Inside bar reversals

http://ninetrans.blogspot.com/2011/10/inside-bar-reversals.html

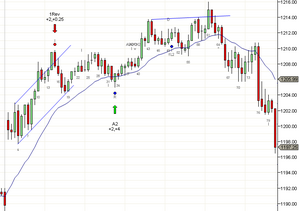

Inside bars reversals are pretty hard to read accurately. Why did the breakout below b11 fail but b15 give a scalp profit? Why did b44 take out the stop beyond the entry bar (b44) before giving a scalp profit making it a poor signal while b62 turned into a great swing trade?

All these bars had strong closes yet two failed and two succeeded. Using a little bit of common sense, we can reduce our chances of taking an unprofitable inside bar entry. b12 is the first attempt to break the trend and failure is expected. B15 was the second attempt and an overshoot, so it should give at least a pullback.

Similarly b44 was the first attempt to fail a strong breakout (b41 was 50%+ beyond prior HOD) and was unlikely to work. b62 on the other hand was a third push up after a trendline break (TL b4-b25) and a TCL overshoot.

Swing moves often end with inside bars and these are usually great with trend entries. For example, b19 ii indicated a possible swing end as did b54.

To Summarize:

- Inside bars are excellent signal bars for failed breakouts but not for any arbitrary reversal. It can be argued that b15 and b62 were breakout failures while b11 and b42 were not.

- Inside bars make good signals when there is a TL or TCL violation

- Inside bars are good signals with-trend or at the end of swings

内包K线是相当难以准确解读的。为什么低于b11的突破失败了,而b15却获得了头皮利润?为什么b44在给出头皮利润之前就把止损带出了入场k线(b44),使其成为一个糟糕的信号,而b62却变成了一个伟大的波段交易? 所有这些k线的收盘都很强势,但有两个失败了,两个成功了。利用一点常识,我们可以减少我们采取无利可图的内包K线进场的机会。B12是打破趋势的第一次尝试,失败是意料之中的。B15是第二次尝试,也是一次超跌,所以它至少应该给出一个回撤。 同样的,b44是第一次尝试强势突破失败(b41超出之前HOD的50%以上),不太可能成功。另一方面,B62是趋势线(TL b4-b25)突破和趋势通道线(TCL)超出后的第三次上涨。 波段走势经常以内包K线结束,而这些通常是很好的趋势入口。例如,b19 ii和b54一样都表明可能是波段结束。 总结一下: 内包K线是突破失败的绝佳信号杠,但不是任何任意反转的信号杠。可以说,b15和b62是突破失败,而b11和b42则不是。 当趋势线(TL)或趋势通道线(TCL)被突破时,内包k线是很好的信号。 内包K线是趋势中或波动结束时的好信号。