10种最常用的BPA价格行为形态之 —— Wedges

Source: 10 best price action trading patterns

传统定义上,wedge 是一个往上或者往下倾斜的收敛三角形。交易者寻找向下降的 [wiki]wedge[/wiki]从上沿突破 ,以及向上升的 [wiki]wedge[/wiki]从下沿跌破。

The traditional definition of a wedge is a converging triangle that slopes up or down, and traders expect the breakout to be in the opposite direction of the slope. They look for an upside breakout of a wedge that is sloped down, and for a downside breakout of a wedge that is sloped up.

当wedge作为趋势中的回调出现时,他是一种持续型态。当它很大且设置正确时,它是反转形态。 当它是[wiki title="flag"]flags[/wiki] 时,它是小的反转形态。 例如,当上升趋势出现 [wiki title="W PB"]wedge pullback[/wiki] 时,它 就是小的熊腿。 交易员预计该熊腿会失败并反转。

Wedges are continuation patterns when they are pullbacks within trends, and they are reversal patterns when they are large and the context is right. When they are flags, they are small reversal patterns. For example, when there is a wedge pullback in a bull trend, the wedge is a small bear leg. Traders expect that bear leg to fail and to reverse up.

从广义上来说,wedge 是任何向上或向下倾斜、有三推(有时是四推或五推)的波浪。 它不一定是收敛的,而且第三推也不必超过第二推。

In the broadest sense, a wedge is any pattern with three (sometimes four or five) pushes that is sloped up or down. It does not have to be convergent and the third push does not have to exceed the second.

一旦出现二推,交易者就可以画一条连接它们的线,然后他们可以将线向右延伸。 当市场的第三推接近该线时,他们将留意反转的机会。

As soon as there are two pushes, traders can draw a line connecting them and then they can extend the line to the right (a trend channel line). They will then watch for a reversal if the market approaches the line for a third time.

任何形态越接近标准,它就越可靠,因为更多的计算机会将其视为重要的。 然而,交易者永远不应该忽视其他潜在的因素,并且应该学会适应每一种形态的每一种可能的变化。 这将为他们提供更多的交易机会。

The closer any pattern is to ideal, the more reliable it is because more computers will treat it as significant. However, traders should never lose sight of the underlying forces and should learn to become comfortable with every conceivable variation of every pattern. This will give them far more trading opportunities.

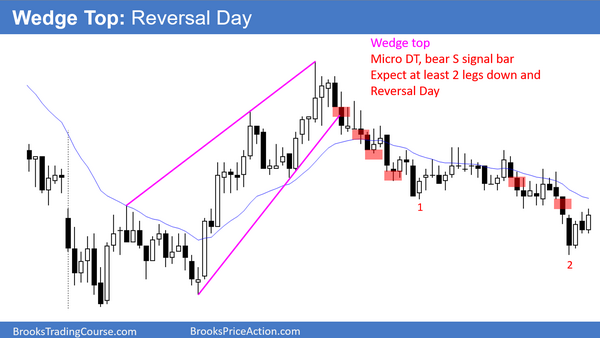

Wedge top 是正在收敛的 bull channel。 大多数 wedge top 有 3 个 legs,但有些有第 4 个leg,很少有第 5 个 leg。 交易者在收于其低点附近的 bear bar 下方卖出,并预计至少会再下跌 2 个 legs。 该 legs 通常细分为更小的leg。 任何 bull channel 都应被视为 bear flag,因为有 75% 的机会跌破 bull trend line。

A wedge top is a bull channel that is converging. Most wedge tops have 3 legs up, but some have a 4th and rarely a 5th. Traders sell below a bear bar closing near its low and expect at least 2 legs down. The legs often subdivide into smaller legs. Any bull channel should be viewed as a bear flag since there is a 75% chance of a break below the bull trend line.

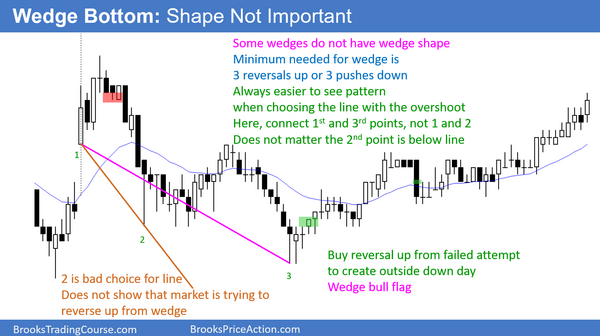

Wedge 很少是完美的,而且大多数看起来不像教科书 wedge。 如果 bear channel 有 3 个向下的 leg,即使 channel 没有 wedge 的形态,也应将其视为 wedge。 同样的力量在起作用: 市场试图反复下跌,但不断逆转上涨。在某些时候,交易员决定需要尝试另一个方向(向上)。

Wedges are rarely perfect, and most do not look like a textbook wedge. If a bear channel has 3 legs down, even if the channel does not have a wedge shape, view it as a wedge. The same forces are at work. The market is trying to go down repeatedly, but keeps reversing up.

At some point, traders decide it needs to try the other direction (up).

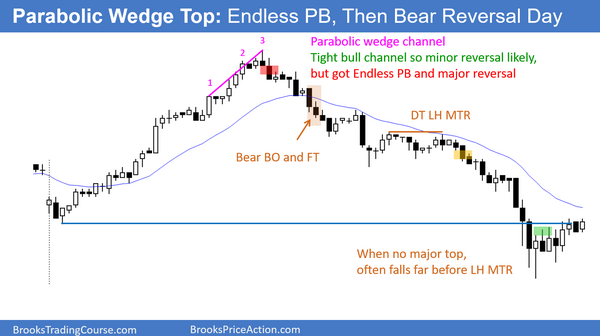

如果在 tight bull channel 中出现 3 次波动,则该通道是一个 parabolic wedge。 这是一个 buy climax,它可以导致一个 trading range,甚至是 bear trend reversal,就像这里一样。

If there are 3 surges in a tight bull channel, the channel is a parabolic wedge. This is a buy climax and it can lead to a trading range, or even a bear trend reversal, like here.