交易手冊:新手應以停損單入場

Source: Beginners should enter with stop orders

Beginners should only enter with stop orders. He often waits for many bars before he finally finds a trade that he is confident will make him money. He very often then watches the market reverse quickly and stop him out, and it occurs to him that he would have made a profit had he done the exact opposite of his trade.

Over time, he comes to accept that it is important to respect the institution taking the other side of every trade because 40-60% of the time, that institution will win and he will lose. That is the nature of trading. During strong breakouts, the probability of continuation can be 70% or higher, but the stop is then far away.

Remember, there always has to be a reason for an institution to take the other side. If you have high probability, then it has a big reward relative to risk. Other than during strong breakouts, the probability that the market will move 10 ticks (or any number) up before going down 10 ticks is between 40 and 60% (「the 40 – 60 rule」). If he always goes for a reward that is at least twice as big as his risk, he will have a positive Trader’s Equation. This means that he will make money over time if he manages his trades correctly.

初學者只應使用止損單進入市場。他經常等待很多K線之後才找到一個他有信心能賺錢的交易機會。然後,他發現市場很經常迅速反轉並止損出局,同時意識到如果他完全相反地進行交易,他本來可以獲得利潤。

隨著失敗的增加,初學者開始不得不尊重與對手盤(機構)的重要性,因為在40-60%的時間裡,對手盤(機構)會贏而他會輸。這就是交易的本質。在強烈突破時,延續的可能性可以達到70%或更高,但此時的止損位置需離得很遠。

記住,機構為何選擇與你對立的一方必須有合理的理由。如果有高概率,那麼相對於風險來說,回報將很大。除了在強烈突破時,市場在下跌之前先上漲10個點(或任何數字)的概率在40%至60%之間(「40-60法則」)。如果你總是追求回報至少是風險的兩倍,那你交易的數學優勢就是正向的。這意味著,如果正確管理交易,他將長期獲利。

註:2盈虧比的勝率通常是40%,剩下的60%虧損則是通過訂單管理減小風險。

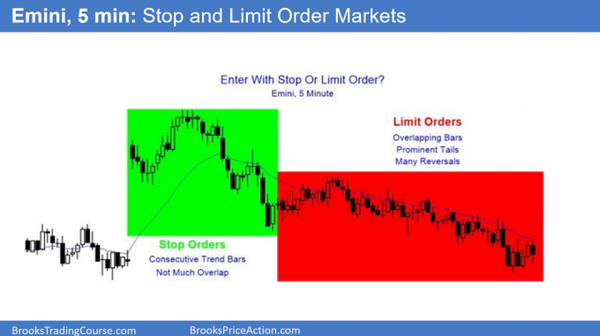

Either stop order market or limit order market

In general, traders should look at any market as either a stop entry type of market or a limit order type of market. Also, traders should assume that every limit order is the opposite side of a stop order. If you buy on a stop at one tick above the high of the prior bar, you should assume that the institution taking the other side entered with a limit order.

If you shorted with a limit order at the high of the prior bar, you should assume that the institution that bought the other side of your trade entered with a stop order. Obviously, you never know who took the other side of your trade or how or why they did, but it does not matter. As a trader, you should look at every breakout, even a breakout above or below the prior bar, as likely to succeed or fail.

止損單與限價單

一般來說,交易者應將市場視為止損單類型的市場或限價單類型的市場。此外,交易者應假設每個限價掛單都是一種止損委託的對手盤。如果你在前一根K線高1 tick的價格止損單買入,你應該假設與你的對手盤機構是通過限價單做空。

如果你以限價單在前一根K線的高點做空,你應該假設與你交易的機構是通過止損委託入場的。顯然,你永遠不會知道是誰接受了你交易的對方,或者他們是如何以及為什麼這樣做的,但這並不重要。作為交易者,你應該將每次突破,即使是突破前一根K線的高點或低點,視為有可能成功或失敗的。

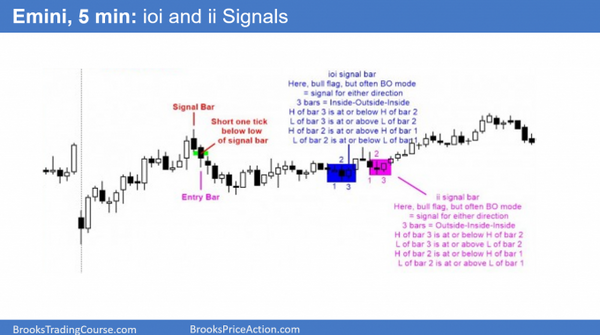

The entry bar is the bar when you enter a trade and the signal bar is the bar before, which gives you a reason to enter. An ioi pattern and an ii pattern are also signals. Depending on their location, they can sometimes be breakout mode setups, which means that traders will be willing to buy a breakout above or sell a breakout below the patterns.

