at yesterday's close and today 1 bar a failed fBO? The definition for flags are 2 or more sideway bars after some trend, correct?

richpuer: Hello Al, It looks like the last bar on your chart here was a BP of the MC...in regards to the previous poster's question, the short would be placed 1 tick below this bar? did i read that correctly at the BP of the MC? thanks AlBrooks wrote (View Post): › docWrite("quote")see above: 73 LH but Microchannel = only short on BP, if any

jgiera:

Al,

Long list of questions but hopefully others will benefit from them too.

Was B12 DT and PB2 a 70% trade given doji SB? Which other trades today were high probablity ones?

Would you sell C of B15? 3rd attempt to break 1102 support.

Would you sell PB B16? MM down was at 1098.25 giving room for scalp + MO was strong.

B21 A2. Is A2 the same as M2S? Also, is there a difference in probability?

Was M2S B28 not best trade because of EMA testing and prior W2?

B38 you mention a new HOD likely. Is it the case on each TR day, or specifically today since e.g. MO up to B38 was strong?

B65 or B66 was a SB?

Was it reasonable to view B77 as test of trend extreme after TLBO and expect down legs tomorrow?

Thank you for EOD commentary.

AlBrooks: the last hour of Y was a W bear flag and when today gapped below its TL and then reversed up, that flag became a FF

JoLee wrote (View Post): › docWrite("quote") Hello Al , Thanks again for EOD analysis - Still puzzled why bar 1 is FF. Wasn't the flag last several bars at yesterday's close and today 1 bar a failed fBO? The definition for flags are 2 or more sideway bars after some trend, correct?

AlBrooks:

80 was the iii BP short but I recommend not taking it since the iii bars were too large and there was only 10 min left in the day. likely trap.

richpuer wrote (View Post): › docWrite("quote")

Hello Al, It looks like the last bar on your chart here was a BP of the MC...in regards to the previous poster's question, the short would be placed 1 tick below this bar? did i read that correctly at the BP of the MC? thanks

AlBrooks wrote (View Post): › docWrite("quote")see above:

73 LH but Microchannel = only short on BP, if any

AlBrooks: i talked about the setup in the audio room and said that day was setting up to be a small TR day and therefor HOD likely to be taken out and then PB to mid range. I started saying thataround B 21-23 but not sure exactly, but before 23 buy. since new HOD likely, that was a great swing. since appeared to be CT, had to expect PBs and just sit thru them, relying on original stop.

jgiera wrote (View Post): › docWrite("quote") Al, Was entry on M2S B28 best trade? Despite EMA testing you mention above?

glorfindel:

Al, I seemed to have missed how I gain access to the audio room; could you fill me in? Thanks!

BPAAdmin: glorfindel wrote (View Post): › docWrite("quote")Al, I seemed to have missed how I gain access to the audio room; could you fill me in? Thanks! The audio room is in testing mode right now and not open to the public. There will be more information available on it opening up to others in the next few days.

glorfindel: Great. Where will you be posting that information. I assume by your answer that the audio room is a definite go?

BPAAdmin: glorfindel wrote (View Post): › docWrite("quote")Great. Where will you be posting that information. I assume by your answer that the audio room is a definite go? There will be e-mails and info on the website. Nothing is yet set in stone... but I think we are headed in the right direction that will work for everyone.

richpuer: Al, what are your thoughts about using/watching the time and sales tape for large 200+ institutional trade sizes near areas where you think they are trying to defend or break? Would this help confirm your beliefs about a certain area?

BPAAdmin: richpuer wrote (View Post): › docWrite("quote")Al, what are your thoughts about using/watching the time and sales tape for large 200+ institutional trade sizes near areas where you think they are trying to defend or break? Would this help confirm your beliefs about a certain area? There was a recent change at the CME. It used to be that if you put out an order for 100 contracts and that got filled in a dozen orders of various sizes they used to do a single print of 100. Now they post each print separately. That makes it much more difficult to track blocks. What would be more accurate would be something like a chart with volume per second. I have tried watching stuff like that and it really isn't much help. You never know if someone is placing big orders going long, selling, going short, or maybe hedging some other position and it has nothing to do with technical factors of the ES. If you look at volume on a minute bar it probably tells you a lot more than trying to watch every big trade.

Maletor: Hey Al, I couldn't buy the 44 BT - it looked like a MC down. My favorite trade of the day was the 28 DP and the 44 failed new HOD. Thanks! edit: W got pushed into the close and is set up for tomorrow morning.

Nitz: I agree AL, The new rule regarding T&S reporting has made it much more dificult to see block trades. Vol is my primary indicator and although there are still some blocks posted, it is not the same as it used to be. I still do not understand why they had to make it more difficult for the retail trader and continue to stack the deck for the pros. I have tried a 5 and 10 second chart to watch the vol as it comes in but I think I was burning out my Retinas. A one min chart with simple bar vol is more than enough but you must be able to watch the vol bar as it increases/jumps in order to see the chunks of vol at a certain price point. I have been doing that for quite some time and it works pretty well as long as I have the conjestion area picked out in advance otherwise it might just be another random vol spike. just my opinion