Category:1REV:修订间差异

无编辑摘要 |

无编辑摘要 |

||

| 第6行: | 第6行: | ||

* ''a good reversal signal. If the reversal signal is weak (for example, it has a large entry side tail or is a bar of the wrong color), it is likely to take out the low and try a second time.'' | * ''a good reversal signal. If the reversal signal is weak (for example, it has a large entry side tail or is a bar of the wrong color), it is likely to take out the low and try a second time.'' | ||

''Such a | ''Such a 1REV is often the low of the day and will close near its high so its a good candidate for a day long swing. In practice, if you get a very sharp move (for e.g. b31-35 on [[20120315]]) that looks like an overshoot and gives a decent profit, its a good practice to take some or all off and wait for more price action.'' | ||

[[Category:NINETRANS]] | [[Category:NINETRANS]] | ||

2023年4月3日 (一) 17:42的版本

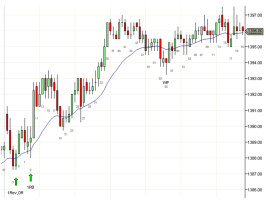

The first reversal of the day. Also see ORV. 1Rev is the first Reversal setup on the day and it usually means there is already a trend on the day.

The simplest to read kind of first reversal is[1][2]:

- a trend move from open consisting entirely of trend bars that penetrates a MSR such as LOY, HOY, COY or EMA (20120315 was both C of prior and EMA) [3]

- a good reversal signal. If the reversal signal is weak (for example, it has a large entry side tail or is a bar of the wrong color), it is likely to take out the low and try a second time.

Such a 1REV is often the low of the day and will close near its high so its a good candidate for a day long swing. In practice, if you get a very sharp move (for e.g. b31-35 on 20120315) that looks like an overshoot and gives a decent profit, its a good practice to take some or all off and wait for more price action.

- ↑ or the ideal 1REV setup

- ↑ https://ninetrans.blogspot.com/2012/03/ideal-first-reversal.html

- ↑ this initial strong move indicates some kind of vacuum test or exhaustive move.