Category:BGD

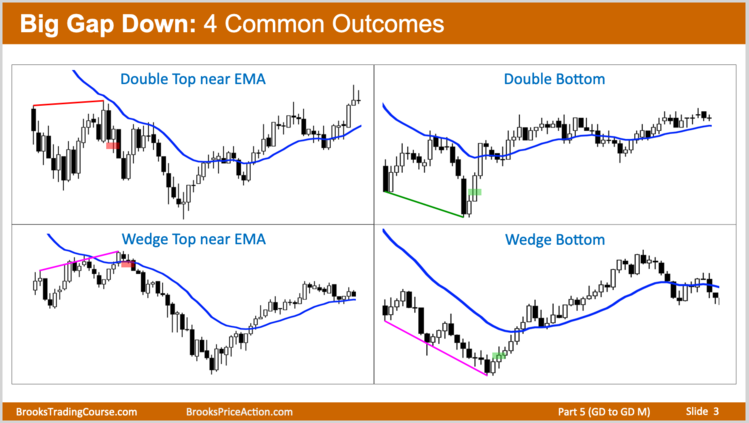

Big Gap Down, should be looked as a big BRBCL, i.e. a strong bear BO, hence, it increases the chance of a trend day, but note that the trend can be up or down. The bears want a double top or wedge top on a pullback to near the EMA. The bulls want a double bottom or wedge bottom for an early low of the day.

When there is a BGD, odds favor bears:

- 85% chance of PB in first 2 hours. 80% chance of at least one reversal attempt in the first hour (i.e. some kind of TR on the open), which also means at least one minor reversal that lasts at least 5 bars.

- 75% chance trending TR day. 70% chance swing down after 1pm ET.

- 65% chance the gap will not close today. 60% chance of swing down in 1st hour.

- if instead it is going up, often pulls back 50% in wedge bull channel.

Worth to mention, if the gap down is overly big, i.e. a HGD, it increases chance of TRO that lasts a couple hours since it might take that long to get near EMA[1].

80% of days: 4 common outcomes after BGD

20% of days: Trend from the open

- BRTFO

- BLTFO