TestPage2:修订间差异

(清空全部内容) |

无编辑摘要 |

||

| 第1行: | 第1行: | ||

{| class="wikitable" | |||

|+ | |||

! | |||

| | |||

|- | |||

! | |||

== Chapter 30B == | |||

| | |||

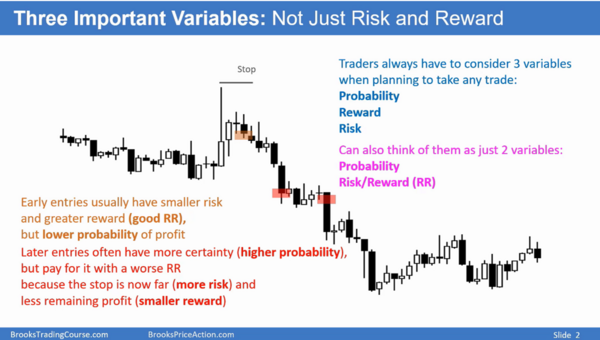

==== Three variables - Risk Reward and Probability ==== | |||

|- | |||

![[File:30B-RRP-2.png|left|thumb|600x600px|Three Important Variables: Not Just Risk and Reward]] | |||

|Three Important Variables: Not Just Risk and Reward | |||

Traders always have to consider 3 variables when planning to take any trade: | |||

* Probability | |||

* Reward | |||

* Risk | |||

Can also think of them as just 2 variables: | |||

* Probability | |||

* Risk/Reward (RR) | |||

Early entries usually have smaller risk and greater reward (good RR), | |||

but lower probability of profit | |||

Later entries often have more certainty (higher probability), | |||

but pay for it with a worse RR because the stop is now far (more risk) and | |||

less remaining profit (smaller reward) | |||

|- | |||

![[File:30B-RRP-7.png|left|thumb|600x600px|Beginners: Afraid of Risk - did not think in terms of probability]] | |||

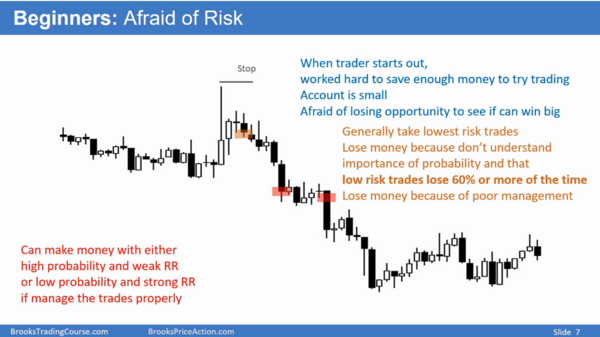

|Beginners: Afraid of Risk | |||

When trader starts out, worked hard to save enough money to try trading | |||

Account is small so Afraid of losing opportunity to see if can win big | |||

Generally take lowest risk trades | |||

Lose money because don’t understand | |||

importance of probability and that low risk trades lose 60% or more of the time | |||

Lose money because of poor management | |||

Can make money with either high probability and weak RR | |||

or low probability and strong RR if manage the trades properly | |||

|- | |||

![[File:30B-RRP-8.png|left|thumb|600x600px|Experienced Traders: Only Think about Math]] | |||

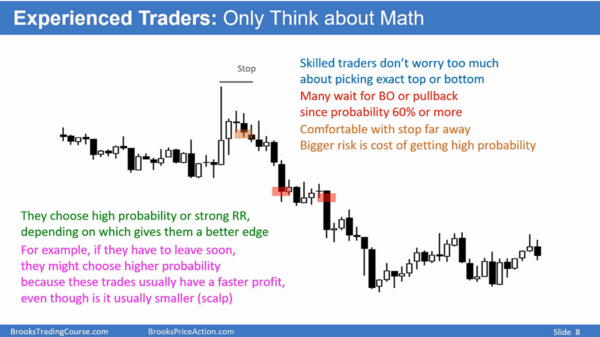

|Experienced Traders: Only Think about Math | |||

They choose high probability or strong RR, depending on which gives them a better edge | |||

For example, if they have to leave soon, they might choose higher probability | |||

because these trades usually have a faster profit, even though ¡s it usually smaller (scalp) | |||

