术语

- 17t

- Category:17t ➟ More about 17t'

- 20GB

- Twenty Gap Bars, about 20 consecutive bars that have not touched the moving average. In bull case, 80% chance of testing prior high after pullback to EMA in SPBLT, but may pullback more first. There is 70% chance of profit taking after the new high[1]. ➟ More about 20GB'

- 41t

- Category:41t ➟ More about 41t'

- 5t

- Category:5t ➟ More about 5t'

- 9t

- Category:9t ➟ More about 9t'

- AIL

- Always in long. ➟ More about AIL'

- AIS

- Always In Short. See also AIL. ➟ More about AIS'

- AODD

- Almost Outside Down Day is a reversal down from above yesterday's high and a sell climax to just above yesterday's low and a reversal up ➟ More about AODD'

- AOUD

- Almost Outside Up Day is a reversal up from below yesterday's low and a buy climax to just below yesterday's high and a reversal down ➟ More about AOUD'

- ATH

- All Time High ➟ More about ATH'

- B

- Buy or Long, depending on context ➟ More about B'

- BA

- Buy Above or probably buyers at the high of the bar ➟ More about BA'

- BB

- Buy Below, or probably buyers at the low of the bar and scaling in lower ➟ More about BB'

- BDBU

- Big Down, Big Up creates big confusion and usually leads to more trading range. When confused, traders BLSH, take quick profits. ➟ More about BDBU'

- BDBUC

- Big Down, Big Up creates big confusion and usually leads to more trading range. When confused, traders BLSH, take quick profits. ➟ More about BDBUC'

- BLSHS

- Buy Low, Sell High, and Scalp ➟ More about BLSHS'

- BO

- Breakout,突破. Breakout means close beyond support or resistance, like high or low of prior bar or bars, or EMA. Bulls want big bull bar closing on its high and far above resistance. Bears want big bear bar closing on its low and far below support. Generally, we can look at breakout from 3 perspectives: Trend, Trading range, and Reversal. See also fBO. ➟ More about BO'

- BOM

- Breakout Mode means trading range. About 50% chance successful breakout up or down, and then about a measured move based on the height of trading range. 50% chance 1st breakout up or down will reverse. This is the top category of all breakout mode. ➟ More about BOM'

- BP

- Buying pressure. ➟ More about BP'

- BRN

- Big Round Number like 2100, 2200, as support or resistance. ➟ More about BRN'

- BSB

- Buy Signal Bar ➟ More about BSB'

- BT

- Breakout Test or Bought, depending on context ➟ More about BT'

- BTC

- Buy The Close. Traders will buy the close of bull bar closing near its high or buy above bull bar that closes near its high. For e.g. when there are consecutive bull bars closing near their highs and above EMA, with 2nd body completely above EMA, traders will buy the close and look for MM up, e.g. 20221215. See also STC.

- Exit below a bear bar, or if 2 or 3 consecutive bear bars, especially when BTC-EOD

- If PB in Buy The Close bull trend. Probable TR within 3 bars. Be ready to exit.[2]

In general, whenever you have a BTC market and then a big reversal, a deep pullback, you are looking to buy above a bull bar. However, you want the (distance between the first entry and) the second entry to be at least two or three times bigger than a minimum scalp. Your goal on the second entry is to make a profit, get out around the first entry, break even on the first entry, and with a profit on the second. And in general, you want the (distance between the first entry and the) second entry to be at least two or three times the size of a minimum scalp. For example, in the E-mini, if the minimum scalp is one point, if you are going to be buying above a bull bar, adding to your position, you want the second entry to be about three points below the first entry[3]. ➟ More about BTC'

- BUBD

- Big Down, Big Up creates big confusion and usually leads to more trading range. When confused, traders BLSH, take quick profits. ➟ More about BUBD'

- BUBDC

- Big Down, Big Up creates big confusion and usually leads to more trading range. When confused, traders BLSH, take quick profits. ➟ More about BUBDC'

