术语:修订间差异

无编辑摘要 |

无编辑摘要 |

||

| 第32行: | 第32行: | ||

;DBL:{{CATEGORY:DBL}} [[:分类:DBL| ''➟ More about DBL'']] | ;DBL:{{CATEGORY:DBL}} [[:分类:DBL| ''➟ More about DBL'']] | ||

;DBR:{{CATEGORY:DBR}} [[:分类:DBR| ''➟ More about DBR'']] | ;DBR:{{CATEGORY:DBR}} [[:分类:DBR| ''➟ More about DBR'']] | ||

;DT:{{CATEGORY:DT}} | ;DT:{{CATEGORY:DT}} 双顶。 [[:分类:DT| ''➟ More about DT'']] | ||

;EB:{{CATEGORY:EB}} [[:分类:EB| ''➟ More about EB'']] | ;EB:{{CATEGORY:EB}} [[:分类:EB| ''➟ More about EB'']] | ||

;EG:{{CATEGORY:EG}} [[:分类:EG| ''➟ More about EG'']] | ;EG:{{CATEGORY:EG}} [[:分类:EG| ''➟ More about EG'']] | ||

2023年11月8日 (三) 15:02的版本

https://papals.org/index.php?title=%E6%9C%AF%E8%AF%AD&action=purge

- 17T

- 17 Tick Trap. Trader entering with stop order usually needs 18 ticks to make 4 points. Stopping at 17 ticks traps traders just shy of goal. Many will exit, sometimes creating reversal. ➟ More about 17T

- 20GB

- Twenty Gap Bars, about 20 consecutive bars that have not touched the moving average. In bull case, 80% chance of testing prior high after pullback to EMA in SPBLT, but may pullback more first. There is 70% chance of profit taking after the new high[1]. ➟ More about 20GB

- 41T

41 Tick Trap. Trader entering with stop order usually needs 42 ticks to make 10 points. Stopping at 41 ticks traps traders just shy of goal. Many will exit, sometimes creating reversal. ➟ More about 41T

- 5T

- 5 Tick Trap. Trader entering with stop order usually needs 6 ticks to make 1 point. Stopping at 5 ticks traps traders just shy of goal. Many will exit, sometimes creating reversal. ➟ More about 5T

- 9T

- 9 Tick Trap. Trader entering with stop order usually needs 10 ticks to make 2 points. Stopping at 9 ticks traps traders just shy of goal. Many will exit, sometimes creating reversal. ➟ More about 9T

- AIL

- Always in long. ➟ More about AIL

- AIS

- Always In Short. See also AIL. ➟ More about AIS

- AODD

- Almost Outside Down Day is a reversal down from above yesterday's high and a sell climax to just above yesterday's low and a reversal up ➟ More about AODD

- AOUD

- Almost Outside Up Day is a reversal up from below yesterday's low and a buy climax to just below yesterday's high and a reversal down ➟ More about AOUD

- ATH

- All Time High ➟ More about ATH

- B

- Buy or Long, depending on context ➟ More about B

- BA

- Buy Above or probably buyers at the high of the bar ➟ More about BA

- BB

- Buy Below, or probably buyers at the low of the bar and scaling in lower ➟ More about BB

- BDBU

- Big Down, Big Up creates big confusion and usually leads to more trading range. When confused, traders BLSH, take quick profits. ➟ More about BDBU

- BDBUC

- Big Down, Big Up creates big confusion and usually leads to more trading range. When confused, traders BLSH, take quick profits. ➟ More about BDBUC

- BLSHS

- Buy Low, Sell High, and Scalp ➟ More about BLSHS

- BO

- Breakout,突破. Breakout means close beyond support or resistance, like high or low of prior bar or bars, or EMA. Bulls want big bull bar closing on its high and far above resistance. Bears want big bear bar closing on its low and far below support. Generally, we can look at breakout from 3 perspectives: Trend, Trading range, and Reversal. See also fBO. ➟ More about BO

- BOM

- Breakout Mode means trading range. About 50% chance successful breakout up or down, and then about a measured move based on the height of trading range. 50% chance 1st breakout up or down will reverse. This is the top category of all breakout mode. ➟ More about BOM

- BP

- Buying pressure. ➟ More about BP

- BRN

- Big Round Number like 2100, 2200, as support or resistance. ➟ More about BRN

- BSB

- Buy Signal Bar ➟ More about BSB

- BT

- Breakout Test or Bought, depending on context ➟ More about BT

- BTC

- Buy The Close. Traders will buy the close of bull bar closing near its high or buy above bull bar that closes near its high. For e.g. when there are consecutive bull bars closing near their highs and above EMA, with 2nd body completely above EMA, traders will buy the close and look for MM up, e.g. 20221215. See also STC.

