分類:PWT-O

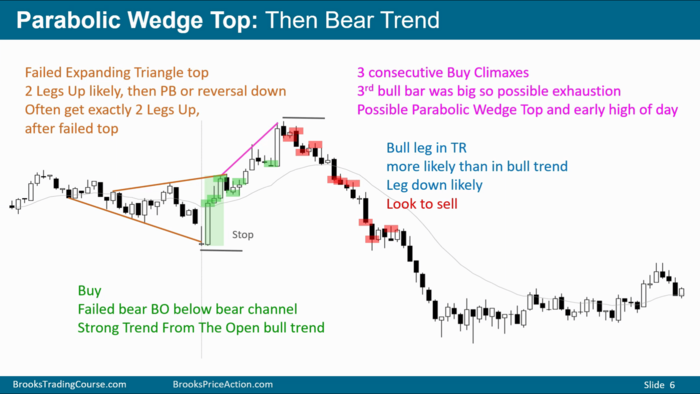

Parabolic wedge top from the open, a type of BXFO, look for ORVD. Typically in a PWT opening reversal, if it is to reverse successfully, it usually goes down in a fairly tight channel for 5 - 10 bars ⚠️ [1], if instead it goes 5 or 6 bars and sideways or bounces, then it is probably NOT going to be a PWT followed by a strong bear trend (like the one below).

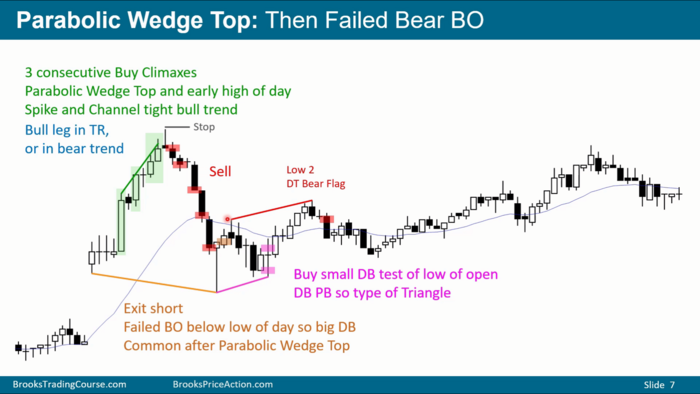

Below is an example of failed PWTFO, notice that after the PWT, market went sideways instead of a tight bear channel for 5 - 10 bars like the chart above.

A lot of times, when you get a parabolic wedge selloff after the buy climax (PWTFO) (when this happens it is also a BDBU pattern at the same time) and it get to LOD, you do get a big reversal up (bounce), market is deciding whether to go for a MM based on the height of the buy climax from the open, or instead either go sideways or bounce in a bull channel (BLCH).

- ↑ 49A, slide 11