- BVT

- Buy Vacuum test of resistance. ➟ More about BVT'

- BX

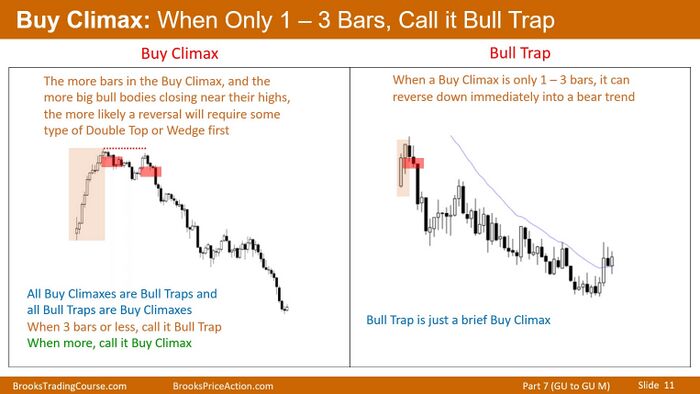

- Buy Climax, one or more big bull bars closing near their highs. All buy climaxes are bull traps and all bull traps are buy climaxes. When 3 bars or less, call it BLTP, when more than 3 bars, call it BX. See also YBX, or BLTP. ➟ More about BX'

- C

- Close ➟ More about C'

- CH

- Channel. ➟ More about CH'

- DB

- Double Bottom. Two consecutive bars with identical lows. Every DB is a H2B, and every H2B is a DB, either term is always correct. If two strong selloffs that reverse up, or two strong reversals up, call it a DB. If one selloff, but 2nd buy signal, like 2nd reversal up from below of LOY or support, call it a H2B. If a selloff tries to reverse twice, it is a H2B; if a 1st selloff fails and bear trend resumes, a 2nd reversal up is a DB. A H2B is just a small DB (usually less than 10 bars). ➟ More about DB'

- DBL

- Disappointed Bulls bought within past few bars and are now disappointed by bars since their entry. Many will try to exit around their entry price. If enough bulls sell out of longs, there could be another leg down. ➟ More about DBL'

- DBR

- Disappointed Bears sold within past few bars and are now disappointed by bars since their entry. Many will try to exit around their entry price. If enough bears buy back their shorts, there could be another leg up. ➟ More about DBR'

- DT

- Double Top. Two consecutive bars with identical highs. ➟ More about DT'

- EB

- Entry Bar. ➟ More about EB'

- EG

- Exhaustion Gap, a gap at any kind at the end of a trend, just before a reversal. Only certain in hindsight. ➟ More about EG'

- EMA

- 20 bar Exponential Moving Average.

➟ More about EMA'

- EOD

- End of Day.

- If market sideways in final 30 minutes, usually sideways until the close and Limit Order Market (LOM)[4] ➟ More about EOD'

- ET

- Expanding triangle. Expanding triangle means 5 or more reversals in a trading range with either 2 higher highs and 1 lower low or 1 lower high and 2 lower lows. 扩张三角形。ET is also discussed in encyclopedia Part 15. ➟ More about ET'

- FBO

- Failed breakout. ➟ More about FBO'

- FF

- Final Flag, usually a horizontal pattern (for e.g. ii) after a trend. The breakout often fails and reverses. A final flag set up is more reliable when it is near the major S/R and it's within the 1st hour of the market. ➟ More about FF'

- FOMC

- Federal Open Market Committee meeting and announcement. See more on Strategy:Trade FOMC. ➟ More about FOMC'

- FT

- Follow Through ➟ More about FT'

- G

- Gap ➟ More about G'

- GB

- Gap Bar. After gap bars, the market usually try to form a major trend reversal[5]. ➟ More about GB'

- GD

- Gap Down. ➟ More about GD'