Skilled traders don’t worry too much about picking exact top or bottom | |||

Many wait for BO or pullback since probability 60% or more | |||

Comfortable with stop far away | |||

Bigger risk is cost of getting high probability | |||

|- | |||

![[File:30B-RRP-9.png|left|thumb|600x600px|Improve the Math: 2 Ways]] | |||

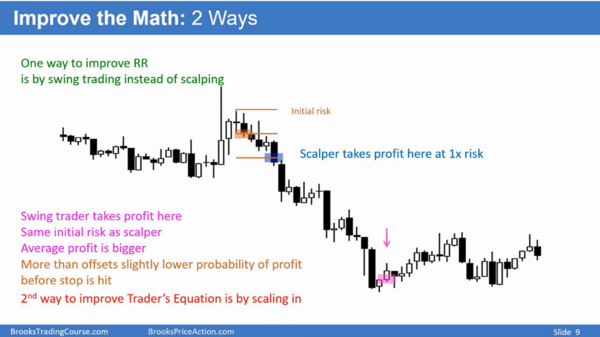

|Improve the Math: 2 Ways | |||

One way to improve RR is by swing trading instead of scalping | |||

Swing trader takes profit here | |||

Same initial risk as scalper | |||

Average profit is bigger | |||

More than offsets slightly lower probability of profit before stop is hit | |||

2nd way to improve Trader’s Equation is by scaling in | |||

|- | |||

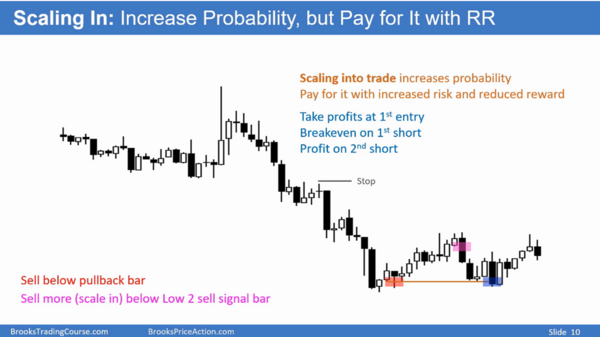

![[File:30B-RRP-10.png|left|thumb|600x600px|Scaling In: Increase Probability, but Pay for It with RR]] | |||

|Scaling In: Increase Probability, but Pay for It with RR | |||

Sell below pullback bar | |||

Sell more (scale in) below Low 2 sell signal bar | |||

Scaling into trade increases probability | |||

Pay for it with increased risk and reduced reward | |||

Take profits at 1st entry | |||

Breakeven on Pt short | |||

Profit on 2nd short | |||

|- | |||

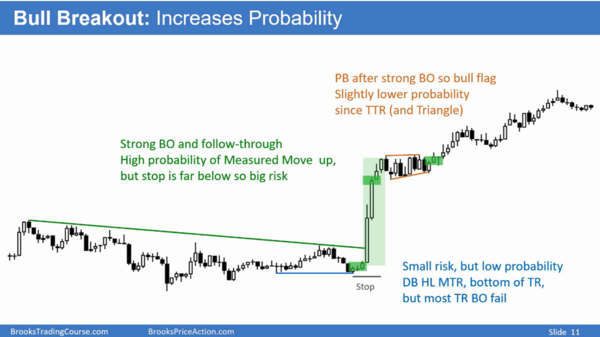

![[File:30B-RRP-11.png|left|thumb|600x600px|Bull Breakout: Increases Probability]] | |||

|Bull Breakout: Increases Probability | |||

Strong BO and follow-through | |||

High probability of Measured Move up, but stop is far below so big risk | |||

PB after strong BO so bull flag | |||

Slightly lower probability | |||

since TTR (and Triangle) | |||

Small risk, but low probability | |||

DB HL MTR, bottom of TR, | |||

but most TR BO fail | |||

|- | |||

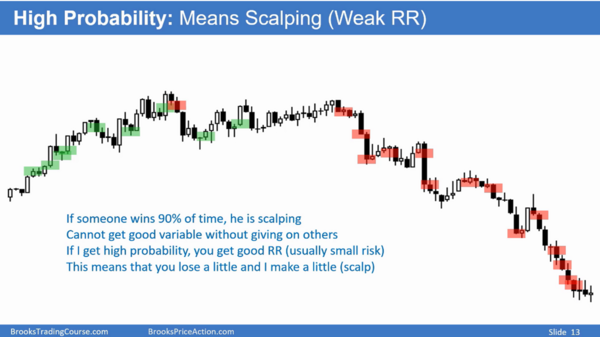

![[File:30B-RRP-13.png|left|thumb|600x600px|High Probability: Means Scalping (Weak RR)]] | |||

