阿布答疑:突破,持仓还是离场?

Source: Ask Al: Breakouts, when to exit or hold?

Question 1: Al, if you buy a breakout, how do you determine when to get out breakeven and when to hold through the pullback?

问题1:如果你买了突破,你怎样确定什么时候止损平仓,什么时候坚持持有回撤?

Video duration: 6min 02sec

刮头皮还是波段? Scalp or swing?[编辑 | 编辑源代码]

For me, it depends on what your goal is. This comes down to scalp versus swing. If I’m buying a breakout and I’m doing it for a scalp, I don’t want the market to come back. I’m pretty quick to get out. If I think that a pullback is acceptable, a lot of times I’ll scale in during a pullback. But if I’m looking at a pullback and I’m saying, “Wait a minute, it should not be doing that,” then I get out.

For a swing trade, depending on how big of a swing, and how far the target is, you have to allow pullbacks. You have to assume that there’ll be pullbacks. As long as your premise[1] is valid and as long as the market — in this case, a bull trend — as long as every pullback stays above the most recent breakout low.

对于我来说,这取决于您的目标是什么。这归结为刮头皮与波段的区别。如果我正在购买突破并且我是为刮头皮而做的,我不希望市场回调到我的入场点,所以我很快就会离场。如果我认为回调是可以接受的,很多时候我会在回调期间逐步加仓。但是,如果我正在看回调并且我说:“等一下,不应该这样做,”那么我就选择离场了。

对于波段交易,取决于波段程度和目标的远近,您必须允许回调,而且您必须假设会有回调。只要您的假设还未证实无效的,只要市场(以牛市为例)每次回调都保持在最近的突破低位之上。

反转信号 Reversal signal[编辑 | 编辑源代码]

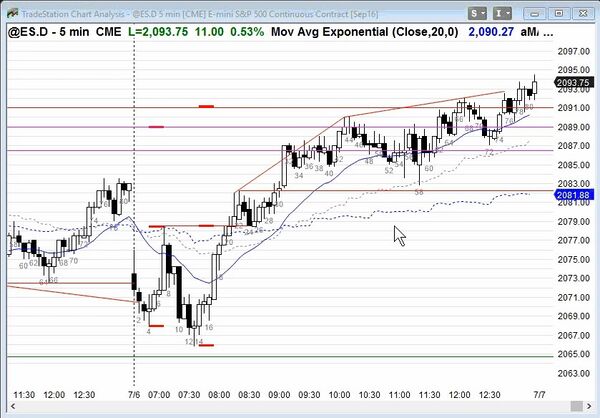

Sometimes you'll get a reversal signal before the market falls below a low. So let's say you're long up here [B44/45], your stop is down here [below B38]. But let's say you decided to short below 57 or below 64, taking a chance for a Major Trend Reversal, that's okay. So, you can get out even though it's still Always In Long. But the Always In Long bulls strictly speaking, until they see a strong reversal down, they stay long as long as it's staying above the bottom of their last leg up.

有时候在市场跌破低点前,您会看到反转信号。假设您在这里(44/45)做多,您的止损位在这里(低于38)。但是,假设您认为 Major Trend Reversal (MTR)正在进行中,决定在57以下或64以下做空 ,那也可以。因此,在 Always In Long(AIL)的情况下,您也可以离场。如果依照 Always In Long 严格要求,在看到强烈的逆转K线之前,只要市场保持在上一个上升趋势的底部以上,多头就会一直持仓。

Question 2: When there’s a breakout like 61. While it is happening, how do differentiate from 28 or 38, to enter with market orders? How do you know how large the bar will be?

问题2:当出现像61这样的突破时,如何在发生时把它与28或38区分以市场订单进入?你怎么知道K线的大小会是多少?

每次都要先看形势 Always review context[编辑 | 编辑源代码]

Okay, so he’s saying when you get a breakout like 61 right here and he’s comparing it to 28 or 38. Now first of all, context is a little bit different. Here we get a wedge bull flag, we’re getting late in the day, 11:30 for trend resumption or trend reversal. And then also as 61 was forming, I tried, it was going up very quickly—I placed a limit order to buy a two tick pull back. And instead of pulling back, it went up like three or four ticks and I was thinking to myself, “Oh, that’s bad. That’s bad. I’m going to get trapped out.” So I just hit ‘Buy the Market’ and I keep my fingers crossed.

当61的突破正在进行时,我们要如何拿它来与28或38比较? 首先,形势有点不同。 在这里(61),我们有个wedge bull flag(WBLF),而且这时候已经是太平洋时间晚上11:30(北京时间凌晨2点半),一般在这时间我们都会看到趋势恢复或趋势逆转。 然后,当61正在形成时,它上涨得非常快,我尝试用了一个限价单来购买两个tick的回调。 但是,与其回调,它反而上升了三或四个tick,我正在想“哦,那糟糕了。我会失去入场的时机。” 于是我就只好以市价单立刻入场,然后希望市场会继续上升。

快速做决策 Decide quickly[编辑 | 编辑源代码]

It’s like when you are a kid, you’re jumping off a high board for the first time. You stand up there and you hesitate and then you say, “I’m just going to do it.” So you bring your arms in tight and your knees up to your chest. Your cheeks are puffed up, you pinched your nose, your eyes are squeezed really hard, and you just jump and hope for the best. So when things are doing that, when they’re going up really quickly, you just don’t know. You have to decide quickly.