- GU

- Gap Up. Gap up creates support, which is magnet[6]. A lot of times when there's a gap the market simply goes sideways (half the time), 25% of the time it begins a bear trend, 25% of time to get a bull trend[7]. When there is a Big Gap Up, it should be looked as a big BLBCH, i.e. a strong bull BO, hence, it increases the chance of a trend day, but the trend can be up or down (if down, it is a failed BLBO). Also, if yesterday ended with a big selloff and today has a BGU, the BGU needs to be looked as a BBLRVB. ➟ More about GU'

- GUB

- Give Up Bar, breakout that often leads to a swing ➟ More about GUB'

- GX

- Globex Session ➟ More about GX'

- GXH

- Globex High ➟ More about GXH'

- GXL

- Globex Low ➟ More about GXL'

- H

- High or High of Day,高点或当日高点 ➟ More about H'

- H1

- One legged pullback in a bull leg[8] so bull flag. Usually Always In Long, but can be in strong minor reversal up in bear trend[9]. Practically, a trader should only take H1 when he is confident the BREAKOUT (with trend or reversal) is strong. Also when we are evaluating market strength, we often look at GPS. See more on Strategy:Trade H1-L1.

- ↑ https://www.papals.org/index.php?title=20230123

- ↑ 笔记:52A Losing When Good Trade Goes Bad

- ↑ 笔记:49A Swing Trading Examples TXT

- ↑ 笔记:48I Trading the End of the Day

- ↑ Video 38A: Trading MTR Tops

- ↑ https://www.brookstradingcourse.com/trade-price-action/video-48f-trading-the-open/, slide 2.

- ↑ 48F

- ↑ especially a bull breakout.

- ↑ i.e. a strong bull breakout in bear trend.

- H2

- Two legged pullback in a bull move, but it can also be a 2nd reversal up from a selloff, so variation of a double bottom.

The BPA system look at a double bottom as a H2 as well, however the fact that they both are called H2 can sometime lead to some confusions to beginner traders, making them think a H2 in a double bottom from a trading range has same probability of success as a H2 in a trend, but in reality, the H2 in a strong trend almost always has higher probability than a H2 in a DB[1].

- ↑ Al actually mentioned this here: Book:CHAPTER 26 Need Two Reasons to Take a Trade

- H3

- Three legged pullback in a bull move, which usually means a wedge bull flag or a wedge bottom ➟ More about H3'

- H4

- High 4 bottom or bull flag, 4 legged bear channel, often consecutive High 2 pullbacks ➟ More about H4'

- HFT

- High frequency trading firm. ➟ More about HFT'

- HH

- Higher High,更高高点,股价在上涨过程中不断形成的比当前高点更高的一系列高点。 ➟ More about HH'

- HL

- Higher Low,更高低点,股价在上涨过程中不断形成的比当前低点更高的一系列低点。 ➟ More about HL'

- HOD

- High of the Day. The most important SR on any chart is LOD and HOD, which leads to more reversals than any other magnet[1].

- ↑ Al brooks, 3-30-2023 EOD review.

- HOY

- High of Yesterday,昨日高点。 ➟ More about HOY'

- HP

- High Probability ➟ More about HP'

- HSB

- Head and Shoulders Bottom, a continuation pattern in both bull and bear markets that sometimes is a reversal pattern. When it is a reversal pattern, it usually is also a HLMTR. See more on HST. ➟ More about HSB'

- HST

- Head and Shoulders Top, a bull continuation pattern in both bull and bear markets that sometimes is a reversal pattern.

- every HST also has a DB formed by the low before and after the head

- every HS pattern is also a TR and therefore a BOM

- if there is a good buy signal bar and many bull bars, 40% chance of BO above the head and about a MM up

- if there is a good sell signal bar and many bear bars, 40% chance of about a MM down (for e.g. 20230310)

- most often, the pattern is not strongly bullish or bearish and the TR continues, even if there is a minor BO above or below. ➟ More about HST'

- ib

- Category:Ib ➟ More about ib'

- ii

- Category:Ii ➟ More about ii'

- iii

- Three inside bars in a row, Breakout Mode, so both buy and sell signal ➟ More about iii'