入場K線是指進入交易時的K線,而信號K線是前一個K線,它給你進入的理由。一個ioi信號k和一個ii信號k。根據它們的位置,它們有時可以成為突破模式的設置,這意味著交易者將願意在圖案上方突破或下方突破時進行買入或賣出。

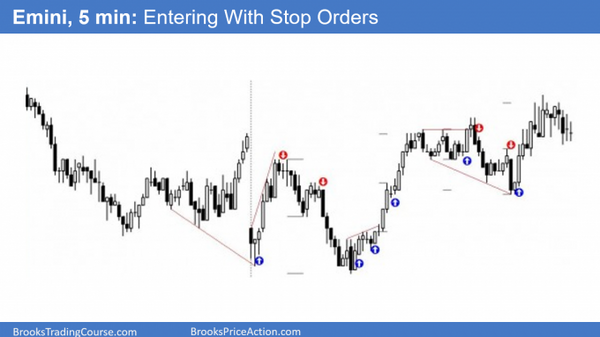

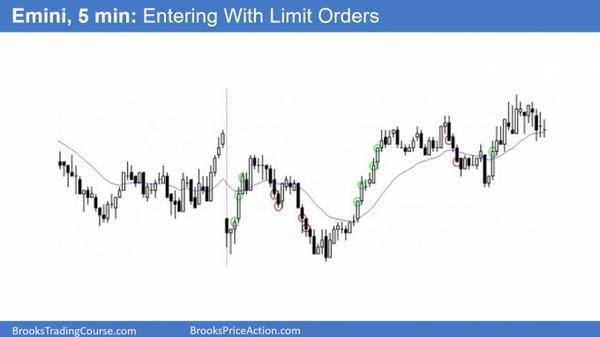

Beginners should stick to entering with stop orders because the market is then going their way for at least one tick. However, more experienced traders recognize that there are times (like the area in red where the market is in a tight trading range and weak bear channel) when limit orders are more profitable.

They will then switch and buy below bars in the bottom half of a range or channel and scale in lower for scalps, and they will also sell with limit orders above bars in the top half of the range or channel and scale in higher for scalps.

初學者應該堅持使用止損單進行進場,因為市場至少在一個點上是順著他們的方向走的。然而,更有經驗的交易員會意識到有時候(比如紅色區域,市場處於緊窄的交易範圍和弱勢熊市通道),限價訂單更具盈利性。

他們會切換策略,在範圍或通道底半部分的柱形圖下方買入,並在低位逐漸擴大倉位,以賺取小幅利潤。同時,他們還會使用限價訂單,在範圍或通道上半部分的柱形圖上方賣出,並在高位逐漸擴大倉位,以賺取小幅利潤。

Need to structure sensible trade

Once you have an opinion, if you can structure a trade that makes sense, then you can take the trade. For example, if there is a small bull flag at the top of a trading range, you know that most breakouts fail, and therefore the probability is that the sellers will overpower the buyers at the high of the prior bar.

This means that you can consider shorting with a limit order at the high of the prior bar. A bull might be willing to buy with a stop order above that bar, taking the opposite side of your trade. However, he knows that the probability of his trade is small. He is willing to take it because he also knows that if the breakout succeeds, the rally might go for at least a measured move up, based on the height of the trading range.

The result is that he took a low probability trade (one where he knew that he would probably lose), but since the reward was so much greater than the risk, he knew that the math was still good for him.

需要構建合理的交易

一旦你有了觀點,如果你可以構建一個有意義的交易,那麼你可以進行這筆交易。例如,如果在交易區間的頂部出現一個小的牛旗形態,你知道大多數突破都會失敗,因此很大概率空頭會掛限價單在這根信號線上方。

這意味著你也可以考慮在 這跟信號K設立一個限價單進行空頭交易。多頭可能願意用一個停損指令在該柱體上方買入,與你的交易形成對立。然而,他知道自己的交易概率很小。他願意冒險是因為他也知道,如果突破成功,行情可能會至少上漲一個根據交易區間高度一倍。

結果是,他進行了一筆低概率的交易(他知道他很可能會虧損),但由於回報遠遠超過風險,他知道數學仍然對他有利。

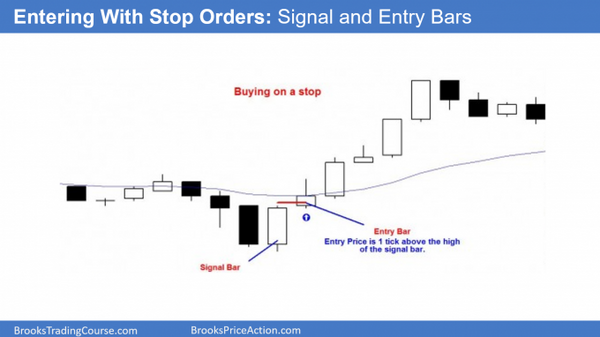

Beginning traders should enter with stop orders, for example, buying one tick above the high of the signal bar on a stop.

初學者交易者應該使用止損單進行交易,例如,在一個止損單上,以信號k的高一個跳點的位置掛單。

High probability is easier to manage

Although the math is good for either side of the trade, high probability trades are easier to manage. This is because low probability trades often look bad for many bars after entry, and the trader is constantly tempted to exit. If he exits too many before they reach their targets, he will not get those infrequent big wins that are needed to offset his frequent small losses, and he will lose money.