|High Probability: Means Scalping (Weak RR) | |||

If someone wins 90% of time, he is scalping | |||

Cannot get good variable without giving on others | |||

If I get high probability, you get good RR (usually small risk) | |||

This means that you lose a little and I make a little (scalp) | |||

|- | |||

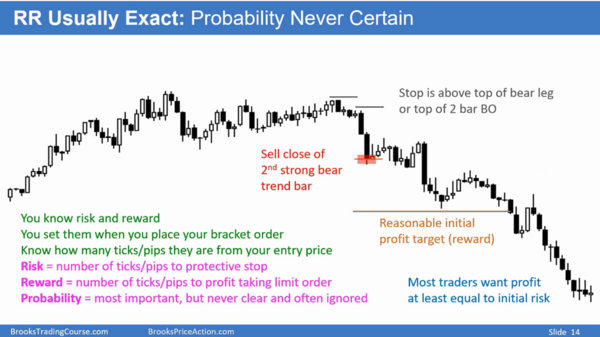

![[File:30B-RRP-14.png|left|thumb|600x600px|RR Usually Exact: Probability Never Certain]] | |||

|RR Usually Exact: Probability Never Certain | |||

You know risk and reward | |||

You set them when you place your bracket order | |||

Know how many ticks/pips they are from your entry price | |||

* Risk = number of ticks/pips to protective stop | |||

* Reward = number of ticks/pips to profit taking limit order | |||

* '''Probability = most important, but never clear and often ignored''' | |||

Sell close of 2nd strong bear trend bar | |||

Stop is above top of bear leg of top of 2 bar BO | |||

Reasonable initial profit target (reward) | |||

Most traders want profit at least equal to initial risk | |||

|- | |||

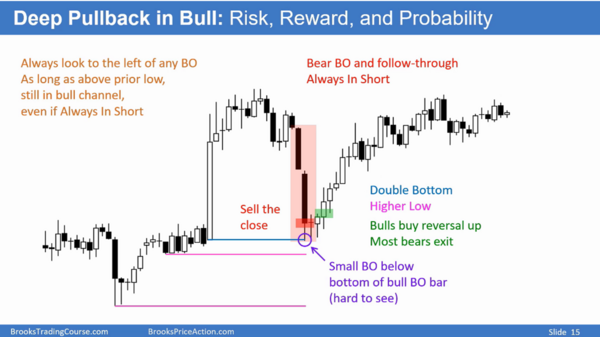

![[File:30-RRP-15.png|left|thumb|600x600px|Deep Pullback in Bull: Risk, Reward, and Probability]] | |||

|Deep Pullback in Bull: Risk, Reward, and Probability | |||

Always look to the left of any BO | |||

As long as above prior low, still in bull channel, | |||

even if Always In Short | |||

Bear BO and follow-through | |||

Always In Short | |||

Double Bottom | |||

Higher Low | |||

Bulls buy reversal up | |||

Most bears exit | |||

Small BO below bottom of bull BO bar (hard to see) | |||

|- | |||

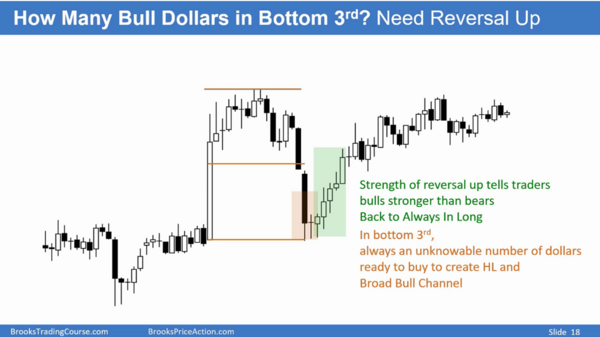

![[File:30B-RRP-18.png|left|thumb|600x600px|How Many Bull Dollars in Bottom 3rd?]] | |||

|How Many Bull Dollars in Bottom 3rd? Need Reversal Up | |||

Strength of reversal up tells traders bulls stronger than bears Back to Always In Long | |||