- ioi

- Category:Ioi ➟ More about ioi'

- ioii

- Category:Ioii ➟ More about ioii'

- L

- Low or Low of Day,低点或当日低点 ➟ More about L'

- L1

- One legged pullback in a bear leg so bear flag. Usually Always In Short, but can be in strong minor reversal down in bull trend. See more on Strategy:Trade H1-L1 or H1. ➟ More about L1'

- L2

- Two legged Pullback in a bear move, but it can also be a 2nd reversal down from a rally, so variation of a double top. ➟ More about L2'

- L3

- Three legged PullBack in a bear move, which usually means a wedge bear flag or a wedge top ➟ More about L3'

- L4

- Low 4 top or bear flag, 4 legged bull channel, often consecutive Low 2 pullbacks ➟ More about L4'

- LH

- Lower High,更低高点,股价在下降趋势中不断形成的比当前高点更低的一系列高点。 ➟ More about LH'

- LL

- Lower Low,股价在下降趋势中不断形成的比当前低点更低的一系列低点。 ➟ More about LL'

- LOD

- Low of the Day. The most important SR on any chart is LOD and HOD, which leads to more reversals than any other magnet[1]. ➟ More about LOD'

- LOM

- Limit order market. ➟ More about LOM'

- LOY

- Low of Yesterday, one type of MSR,昨日低点。 ➟ More about LOY'

- LP

- Low Probability so swing only or wait ➟ More about LP'

- MA

- Moving Average. Assume 20 bar EMA unless I say otherwise. 均线,默认为20均线。 ➟ More about MA'

- MAG

- Moving Average Gap bar. In a trend, If a pullback goes beyond the moving average, it will have the first moving average gap bar setup (for example, in a strong bull trend, there is finally a pullback that has a bar with a high below the exponential moving average). This is usually followed by a test of the extreme and likely a new extreme[2]. Each pullback prior to the reversal is a with-trend entry, because each is a first pullback of one type or another (bar, minor trend line, moving average, moving average gap, or major trend line), and any type of first pullback is usually followed by at least a test of the extreme and usually a new extreme until after the major trend line is broken[3].

MAGB Often leads to the final leg of a trend before the market attempts a MTR[4]. Bar 13 in below chart is an example of bull MAGB, i.e. MAGBB. It is also a possible WB or WBLF. ➟ More about MAG'

- MDB

- Micro Double Bottom ➟ More about MDB'

- MDR

- Midday reversal is a reversal in the middle of the day, sometimes exactly at bar 40 or 41, and sometimes leads to opposite trend for rest of day. Note that the start of a MDR does NOT have to be HOD or LOD (though they often are), it can be a lower high for MDRD or higher low for MDRU. For e.g. on 20230922, bar 40-42 formed a LHMTR after the strong bear breakout 27-30 from the WT. ➟ More about MDR'

- MDT

- Micro Double Top. 微型双顶。 ➟ More about MDT'

- MG

- Measuring Gap, a gap of any kind that can lead to a measured move. Only certain in hindsight. ➟ More about MG'

- MGA

- Magnet Above ➟ More about MGA'

- MGB

- Magnet Below ➟ More about MGB'

- MGN

- Magnet, also SR,磁力位。 ➟ More about MGN'

- MM

- Measured Move,等距测量。通常作为摆动交易的止盈目标[5]。

- ↑ Al brooks, 3-30-2023 EOD review.

