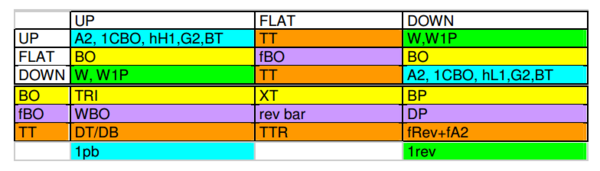

Setup Chart off Nine Transitions

Setup Chart Read this first: Four trades off nine transitions

This chart describes all my setups from the nine transitions.

When the trend is up, I'm looking for A2 in a normal trend, 1chbo in a channel move, H1 in a hard trend and G2 in a deep pullback.[1]

Im also looking to exit and stay out when the trend ends in a Trend termination (TT) move such as a double top, TTR or weak reversal followed by weak A2.

If there is a wedge move and reversal, Im looking for W and W1P entries to reverse.[2]

Down trend is very similar except all entries are complementary.

When the movement is flat or trading range, Im looking for trend breakouts. usually these are triangle breakouts, expanding triangle breakouts and breakout pullbacks.[3]

If the range is large enough, I may consider fBO trades. These include a reversal bar on breakout, Double bottom pullback and a two or three legged failed breakout (WBO).[4] Often I will not take these trades and simply take one of the breakout on the other side of the range.

TT is not something to trade but rather a sign to exit your trend positions. A double top or double bottom, a TTR move or a reversal and continuation trade that both do not have follow through are the most common trend termination signals.[5]

In addition to the above, I also trade the first reversal of the day and the first pullback of the day at the open,[6] but those are complex topics that deserve their own posts.

A2: A second attempt to reverse a pullback move near the ema. A second failed attempt to reverse the trend and therefore a continuation signal. If its too far from the ema it may not qualify to be an A2

1CBO: The first break of a channel move. This is usually expected to fail and is a signal to enter in the direction of the channel

hH1: H1 in a hard trend. (H1: The first time a bar ticks above the high of a previous bar in a down move. First attempt to reverse a down move. )

G2: If the G fill attempt fails, a second G bar is G2. This is a higher probability trade. (G: Gap bar. The first bar in a down move whose high is below ema or first bar in an up move whose low is above ema. If this bar is bullish in a bear move, its a buy signal and vice versa.

BT: A breakout test (BT) is a pullback to -1t to +2t of your original entry. Essentially, this means that the traders are re-affirming the original trade and the price is likely to continue in the same direction. BTs are an important indicator or trend continuation. BT is one of the rare places where you can treat a doji bar as a valid signal bar.

W: Wedge. Three pushes up with the third push overshooting a trend channel line or at least touching it. A reversal signal makes it a W reversal

W1P: The first pullback that allows an entry in the new direction after a W reversal

- ↑ A2: A second attempt to reverse a pullback move near the ema. A second failed attempt to reverse the trend and therefore a continuation signal. If its too far from the ema it may not qualify to be an A2 1CBO: The first break of a channel move. This is usually expected to fail and is a signal to enter in the direction of the channel hH1: H1 in a hard trend. (H1: The first time a bar ticks above the high of a previous bar in a down move. First attempt to reverse a down move. ) G2: If the G fill attempt fails, a second G bar is G2. This is a higher probability trade. (G: Gap bar. The first bar in a down move whose high is below ema or first bar in an up move whose low is above ema. If this bar is bullish in a bear move, its a buy signal and vice versa. BT: A breakout test (BT) is a pullback to -1t to +2t of your original entry. Essentially, this means that the traders are re-affirming the original trade and the price is likely to continue in the same direction. BTs are an important indicator or trend continuation. BT is one of the rare places where you can treat a doji bar as a valid signal bar.

- ↑ W: Wedge. Three pushes up with the third push overshooting a trend channel line or at least touching it. A reversal signal makes it a W reversal W1P: The first pullback that allows an entry in the new direction after a W reversal

- ↑ BO: Breakout pullback. Price pulls back often back inside the price action barrier that was broken. TRI: Triangle XT: Expanding triangle BP: Breakout pullback. Price pulls back often back inside the price action barrier that was broken.

- ↑ fBO: A failed breakout. Most first attempts to breakout fail. Rev bar: Reversal bar DP: A pullback that gives a long entry after a double bottom or a short entry after a double top WBO: a two or three legged failed breakout

- ↑ TT: Trend termination, such as double top, TTR or weak reversal followed by weak A2. It is exit (but not reversal) signals. DT/DB: Double top/double bottom TTR: Tight trading range fRev + fA2: failed reversal + failed A2. A reversal and continuation trade that both do not have follow through.

- ↑ 1rev: The first reversal of the day. 1pb: The first pullback in a day or the first pullback after 1Rev.