Inside bar reversals

http://ninetrans.blogspot.com/2011/10/inside-bar-reversals.html

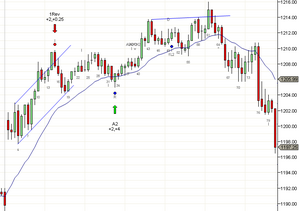

Inside bars reversals are pretty hard to read accurately. Why did the breakout below b11 fail but b15 give a scalp profit? Why did b44 take out the stop beyond the entry bar (b44) before giving a scalp profit making it a poor signal while b62 turned into a great swing trade?

All these bars had strong closes yet two failed and two succeeded. Using a little bit of common sense, we can reduce our chances of taking an unprofitable inside bar entry. b12 is the first attempt to break the trend and failure is expected. B15 was the second attempt and an overshoot, so it should give at least a pullback.

Similarly b44 was the first attempt to fail a strong breakout (b41 was 50%+ beyond prior HOD) and was unlikely to work. b62 on the other hand was a third push up after a trendline break (TL b4-b25) and a TCL overshoot.

Swing moves often end with inside bars and these are usually great with trend entries. For example, b19 ii indicated a possible swing end as did b54.

To Summarize:

- Inside bars are excellent signal bars for failed breakouts but not for any arbitrary reversal. It can be argued that b15 and b62 were breakout failures while b11 and b42 were not.

- Inside bars make good signals when there is a TL or TCL violation

- Inside bars are good signals with-trend or at the end of swings

內包K線是相當難以準確解讀的。為什麼低於b11的突破失敗了,而b15卻獲得了頭皮利潤?為什麼b44在給出頭皮利潤之前就把止損帶出了入場k線(b44),使其成為一個糟糕的信號,而b62卻變成了一個偉大的波段交易? 所有這些k線的收盤都很強勢,但有兩個失敗了,兩個成功了。利用一點常識,我們可以減少我們採取無利可圖的內包K線進場的機會。B12是打破趨勢的第一次嘗試,失敗是意料之中的。B15是第二次嘗試,也是一次超跌,所以它至少應該給出一個回撤。 同樣的,b44是第一次嘗試強勢突破失敗(b41超出之前HOD的50%以上),不太可能成功。另一方面,B62是趨勢線(TL b4-b25)突破和趨勢通道線(TCL)超出後的第三次上漲。 波段走勢經常以內包K線結束,而這些通常是很好的趨勢入口。例如,b19 ii和b54一樣都表明可能是波段結束。 總結一下: 內包K線是突破失敗的絕佳信號槓,但不是任何任意反轉的信號槓。可以說,b15和b62是突破失敗,而b11和b42則不是。 當趨勢線(TL)或趨勢通道線(TCL)被突破時,內包k線是很好的信號。 內包K線是趨勢中或波動結束時的好信號。