- ↑ i.e. trend resumption

- ↑ Book:CHAPTER 11 First Pullback Sequence: Bar, Minor Trend Line, Moving Average, Moving Average Gap, Major Trend Line

- ↑ 笔记:49A Swing Trading Examples

- ↑ 参考“区间”第7章。

- MP

- Midpoint ➟ More about MP'

- MRV

- Minor Trend Reversal so trading range or pullback more likely than opposite trend. Wait or swing trade. Switch to scalp if disappointed by weak reversal. ➟ More about MRV'

- MTR

- Major trend reversal, note that though being one of the best swing set up, MTR are more often followed by trading ranges instead of trends in the opposite direction[1]. See more on Strategy:Trade MTR。 ➟ More about MTR'

- MW

- Micro Wedge, a wedge formed by only 3 - 4 bars. Micro wedge is a type of parabolic wedge[2]. The word "Micro" here is same as the "Micro" in micro channel. ➟ More about MW'

- NL

- NeckLine ➟ More about NL'

- NW

- Nested Wedge, 3rd leg is smaller wedge, or final leg subdivides into smaller wedge. ➟ More about NW'

- OB

- Outside bar, the high is at or above the high of the prior bar and the low is at or below the low.

Outside bars are expanding triangle patterns on lower time frames. Both IB and OB are variants of trading ranges that form on a micro scale that are summarized into one or two bars on higher time frame. ➟ More about OB'

- OD

- Outside down bar, which means its high is at or above the high of the prior bar and its low is at or below the low of the prior bar and its close is below the open

外包阴线 的意思是它的最高价与前一根K线的最高价相同或更高,最低价与前一根K线的最低价相同或更低,而且它的收盘价低于开盘价。

Outside Down Day[3] ➟ More about OD'

- ODD

- Outside Down Day, which means a reversal down from above yesterdays high to below yesterdays low. 70% of outside down days close in lower 1/3 of the range, only 20% close above middlepoint[4].

外包下跌日,意味着从昨天的高点反转下行到低于昨天的低点。70%的外包下跌日收盘在区间的下部1/3内,只有20%的收盘价在中间点以上。

- OO

- Consecutive outside bars, Breakout Mode, so both Buy and Sell signal. In a bull trend, it can be top or bull flag. In a bear trend, it can be bottom or bear flag ➟ More about OO'

- OOD

- Open of Day,每天的开盘位,日内的重要SR之一。 ➟ More about OOD'

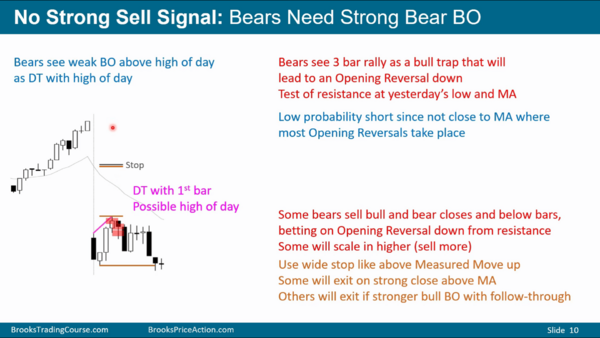

- ORV

- Opening Reversal,开盘反转。Opening reversal is an early reversal at SR, since the turn is usually at some key point (MSR) like:

- a moving average (MA, where most Opening Reversals take place[1])

- a test of the high or low of yesterday

- a swing high or low of yesterday or today

- a breakout of a trading range of yesterday or today

- a trend line or trend channel line

- or any of the above on a different time frame chart or on the Globex chart.

Most traders should work hard to become experts at spotting and trading the best opening reversals, and make these swing trades the cornerstone of their trading[2]. See more about how to trade ORV on Strategy:Trade ORV.

- ORVD

- Opening Reversal Down. See more in ORV. ➟ More about ORVD'

- ORVU

- Opening Reversal Up. See more in ORV. ➟ More about ORVU'

- OU

- Outside up bar, which means its high is at or above the high of the prior bar and its low is at or below the low of the prior bar and its close is above the open ➟ More about OU'

- OUD

- Outside Up Day, which means a reversal up from below yesterdays low to above yesterdays high ➟ More about OUD'

- OW

- Open of Week ➟ More about OW'

- P

- Probability ➟ More about P'

- PB

- Pullback. ➟ More about PB'

- PBX

- Parabolic Buy Climax.

- If PBX is followed by PSX, it is a BDBU pattern, expect more TRPA. Vice versa. Example 20231128.