I knew that I wanted to buy and I usually try to buy with a limit order. And I probably did buy on a limit order on 28 or 27 or 37. Because that’s what I typically do. But here [36/49/57], I thought that we had a wedge and a micro double bottom like we’d go to the bottom and that we had the potential to get up to the 60-minute moving average for the high of the day so I thought there was a potential for a breakout.

就像当你还是个孩子,第一次在泳池跳下高台时那样,你站在那里犹豫不决,然后你说:“我只需鼓起勇气做就行了。”你把手臂紧贴在身体两侧,将膝盖抬到胸前,你的脸颊鼓起来,捏住鼻子,紧闭双眼,然后你就跳下去,希望一切顺利。所以当事情发展得很快时,而你根本不知道该怎么做,你必须快速做决策。

我知道我想入场,我通常会尝试用限价单购买。我可能在28或27或37时以限价单购买,因为那是我通常会做的事情。但是在这里[36/49/57],我认为我们有wedge(W)和micro double bottom(MDB)在底部形成支撑,而且我们有可能测试60分钟移动平均线,所以我认为这个突破并不是假突破。

留意趋势恢复或趋势反转的迹象 Look for trend resumption or reversal[编辑 | 编辑源代码]

And it’s really easy to get lulled into indifference when you’re in a sideways market for 2 hours like that. But around 11, 11:30, 12, I always start to pay a lot more attention. And I look for trend resumption or trend reversal. So, for me, you’re saying how do I know 28 and 38 are not going to be strongly bullish. Well, first of all, 28 — tight bear channel – it’s probably a minor reversal. And 38, right now, it’s a second leg up in a trading range day, and it’s just not all that big so I’m not too certain about that.

Here, we’ve got a wedge higher low and a very big bull-bar, the biggest bull-bar of the day, and we’re breaking out of what I think is a wedge bull flag or a triangle. And I tried to buy and could not buy the way I typically buy. So it’s probably something atypical about what’s going on. The character of the market might change.

当你一直在想这样处于交易区的市场中连续交易了2个小时,你很容易对于市场的波动变得冷漠。但是大约在太平洋时间11点、11点半或12点左右(北京时间凌晨2点至3点之间),我总是开始更加留意市场任何趋势恢复或趋势反转的迹象。因此,你想知道28和38会不会强烈看涨:首先,28是处于tight bear channel(TBRCH),所以这可能只是次要反转;而38是交易区间日的第二个上涨,而且它的涨幅并不是很大,所以我对与会不会强烈看涨并不太确定。

在61,我们有 wedge higher low 和一个非常大的阳线,甚至是当天最大的阳线,我们还正突破 wedge bull flag 或 triangle(TRI)的区间。另外,我试图做多但无法以我平常的方式入场,所以市场的性质可能将会发生变化。

Question 3. You mentioned that you missed the buy on the close of 61. What told you that it was a breakout while still in a sideways trading range? 问题3. 你提到错过了61的尾盘买入机会。在当时仍处于交易区间,是什么让你认为这是一个突破?

限价单K线 Limit order bars[编辑 | 编辑源代码]

Well, two things. You’ve got this big-bull reversal bar, you always hear me talk about those bars being limit order bars with sellers above. Those sellers are scalpers. If the context is good, here we’re in a bull trend, at the moving average, I think most of the time you make a profit buying above 58. But you need a wide stop. And the alternative is instead of buying above 58, you place a limit order to buy a 50% pull back. And then 61, now we have a second entry buy setup, with closing on its high at the moving average. To me, that’s even a higher probability buy than buying above 58.

这里有两点你需要注意:57是一个很大的反转阴线,你常听我谈论这些K线会吸引空头在这K线的上方挂限价单,那些空头都是刮头皮交易员。如果形势不错,就像在这里我们正处在多头趋势中,而且在移动平均线上,我认为大多数的时候你在58上方的位置做多会盈利,但你需要一个宽松的止损。另一个选择是,不是在58以上买入,而是在50%回调处挂限价单。然后,在61我们有了一个第二次入场的机会,这K线在移动平均线上收盘接近高点。对我来说,这比在58以上买入有更高的概率。

做正确的事 The right thing to do[编辑 | 编辑源代码]

And [second thing] I talk, sometimes have stuff I have to do on the phone, doctor’s appointments, and contractors, who knows what. And my mother sometimes calls. She’s always amusing to me.

What happens is, she’ll call and she’d say “Al. Did you call?” And I know what she’s saying – she’s saying that she’s lonely. And she may be faking it. I don’t know, maybe half the time she says that nobody called, and she just wants to talk to me. So I say “Oh? No Ma, but I can talk.” So whenever she calls, I always take the call. I always speak with her a couple of times a week. And that results in me — it costs me money. But it’s still the right thing to do so I do it.

我有时必须在电话上处理事务,如医生预约和与承包商洽谈等。我母亲有时也会打电话来,她总是逗我开心,她会打电话来问我“Al,你打电话了吗?”。我知道她的意思是她很孤独,有时她可能是在假装,这我无法确定,也许有一半的时间她会说没有人打电话,她只想和我聊天。所以我会说 “哦?妈,没有,但我可以和你聊天。”所以,每当她打电话来,我总是会接听,而且我每周都会和她交谈几次。虽然这样在电话聊天会花费我不少钱,但这仍然是正确的事情,所以我这么做。交易也是如此,你必须做正确的事情。

- ↑ video 52B