- Exit below a bear bar, or if 2 or 3 consecutive bear bars, especially when BTC-EOD

- If PB in Buy The Close bull trend. Probable TR within 3 bars. Be ready to exit.[2]

In general, whenever you have a BTC market and then a big reversal, a deep pullback, you are looking to buy above a bull bar. However, you want the (distance between the first entry and) the second entry to be at least two or three times bigger than a minimum scalp. Your goal on the second entry is to make a profit, get out around the first entry, break even on the first entry, and with a profit on the second. And in general, you want the (distance between the first entry and the) second entry to be at least two or three times the size of a minimum scalp. For example, in the E-mini, if the minimum scalp is one point, if you are going to be buying above a bull bar, adding to your position, you want the second entry to be about three points below the first entry[3]. ➟ More about BTC

- BUBD

- Big Down, Big Up creates big confusion and usually leads to more trading range. When confused, traders BLSH, take quick profits. ➟ More about BUBD

- BUBDC

- Big Down, Big Up creates big confusion and usually leads to more trading range. When confused, traders BLSH, take quick profits. ➟ More about BUBDC

- BVT

- Buy Vacuum test of resistance. ➟ More about BVT

- BX

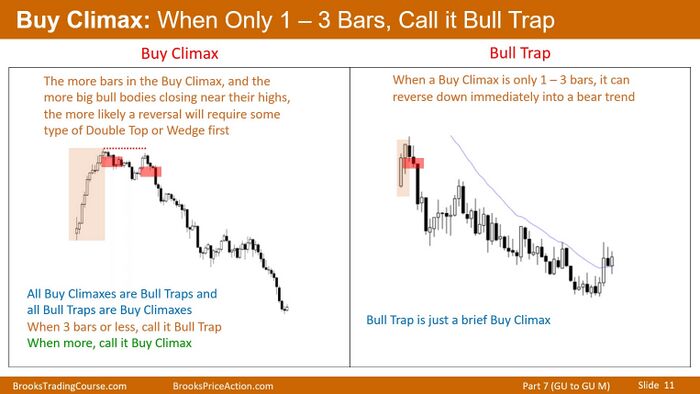

- Buy Climax, one or more big bull bars closing near their highs. All buy climaxes are bull traps and all bull traps are buy climaxes. When 3 bars or less, call it BLTP, when more than 3 bars, call it BX. See also YBX, or BLTP. ➟ More about BX

- C

- Close ➟ More about C

- CH

- Channel. ➟ More about CH

- DB

- Double Bottom. Two consecutive bars with identical lows. Every DB is a H2B, and every H2B is a DB, either term is always correct. If two strong selloffs that reverse up, or two strong reversals up, call it a DB. If one selloff, but 2nd buy signal, like 2nd reversal up from below of LOY or support, call it a H2B. If a selloff tries to reverse twice, it is a H2B; if a 1st selloff fails and bear trend resumes, a 2nd reversal up is a DB. A H2B is just a small DB (usually less than 10 bars). ➟ More about DB

- DBL

- Disappointed Bulls bought within past few bars and are now disappointed by bars since their entry. Many will try to exit around their entry price. If enough bulls sell out of longs, there could be another leg down. ➟ More about DBL

- DBR

- Disappointed Bears sold within past few bars and are now disappointed by bars since their entry. Many will try to exit around their entry price. If enough bears buy back their shorts, there could be another leg up. ➟ More about DBR

- DT

- Double Top. Two consecutive bars with identical highs. 双顶。 ➟ More about DT

- EB

- Entry Bar. ➟ More about EB

- EG

- Exhaustion Gap, a gap at any kind at the end of a trend, just before a reversal. Only certain in hindsight. ➟ More about EG

- EMA

- 20 bar Exponential Moving Average.

➟ More about EMA

- EOD

- End of Day.