See also PSX. ➟ More about PBX'

- PH

- Possible High of day or swing high, reasonable sell setup. Since it is a reversal trade, it is not high probability so it is a swing setup ➟ More about PH'

- PL

- Possible Low of day or swing low, reasonable buy setup. Since it is a reversal trade, it is not high probability so it is a swing setup

可能是当日最低点或者波段最低点,合理的买入机会。由于这是一个反转交易,所以概率不高,因此是一个摆动交易机会。 ➟ More about PL'

- PSX

- Parabolic Sell Climax, for e.g. a parabolic wedge bottom.

- If PBX is followed by PSX, it is a BDBU pattern, expect more TRPA. Vice versa. Example 20231128.

See more on PBX. ➟ More about PSX'

- PT

- Profit Target, or Profit taking. ➟ More about PT'

- PTG

- Profit Taking ➟ More about PTG'

- PW

- Parabolic wedge, a reversal pattern. In below chart, bar 49-61 is a typical example of PW.

- RB

- Reversal Bar. A bar with tail on top and close below midpoint is bear reversal bar. A bar with tail below and close above midpoint is bull reversal bar.

A good looking bull reversal bar after a BGD is always a good trade for a scalp at least[1], vice versa for a good looking bear reversal bar after a BGU, especially when the context is right, for e.g. HTF like daily chart is in trading range and the gap is at the top/bottom of the range.

Also note that a doji before a reversal bar greatly weakens the signal[2].

- REV

- Reversal or reversals ➟ More about REV'

- REVD

- Reversal Down ➟ More about REVD'

- REVU

- Reversal Up ➟ More about REVU'

- RR

- Risk Reward, or Risk Reward Ratio, most easily thought of as the size of your stop compared to the size of your profit target ➟ More about RR'

- RS

- Resistance ➟ More about RS'

- S

- Sell or Short, depending on context ➟ More about S'

- SA

- Sellers Above, or probably sellers at the high of the bar and scaling in higher ➟ More about SA'

- SB

- Signal bar. Normally a trader would want a good signal bar to enter any trade, especially when trading a reversal, but when market is already clearly trending, good signal bar is relatively less important than the overall pattern (for e.g. H2 or A2 buy), in fact, a strong trend usually doesn't give a good signal bar, like bar 36 on 20230125, market wants to make more buyers chase it up.

Bad signal bar[编辑 | 编辑源代码]

Bad signal bar lowers the probability of a setup, especially when there are consecutive bad signal bars, making the setup less reliable. Below, bar 4 and bar 8 formed a possible GD DT pattern, but bar 4 is a bad SB for L1 and bar 8 is another bad SB for L2, hence consecutive bad SB, this increases the chance of a TRBRL than start of a strong BRT.

- SBL

- Scale in Bulls ➟ More about SBL'

- SBR

- Scale in Bears ➟ More about SBR'

- SCB

- Spike and Channel Bottom ➟ More about SCB'

- SCT

- Spike and Channel trend. It is a breakout followed by a pullback and then at least 2 more legs in a channel, which often has a wedge shape. SC trend is the most common type of trend and is present in some form almost every day and in every trend. ➟ More about SCT'

- SH

- Swing High ➟ More about SH'

- SL

- Swing Low ➟ More about SL'

- SP

- Selling pressure. ➟ More about SP'

- SSB

- Strong SB. ➟ More about SSB'

- STC

- Sell The Close bear trend so traders will sell the close of bear bar closing near its low or sell below bear bar that closes near its low. When there are consecutive bear bars closing near their lows and below EMA with 2nd body completely below EMA, it is a better STC for possible MM down, see example on 20230203 bar 41/42, or 20230216 bar 66/67. See more details on BTC. ➟ More about STC'

- SVT

- Sell Vacuum test of support. ➟ More about SVT'

- SX

- Sell Climax, one or more big bear bars closing near their lows. Sell climax that needs 2 attempts to reverse up is a H2 bottom, if the bottoms are at about the same level and about 10 or more bars apart, call it a Double Bottom. ➟ More about SX'

