10種最常用的BPA價格行為形態之 —— Wedges

Source: 10 best price action trading patterns

傳統定義上,wedge 是一個往上或者往下傾斜的收斂三角形。交易者尋找向下降的 [wiki]wedge[/wiki]從上沿突破 ,以及向上升的 [wiki]wedge[/wiki]從下沿跌破。

The traditional definition of a wedge is a converging triangle that slopes up or down, and traders expect the breakout to be in the opposite direction of the slope. They look for an upside breakout of a wedge that is sloped down, and for a downside breakout of a wedge that is sloped up.

當wedge 是在趨勢內回撤時,它是一種整理形態。當它很大且設置正確時,它是反轉形態。 當它是[wiki title="flag"]flags[/wiki] 時,它是小的反轉形態。 例如,當上升趨勢出現 [wiki title="W PB"]wedge pullback[/wiki] 時,它 就是小的熊腿。 交易員預計該熊腿會失敗並反轉。

Wedges are continuation patterns when they are pullbacks within trends, and they are reversal patterns when they are large and the context is right. When they are flags, they are small reversal patterns. For example, when there is a wedge pullback in a bull trend, the wedge is a small bear leg. Traders expect that bear leg to fail and to reverse up.

從廣義上來說,wedge 是任何向上或向下傾斜、有三推(有時是四推或五推)的波浪。 它不一定是收斂的,而且第三推也不必超過第二推。

In the broadest sense, a wedge is any pattern with three (sometimes four or five) pushes that is sloped up or down. It does not have to be convergent and the third push does not have to exceed the second.

一旦出現二推,交易者就可以畫一條連接它們的線,然後他們可以將線向右延伸。 當市場的第三推接近該線時,他們將留意反轉的機會。

As soon as there are two pushes, traders can draw a line connecting them and then they can extend the line to the right (a trend channel line). They will then watch for a reversal if the market approaches the line for a third time.

任何形態越接近標準,它就越可靠,因為更多的計算機會將其視為重要的。 然而,交易者永遠不應該忽視其他潛在的因素,並且應該學會適應每一種形態的每一種可能的變化。 這將為他們提供更多的交易機會。

The closer any pattern is to ideal, the more reliable it is because more computers will treat it as significant. However, traders should never lose sight of the underlying forces and should learn to become comfortable with every conceivable variation of every pattern. This will give them far more trading opportunities.

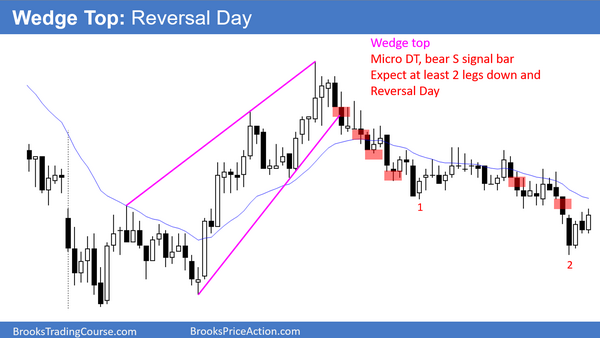

Wedge top 是正在收斂的 bull channel。 大多數 wedge top 有 3 個 legs,但有些有第 4 個leg,很少有第 5 個 leg。 交易者在收於其低點附近的 bear bar 下方賣出,並預計至少會再下跌 2 個 legs。 該 legs 通常細分為更小的leg。 任何 bull channel 都應被視為 bear flag,因為有 75% 的機會跌破 bull trend line。

A wedge top is a bull channel that is converging. Most wedge tops have 3 legs up, but some have a 4th and rarely a 5th. Traders sell below a bear bar closing near its low and expect at least 2 legs down. The legs often subdivide into smaller legs. Any bull channel should be viewed as a bear flag since there is a 75% chance of a break below the bull trend line.

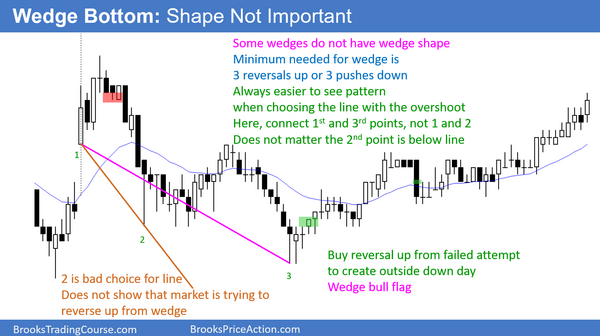

Wedge 很少是完美的,而且大多數看起來不像教科書 wedge。 如果 bear channel 有 3 個向下的 leg,即使 channel 沒有 wedge 的形態,也應將其視為 wedge。 同樣的力量在起作用: 市場試圖反覆下跌,但不斷逆轉上漲。在某些時候,交易員決定需要嘗試另一個方向(向上)。

Wedges are rarely perfect, and most do not look like a textbook wedge. If a bear channel has 3 legs down, even if the channel does not have a wedge shape, view it as a wedge. The same forces are at work. The market is trying to go down repeatedly, but keeps reversing up.

At some point, traders decide it needs to try the other direction (up).

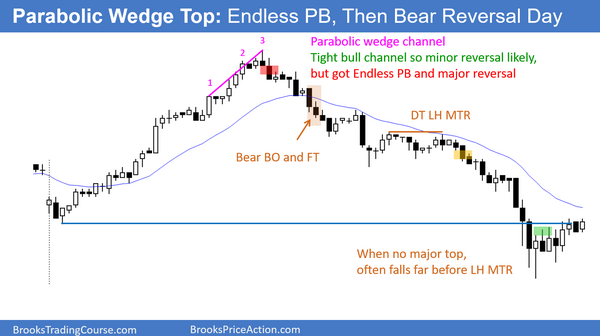

如果在 tight bull channel 中出現 3 次波動,則該通道是一個 parabolic wedge。 這是一個 buy climax,它可以導致一個 trading range,甚至是 bear trend reversal,就像這裡一樣。

If there are 3 surges in a tight bull channel, the channel is a parabolic wedge. This is a buy climax and it can lead to a trading range, or even a bear trend reversal, like here.