- If market sideways in final 30 minutes, usually sideways until the close and Limit Order Market (LOM)[4] ➟ More about EOD

- ET

- Expanding triangle. Expanding triangle means 5 or more reversals in a trading range with either 2 higher highs and 1 lower low or 1 lower high and 2 lower lows. 扩张三角形。ET is also discussed in encyclopedia Part 15. ➟ More about ET

- FBO

- Failed breakout. ➟ More about FBO

- FF

- Final Flag, usually a horizontal pattern (for e.g. ii) after a trend. The breakout often fails and reverses. A final flag set up is more reliable when it is near the major S/R and it's within the 1st hour of the market. ➟ More about FF

- FOMC

- Federal Open Market Committee meeting and announcement. See more on Strategy:Trade FOMC. ➟ More about FOMC

- FT

- Follow Through ➟ More about FT

- G

- Gap ➟ More about G

- GB

- Gap Bar. After gap bars, the market usually try to form a major trend reversal[5]. ➟ More about GB

- GD

- Gap Down. ➟ More about GD

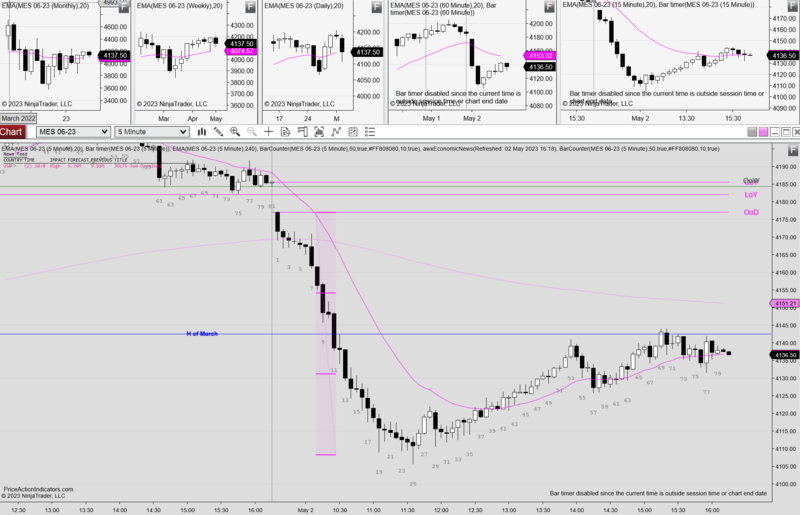

- GU

- Gap Up. Gap up creates support, which is magnet[6]. A lot of times when there's a gap the market simply goes sideways (half the time), 25% of the time it begins a bear trend, 25% of time to get a bull trend[7]. When there is a Big Gap Up, it should be looked as a big BLBCH, i.e. a strong bull BO, hence, it increases the chance of a trend day, but the trend can be up or down (if down, it is a failed BLBO). Also, if yesterday ended with a big selloff and today has a BGU, the BGU needs to be looked as a BBLRVB. ➟ More about GU

- GUB

- Give Up Bar, breakout that often leads to a swing ➟ More about GUB

- GX

- Globex Session ➟ More about GX

- GXH

- Globex High ➟ More about GXH

- GXL

- Globex Low ➟ More about GXL

- H

- High or High of Day,高点或当日高点 ➟ More about H

- H1

- One legged pullback in a bull leg[8] so bull flag. Usually Always In Long, but can be in strong minor reversal up in bear trend[9]. Practically, a trader should only take H1 when he is confident the BREAKOUT (with trend or reversal) is strong. Also when we are evaluating market strength, we often look at GPS. See more on Strategy:Trade H1-L1.

- ↑ https://www.papals.org/index.php?title=20230123

- ↑ 笔记:52A Losing When Good Trade Goes Bad

- ↑ 笔记:49A Swing Trading Examples TXT

- ↑ 笔记:48I Trading the End of the Day

- ↑ Video 38A: Trading MTR Tops

- ↑ https://www.brookstradingcourse.com/trade-price-action/video-48f-trading-the-open/, slide 2.

- ↑ 48F

- ↑ especially a bull breakout.

- ↑ i.e. a strong bull breakout in bear trend.

- H2

- Two legged pullback in a bull move, but it can also be a 2nd reversal up from a selloff, so variation of a double bottom.

The BPA system look at a double bottom as a H2 as well, however the fact that they both are called H2 can sometime lead to some confusions to beginner traders, making them think a H2 in a double bottom from a trading range has same probability of success as a H2 in a trend, but in reality, the H2 in a strong trend almost always has higher probability than a H2 in a DB[1].