In bottom 3rd, always an unknowable number of dollars ready to buy to create HL and Broad Bull Channel | |||

|- | |||

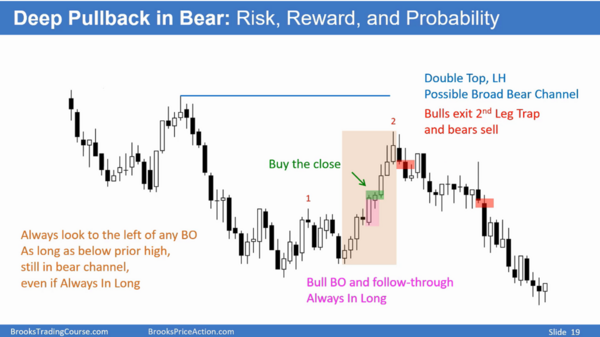

![[File:30B-RRP-19.png|left|thumb|600x600px|Deep Pullback in Bear: Risk, Reward, and Probability]] | |||

|Deep Pullback in Bear: Risk, Reward, and Probability | |||

Always look to the left of any BO | |||

As long as below prior high, still in bear channel, even if Always In Long | |||

Double Top, LH Possible Broad Bear Channel | |||

Bulls exit 2nd Leg Trap and bears sell | |||

|- | |||

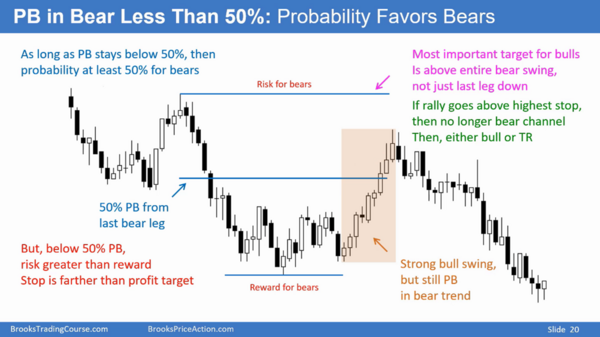

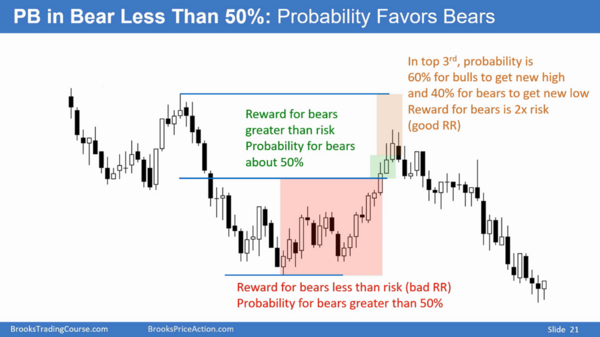

![[File:30B-RRP-20.png|left|thumb|600x600px|PB in Bear Less Than 50%: Probability Favors Bears]] | |||

|PB in Bear Less Than 50%: Probability Favors Bears | |||

As long as PB stays below 50%, then probability at least 50% for bears | |||

But, below 50% PB, risk greater than reward | |||

Stop is farther than profit target | |||

Most important target for bulls Is above entire bear swing, not just last leg down | |||

If rally goes above highest stop, then no longer bear channel | |||

Then, either bull or TR | |||

|- | |||

![[File:30B-RRP-21.png|left|thumb|600x600px|PB ¡n Bear Less Than 50%: Probability Favors Bears]] | |||

