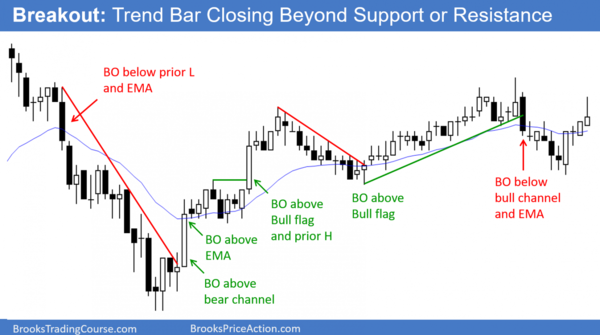

10種最常用的BPA價格行為形態之 —— Breakouts

突破(Breakout,BO)什麼呢? 可以是任何支撐或阻力,但這並不重要,因為每根趨勢棒都可以說是對某個位置的突破,即使只是從前一根K線的高點或低點。隨著經驗的積累,交易者會逐漸看清市場真正在突破什麼。

Breakout of what? Of any support or resistance. It does not matter. Every trend bar is a breakout of something, if only the high or low of the prior bar. With experience, traders begin to see what is truly being broken out.

市場最常突破的位置包括區間(TR)、回撤(PB)、先前的高點與低點、趨勢線(TL)、通道(CH)和均線(MA),但有的時候交易者需要切換到更高的時間框架才能看到市場在突破什麼。

The most common things are trading ranges, pullbacks, prior highs and lows, trend lines, channels, and moving averages. Sometimes traders need to switch to a higher time frame to see the breakout.

在這10種最佳價格行為形態中,突破是我的最愛,因為我喜歡高概率交易。

Among the 10 best price action trading patterns, breakouts are my favorite because I like high probability trades.

一個突破其實就是一個向上或向下的趨勢棒,這個趨勢棒至少會收在一個弱支撐之下(當向下突破時),或者弱阻力之上(當向上突破時)。突破的K線越大,被突破的支撐或阻力越重要,該突破所造成的趨勢持續更長時間的可能性就越大。

A breakout is simply a trend bar up or down. A breakout always closes beyond at least minor support or resistance. The bigger the bar and the more important the support or resistance, the more likely the trend will continue at least a little longer.