- TBTL

- TBTL, ten bar two legs. Approximately Ten Bar correction with at least Two Legs. Obviously, not every pullback is a TBTL correction, for e.g. the pullback during the early stage of a strong trend usually has very small pullbacks. Traders should expect TBTL correction when the trend has gone for a while, or late in the trade, where more bulls are either taking profit or only looking for scalping profit, and more bears are will to short, i.e. more TRPA, instead of a hoping for TBTL during the early stage of a trend, for e.g. the BO phase. TBTL can be used in either in a reversal trade or with-trend trade. ➟ More about TBTL'

- TE

- Traders Equation (need chance of success times the reward greater than chance of loss times the risk). ➟ More about TE'

- TGA

- Target Above ➟ More about TGA'

- TGB

- Target Below ➟ More about TGB'

- TL

- Trendline,趋势线。 ➟ More about TL'

- TR

- Trading Range. 盘整区间,或者“交易区间”。 ➟ More about TR'

- TRD

- Trading Range Day. ➟ More about TRD'

- TRES

- Trend Resumption ➟ More about TRES'

- TRESD

- Trend Resumption Down ➟ More about TRESD'

- TRESU

- Trend Resumption Up ➟ More about TRESU'

- TREV

- Trend Reversal ➟ More about TREV'

- TREVD

- Trend Reversal Down ➟ More about TREVD'

- TREVU

- Trend Reversal Up ➟ More about TREVU'

- TRI

- Triangle,三角形。Triangle means trading range with 5 or more reversals with either 2 higher lows and 1 lower high or 1 higher low and 2 lower highs. 50% chance breakout up or down, and 50% chance 1st breakout fails, Breakout Mode. 三角意味着交易区间至少有5根及以上的反转k线,有2个更高的低点和一个更低的高点,或者1个更高的的低点和2个更低的高点。50%机率向上或向下突破,50%机率第一次突破失败。属于突破模型。

Facts:

- Whenever you have a triangle late in the bull trend, it is often a FF[1], which means if you get a strong breakout, market will try to get back to the apex of the triangle. ⚠️

- ↑ 48H

- TRO

- Trading Range Open so mostly a limit order market and Breakout Mode. The bulls will look for a double bottom or wedge bottom and then a swing up. The bears want a double top or wedge top and then a swing down. If there are Early Trading Range price action after Trading Range yesterday, Chances are we’ll have at least an hour or two of Trading Range price action today[1].

When the day opens with a clear trading range presented by multiple legs, there is a very good chance that any trend attempt away from it will at least attempt to turn back into the range due to the magnetic effect of the consolidation, this is similar to the case that market tends to test the apex of the triangle at certain time after the BO, if there is a BO. Often, the trend will reverse exactly at the measured move of the opening range as shown on 20230206.

If the reversal is successful, market will attempt to take out the other extreme of the day. On this example https://ninetrans.blogspot.com/2012/01/measured-move-of-opening-range.html, a successful reversal attempt to take out the other extreme of the day (b29) and can result in a trend in the new direction. When the breakout attempt is during lunch hour, the pullback could be complex and drawn out (b29-46). The fewer the bars the pullback has, the higher the chances of a successful reversal.

When the opening range is relative small, traders will expect a MM up or down breakout of the OR at certain time, for e.g. 20230523.

See also SBPO or SSPO. ➟ More about TRO'

- TTR

- Tight trading range, sometime called barbwire (BW). LOM, bad for scalping with stop orders, most traders should wait. ➟ More about TTR'

- TTRD

- TTR Day ➟ More about TTRD'

- TTRDD

- Category:TTRDD ➟ More about TTRDD'

- TTRDU

- Category:TTRDU ➟ More about TTRDU'

- TW

- Truncated Wedge. ➟ More about TW'

- W

- Wedge or anything similar, like any 3 push pattern. ➟ More about W'