|PB in Bear Less Than 50%: Probability Favors Bears | |||

In top 3rd, probability is 60% for bulls to get new high | |||

and 40% for bears to get new low | |||

Reward for bears is 2x risk (good RR) | |||

|- | |||

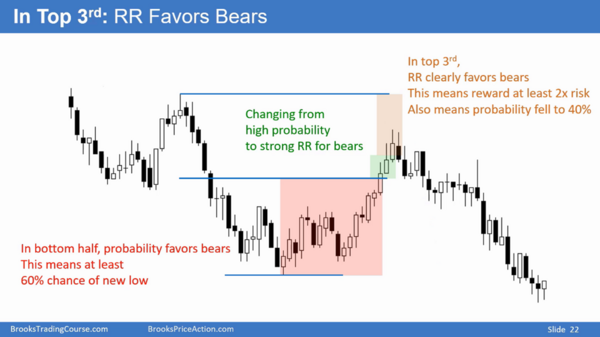

![[File:30B-RRP-22.png|left|thumb|600x600px|In Top 3rd: RR Favors Bears]] | |||

|In Top 3rd: RR Clearly Favors Bears | |||

This means reward at least 2x risk | |||

Also means probability fell to 40% | |||

In bottom half, probability favors bears | |||

This means at least 60% chance of new low | |||

|- | |||

![[File:30B-RRP-23.png|left|thumb|600x600px|How Many Bear Dollars in Top 3rd? Need Reversal Down]] | |||

|How Many Bear Dollars in Top 3rd? Need Reversal Down | |||

Even though probability favors bulls, | |||

RR is at least 2:1 for the bears | |||

Always bears willing to sell | |||

In top 3rd, always an unknowable number of dollars ready to sell to create LH and Broad Bear Channel | |||

Strength of reversal down tells traders bears stronger than bulls | |||

Back to Always In Short | |||

[[Category:LK2468]] | |||

[[Category:How To Trade PA]] | |||

|} | |||

[[Category:Reviewed]] | |||

2023年5月19日 (五) 16:57的版本

Chapter 30B[编辑 | 编辑源代码] |

Three variables - Risk Reward and Probability[编辑 | 编辑源代码] |

|---|---|

| Three Important Variables: Not Just Risk and Reward

Traders always have to consider 3 variables when planning to take any trade:

but lower probability of profit

but pay for it with a worse RR because the stop is now far (more risk) and less remaining profit (smaller reward) | |

| Beginners: Afraid of Risk

Account is small so Afraid of losing opportunity to see if can win big

Lose money because don’t understand importance of probability and that low risk trades lose 60% or more of the time Lose money because of poor management

or low probability and strong RR if manage the trades properly | |

| Experienced Traders: Only Think about Math

For example, if they have to leave soon, they might choose higher probability because these trades usually have a faster profit, even though ¡s it usually smaller (scalp)

Many wait for BO or pullback since probability 60% or more

Bigger risk is cost of getting high probability | |

| Improve the Math: 2 Ways

One way to improve RR is by swing trading instead of scalping

Same initial risk as scalper Average profit is bigger More than offsets slightly lower probability of profit before stop is hit

| |

| Scaling In: Increase Probability, but Pay for It with RR

Sell more (scale in) below Low 2 sell signal bar

Pay for it with increased risk and reduced reward

Breakeven on Pt short Profit on 2nd short | |

| Bull Breakout: Increases Probability

High probability of Measured Move up, but stop is far below so big risk

Slightly lower probability since TTR (and Triangle)

DB HL MTR, bottom of TR, but most TR BO fail | |

| High Probability: Means Scalping (Weak RR)

If someone wins 90% of time, he is scalping Cannot get good variable without giving on others If I get high probability, you get good RR (usually small risk) This means that you lose a little and I make a little (scalp) | |

| RR Usually Exact: Probability Never Certain

You set them when you place your bracket order Know how many ticks/pips they are from your entry price

Stop is above top of bear leg of top of 2 bar BO

Most traders want profit at least equal to initial risk | |

| Deep Pullback in Bull: Risk, Reward, and Probability

As long as above prior low, still in bull channel, even if Always In Short

Always In Short

Higher Low Bulls buy reversal up Most bears exit

| |

| How Many Bull Dollars in Bottom 3rd? Need Reversal Up

| |

| Deep Pullback in Bear: Risk, Reward, and Probability

As long as below prior high, still in bear channel, even if Always In Long

Bulls exit 2nd Leg Trap and bears sell

| |

| PB in Bear Less Than 50%: Probability Favors Bears

Stop is farther than profit target

If rally goes above highest stop, then no longer bear channel Then, either bull or TR | |

| PB in Bear Less Than 50%: Probability Favors Bears

and 40% for bears to get new low

| |

| In Top 3rd: RR Clearly Favors Bears

This means reward at least 2x risk Also means probability fell to 40% In bottom half, probability favors bears This means at least 60% chance of new low | |

| How Many Bear Dollars in Top 3rd? Need Reversal Down

Even though probability favors bulls, RR is at least 2:1 for the bears Always bears willing to sell

Back to Always In Short |