10種最常用的BPA價格行為形態之 —— Final Flags

https://www.brookstradingcourse.com/price-action/10-best-price-action-trading-patterns/

Final Flags[編輯 | 編輯原始碼]

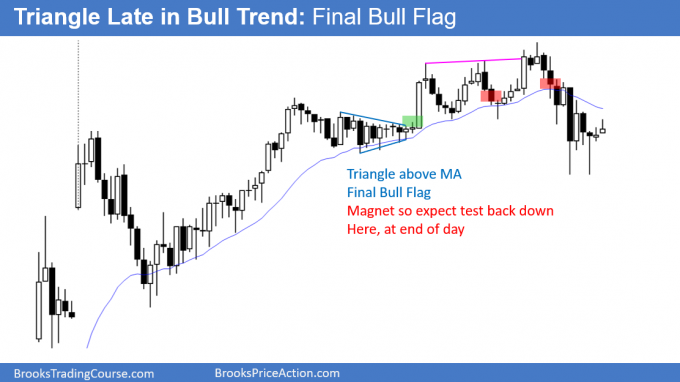

一個Final Flag需要滿足以下幾個基本要素:

- 一個比較清晰的趨勢 (Trend)

- 一個常常呈水平方向的回調(不同於楔形回調),有時它可以簡短得只有一根K線 (在高一些時間框架下其實就是II) (Pullback that is usually mostly horizontal. It can be as brief as a single bar) (On HTF, it actually is an II pattern)

- 當前的趨勢比較接近某個磁力位 magnet(上升趨勢中的阻力,下跌趨勢中的支撐)(Trend is typically close to a magnet (resistance in a bull, support in a bear))

- 一些其他反轉跡象(比如在上漲趨勢中,在通道頂部附近賣壓開始積累、變強)(There are likely other signs of a possible reversal (in a bull, examples include building selling pressure near the top of a channel))

Final flag指的是在某個特定情況下,一個反轉以一種「順勢的形式」作為其反轉過程的開始,此「順勢的形式」從現有的趨勢的方向看是一個順勢的牛旗或者熊旗,但當反轉成功後回頭看,此牛旗或者熊旗常被看做最終旗形,因為它是舊趨勢徹底結束之前的最後一個牛旗或者熊旗[1]。在交易最終旗型時,交易者認為舊趨勢的延續即將失敗,他們已經準備好開始進行與舊趨勢方向相反的交易。(A final flag is a trend reversal pattern that begins as a continuation pattern. Traders expect the continuation to fail and are ready to take a trade in the opposite direction. )

與所有的反轉交易一樣,最終旗形反轉後走出一個成功的Swing的概率通常只有40%[2]左右,對此我的基本原則是TBTL,也就是說一個成功的波段至少有 10 bars & two legs (TBTL)。同時,一個Swing也意味着回報至少是風險的兩倍 (這是我對一個成功的波段交易的最低標準)。(Like all trend reversals, the probability of a swing is usually only about 40%. My general goal is 10 bars 2 legs, which means a swing that has at least Ten Bars and Two Legs (TBTL). A swing also means a reward that is at least twice as large as the risk (my minimum criterion for a successful swing). )

做波段交易60%的結果都是小幅盈利或小幅虧損,它們之間會相互抵消。追求高成功概率的交易者通常會等待在反轉方向出現一個強勁的突破,那時,這個波段交易的成功概率通常為60%或更高,但止損位也會因為已經發生的突破被拉得很遠,因此也就意味着更大的風險,但這是這種類型的交易者為了更高的成功率所必須付出的代價。因為機構是市場上的主要參與者,我們的任何一個賣出或者買入交易,都必須有機構在另外一邊相應買入或者賣出,如果一個你想獲得更高的成功率,你就必須接受更差的盈虧比(我們必須默認機構和我們同樣聰明)。(Sixty percent of the trades result in small wins and losses that usually balance each other out. Traders who want a higher probability usually will wait for the reversal to have a strong breakout in the new direction. At that point, the probability of a swing trade is often 60% or more, but the stop is far away. That increase in risk is the trade-off. There always has to be something in the trade for the institution taking the other side of your trade. If you get great probability, you pay for it with bad risk/reward (reduced reward relative to risk).)

問答:

- 這裏的最終旗型會不會是更類似MTR的一種?我記得每次Al提到MTR的成功率都是40%,然後Al一般只會說scalp,swing,還有minimum scalp size,而文中的波段交易屬於哪一種?答:最終旗型Final Flag其實是MTR Setup的一種,相對來說,「標準的」MTR屬於比較「正常」的或者「典型」的反轉形態,比較強調首次反轉嘗試有足夠的力度,雖然其常常在EMA附近失敗,但卻為後面的成功第二次反轉打下基礎。相對於典型的MTR反轉,Final Flag反轉有更多的Vaccum Test的意味,以Final bear flag為例,在呈水平方向的回調出現時,多空雙方力量實際上已經接近均衡狀態,當後面的Bear breakout出現時,無論是尚未離場的Swing bears還是剛剛short的Scalping bears都開始選擇止盈,此時對這個Final flag比較有信心的多方也開始買入,從而造成了一種真空效應,這種真空效應,也往往發生在MSR附近。

- ↑ 末端旗形:你預計主趨勢已經過度,尋找一個反轉形態。末端旗形經常可能出現雙底,雙頂或者以三重推的楔形方式出現。 Charles

- ↑ At the other extreme is swing trading for a profit that is at least twice as large as his risk. Most of these setups are only 40 to 50 percent certain Book:CHAPTER 24 Scalping, Swinging, Trading, and Investing 我的理解是swing至少2RR,scalp 0.5-1RR。?Zagh