分類:SBLT

This is the top category for all trends that can be categorized as "Strong trend". Note that all the cases discussed below are using bull trend as example, bear trend vice versa.

Characters of Strong Trend[編輯 | 編輯原始碼]

Major Signs To Look For (the more the better)[編輯 | 編輯原始碼]

- 3+ consecutive bull bars closes on high, or 2 especially large CC bull bars close on high.

- If looking for trend-from-the-open trend, better with 3+ big trend bars starts from the open, for e.g. 20210421 XLB.

- BLTFO becomes more likely especially when the trend bar size is significantly bigger than yesterday's average bars.

- Bars stay well above EMA for most of the time.

- Strong trend days are usually very respectful to 20 EMA, which makes it usually a good place to enter the trend, even sometime the pullback can seem very strong (like 3+ consecutive bars or 1 or 2 big bear bars) to scare weak bulls out and trap weak bears.

- One or two very strong bull bar, or 3+ smaller but consecutive bull bars at EMA.

- In a strong bull trend, there is often strong buying pressure at EMA. For e.g. good buy signal bar at EMA, example: 20210412 UAL.

- Sometime instead of a good signal bar, the strong BP can be represented by 3+ small but consecutive bull bars at EMA, example: 20221122 bar 28-31, and 36-39.

- Bear bars are usually relative smaller.

- In strong bull trend, bear bars are usually relative smaller, at least not larger than the average size of past 20 average bull bars. If bear bars are significantly bigger, traders need to be cautious about possible reversal.

- 2+ gaps created by trend bar.

- Good bear signal bars quickly turns into bear trap.

- In strong bull trend, good bear signal bars quickly turns into bear trap, i.e. aggressively bought by bulls, indicating many bulls can not wait to buy at lower price, example: bar 15-16 on 20230106.

- Some time strong bull trend reverses up from far below EMA to far above EMA.

- Strong BO above or vacuum test(strong bull reversal) of some major S/R (support and resistance) on the chart.

- Big gap up or down, which increases the probability of trend day, but the trend can be either up or down.

- There is a strong breakout on higher time frame, for e.g. 15 mins or hourly chart.

Signs of Very Strong Bull Spike[編輯 | 編輯原始碼]

- Consistently fast moving price up in relative small range.

- Very less sudden move in opposite direction.

- Pullback is small, usually doesn't pullback beyond 50% of prior bull bar, indicating bulls quickly buy PB whenever there is any.

- During the pullback when there is an abrupt bear move, the bear move usually stops right away, pause and then goes up quickly, which indicates bulls buying the PB aggressively in the bull spike.

Caution[編輯 | 編輯原始碼]

- Strong trend but TR open. If a strong bull trend but there was reasonable strong selling pressure in the open, bears likely to try again in the final 1/3 of the day.

- One way to evaluate the buying pressure of reversal in the pullback of a bear trend: hide the initial strong BO and look at the remaining chart. see a few example on 20210427, MVIS is a healthy bear trend but DOCU and TQQQ is not.

- When reversing up strongly from far below EMA(usually gap down), look for strong BO across EMA. Sometime if there is a pullback after the initial BO of EMA, buy above a BLBCH after the pullback, e.g. buy above 21 on PYPL. Vice versa.

What to Expect in Strong Bull Trend Day[編輯 | 編輯原始碼]

- Most strong trend pull back to EMA after 1:30PM ET.

- A healthy strong trend is resistant to SPY moves, for e.g. if SPY is going down, the stock might be in a TTR.

- If a strong trend is to last all day, it usually needs at least two successful BO. (Al, 3-12-2021) e.g. 20210423

- Sometime the PB to EMA can be deep, and close to turning it to always-in-short, which actually is probably the best time to buy.

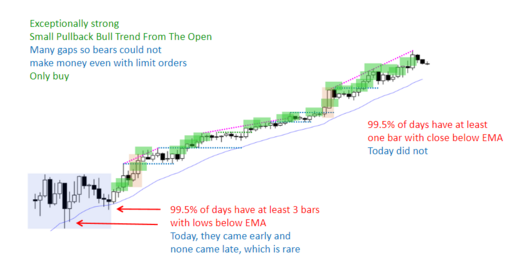

- No matter how strong the trend is, 99.5% of the day it gets to EMA sometime during the day. If strong bull trend day (more than 50 bars above MA), 99.5% of the time there are at least 3 bars with L below EMA. No matter how strong the trend is, 99.5% of the day there is at least one bar closes below the EMA (Example of the 0.5% case: 20221122). vice versa.

- During a strong trend 80% reversal attempt will fail.

- Usually gets at least 2 hours of TR in middle of the day.

If it is to Become a Reversal Day[編輯 | 編輯原始碼]

- Usually there is a good strong signal bar, AND good follow through bar, for e.g. 20210513 CMCSA, or 20210518 TWTR.

- If the follow through selling is weak, for e.g. even there are consecutive bear bars but bars are smaller comparing to the prior breakout bull bars and have tails, even the pullback can last longer then usual, there is good chance of bull trend resumption, so better hold, e.g. 20210513 KHC, but this usually means losing more if it does become a successful reversal.

- The bull pullback in the bigger bear reversal bars should usually be less than 50%.

Management[編輯 | 編輯原始碼]

- 尋找入場機會時,S/R是首要需要觀察的因素,Pattern上的某些細節次之。

- Full size入場,最好使用money stop。(入場時可能會有些緊張,需要密切觀察是否會馬上reverse,是否可能是trap)

- 無論是初始進場還是scale in higher,signal bar最好close on its high.

- 入場時的stop是bottom line, 如果市場要hit the stop,正說明對trend的判斷是錯誤的,市場可能不是trend而是trading range,而判斷錯誤是正常的,要接受自己的錯誤判斷。

- 入場後如果市場反着走,唯一考慮的是如何合理get out,而不是考慮scale in。因為scale in lower不是此系統內的策略,所以要堅決杜絕scale in的想法和做法。不謹慎的scaling in會造成很多心理問題最終導致巨大虧損。

- When entering in a pullback, the initial leg should be strong enough; when entering breakout, the initial leg should be strong enough. So both time needs to be strong enough. Bad example of not strong enough but entered, FAS. Be aware breakout is high probability trade, but pullback is lower probability trade.

- Always enter or exit using

stop order. - Do not trade correlated stocks at same time, because their chart are similar and if trading them both at the same time it is essentially same as double the size, which means doubled the risk. Bad example RIOT and MARA.

- Stick to the original stop for at least the 2nd half position, you need to gain profit as much as possible to cover the loss for those trades that stops are hit.

- Be more careful in 3rd part of the day, which usually means exit quickly if market goes against you. For e.g. if it has been a bear trend for 2/3 of the day, if there was reasonable strong bull reversal attempt earlier in the day, bulls may try reversal again in final 1/3 of the day, so get out earlier and no need to hold to original stop. Bad e.g. RIOT and MARA.