The high probability side is easier to manage because, by definition, you will probably make money on every trade. This means that you can mess up occasional trades and still end up profitable over time. This obviously sounds great, but it is not easy.

Remember, there has to be something in it for the other side. If you get high probability, he gets big reward relative to risk. This means that you get small reward relative to your risk. In the EURUSD, if you are buying a strong breakout on the 5 minute chart and you enter on the fourth bar of the breakout, your stop is below the low of this four bar rally, which might be 50 pips (ticks) away.

Also, since you are entering late, the profit that remains in the trade is less, and your reward might be only as big as your risk, instead of two or more times greater than your risk. Some traders prefer high probability trades, and that is mostly due to their personalities. Since they are going for high probability, the reward is small, and they are therefore scalpers.

高概率更易管理

儘管數學上適用於交易的雙方,但高概率交易更易管理。這是因為低概率交易在入場後的幾根K線往往看起來不好,交易者總是忍不住想要退出。如果他在交易到達目標前太多次退出,他將無法獲得那些小概率的大盈虧比交易,以抵消頻繁的小虧損,結果會虧錢。

高概率這邊更容易管理,因為根據定義,你在每筆交易上可能賺錢。這意味著你可以偶爾弄砸交易,但長期來說仍然能獲利。這聽起來很棒,但卻也不容易。註:因為低盈虧比。

記住,多空雙方一定是共贏的局面。如果你獲得高概率,對方就會獲得高盈虧比。這意味著你的盈虧比就會小。在EURUSD上,如果你在5分鐘圖上買入一個強勢突破,並在突破的第四根K線入場,你的止損可能是低點下方的50個pips之外。

此外,由於你進入較晚,交易中剩下的利潤較少,你的回報可能只是與你的風險相當,而不是兩倍或更多。一些交易者更喜歡高概率交易,這在很大程度上與他們的個性有關。因為他們追求高概率,回報較小,所以是刮頭皮交易。

Most traders swing trade and scalp

The best scalpers can win on 90% of their trades. However, most successful traders cannot trade this intensely long term and prefer to take trades where the reward is at least twice as big as the risk. This means that they win about 40% of the time. Their initial stops might get hit about 40% of the time, and the rest of the trades are small losers and winners that mostly offset each other. Since the reward is at least twice the risk, they have a solid mathematical approach to trading.

This is the type of approach that most traders should use. In general most of their entries should be with stops, buying at one tick above the high of the prior bar and putting a protective stop one tick below the bar, or shorting at one tick below the low of the prior bar and putting the protective stop one tick above that bar.

I always want to see how the market responds when it reaches support and resistance areas, and I devote a lot of time in the course explaining how to spot the areas that the institutional computers will calculate as potential support and resistance. In the example below, I highlighted several by drawing lines on the chart.. Traders will take partial or full profits around support and resistance orders and it is therefore important to know where they are.

大多數交易員進行擺動交易和刮頭皮。

最佳的刮頭皮交易員可以在90%的交易中獲勝。然而,大多數成功的交易員無法以這種高度強度的方式進行長期交易因為盈虧比低於1。2盈虧比的擺動交易則更好。這意味著他們大約有40%的勝率。他們的初始止損也會有大約40%的時間會觸發,其餘的止損則是小虧損和小盈利,基本上會相互抵消。由於獎勵至少是風險的兩倍,他們在交易中採用了可靠的數學方法。

這是大多數交易者應該採用的方法。一般來說,他們大多數的進場應該設置止損,即在前一根K線的高點上方一個跳點的價格買入,並將保護性止損設置在該K線之下一個跳點的位置上,或者在前一根K線的低點下方一個跳點的價格做空,並將保護性止損設置在該K線之上一個跳點的位置上。

當市場達到支撐位和阻力位時,我總是想看看它是如何反應的,並且在課程中花了很多時間來解釋如何觀察支撐位和阻力位,這些都是機構預判的潛在阻力支撐位。在下面的示例中,我通過畫圖形來突出顯示了幾個。交易員會在支撐位和阻力位附近部分或全部獲利,因此了解這些位置非常重要。

I think that one of the most important skills to develop is the ability to assess the strength of buying and selling pressure. The highest probability trades usually occur during breakouts, and if you can learn how to determine the strength of a breakout and the likelihood of the trend continuing, you are giving yourself a strong edge.

For example, below is the same chart, but with green circles highlighting reasonable long entries on the close of bars and red circles highlight closes that are reasonable shorts as soon as the bar closes.

我認為,交易員最重要的技能是能夠評估買賣壓力的強度。最有可能的交易通常發生在突破時,如果你能學會如何判斷突破的強度以及趨勢延續的可能性,那麼你將給自己一個強大的優勢。

例如,下方是同一張圖表,但用綠色圓圈標出了合理的買入機會,即在價格線收盤時進行買入,並用紅色圓圈標出了合理的賣出機會,即在價格線收盤後進行賣出。