- ↑ Al actually mentioned this here: Book:CHAPTER 26 Need Two Reasons to Take a Trade

- H3

- Three legged pullback in a bull move, which usually means a wedge bull flag or a wedge bottom ➟ More about H3

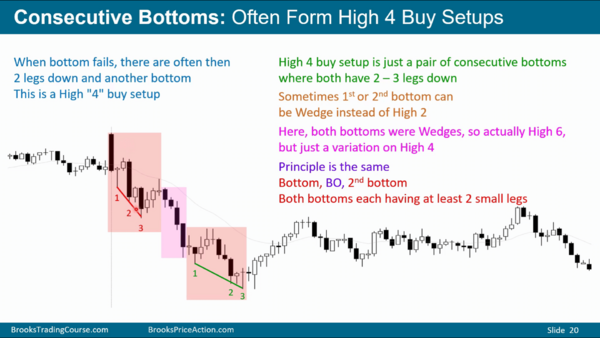

- H4

- High 4 bottom or bull flag, 4 legged bear channel, often consecutive High 2 pullbacks ➟ More about H4

- HFT

- High frequency trading firm. ➟ More about HFT

- HH

- Higher High,更高高点,股价在上涨过程中不断形成的比当前高点更高的一系列高点。 ➟ More about HH

- HL

- Higher Low,更高低点,股价在上涨过程中不断形成的比当前低点更高的一系列低点。 ➟ More about HL

- HOD

- High of the Day. The most important SR on any chart is LOD and HOD, which leads to more reversals than any other magnet[1].

- ↑ Al brooks, 3-30-2023 EOD review.

- HOY

- High of Yesterday,昨日高点。 ➟ More about HOY

- HP

- High Probability ➟ More about HP

- HSB

- Head and Shoulders Bottom, a continuation pattern in both bull and bear markets that sometimes is a reversal pattern. When it is a reversal pattern, it usually is also a HLMTR. See more on HST. ➟ More about HSB

- HST

- Head and Shoulders Top, a bull continuation pattern in both bull and bear markets that sometimes is a reversal pattern.

- every HST also has a DB formed by the low before and after the head

- every HS pattern is also a TR and therefore a BOM

- if there is a good buy signal bar and many bull bars, 40% chance of BO above the head and about a MM up

- if there is a good sell signal bar and many bear bars, 40% chance of about a MM down (for e.g. 20230310)

- most often, the pattern is not strongly bullish or bearish and the TR continues, even if there is a minor BO above or below. ➟ More about HST

- IB

- Inside bar, the high of the bar is at or below the high of the prior bar and the low is at or above the low of the prior bar.

A close inspection shows reversals or breakouts that start from inside bars seem to have a higher tendency of failing and pulling back rather quickly. Inside bars indicate range compression and are usually triangles that formed on a lower time frame[1].

Both IB and OB are variants of trading ranges that form on a micro scale that are summarized into one or two bars on higher time frame.

Note that an inside bar needs to have a strong close to be a reversal signal, but a tail may be acceptable if its a failed breakout of a Trading Range[2].

- II

- Consecutive inside bars, Breakout Mode, so both buy and sell signal.

- II late in a strong selloff often becomes final flag, especially after a series of sell climax[1]. Vice versa, II late in strong rally often became FF[2]. Traders should expect profit taking.

- II might increases the chance of abrupt trend reversal, especially after a climax, e.g. 20230214. ii is always a MDT or MDB, and usually a small triangle.

- III

- Three inside bars in a row, Breakout Mode, so both buy and sell signal ➟ More about III

- IOI

- Outside bar surrounded by Inside bars. ➟ More about IOI

- IOII

- Consecutive inside bars after an outside bar, Breakout Mode setup so both buy and sell signal bar ➟ More about IOII

- L

- Low or Low of Day,低点或当日低点 ➟ More about L

- L1

- One legged pullback in a bear leg so bear flag. Usually Always In Short, but can be in strong minor reversal down in bull trend. See more on Strategy:Trade H1-L1 or H1. ➟ More about L1

- L2

- Two legged Pullback in a bear move, but it can also be a 2nd reversal down from a rally, so variation of a double top. ➟ More about L2

- L3

- Three legged PullBack in a bear move, which usually means a wedge bear flag or a wedge top ➟ More about L3

- L4

- Low 4 top or bear flag, 4 legged bull channel, often consecutive Low 2 pullbacks ➟ More about L4

- LH

- Lower High,更低高点,股价在下降趋势中不断形成的比当前高点更低的一系列高点。 ➟ More about LH

- LL

- Lower Low,股价在下降趋势中不断形成的比当前低点更低的一系列低点。 ➟ More about LL

- LOD

- Low of the Day. The most important SR on any chart is LOD and HOD, which leads to more reversals than any other magnet[1]. ➟ More about LOD

- LOM

- Limit order market. ➟ More about LOM

- LOY

- Low of Yesterday, one type of MSR,昨日低点。 ➟ More about LOY

- LP

- Low Probability so swing only or wait ➟ More about LP

- MA

- Moving Average. Assume 20 bar EMA unless I say otherwise. 均线,默认为20均线。 ➟ More about MA

- MAG

- Moving Average Gap bar. In a trend, If a pullback goes beyond the moving average, it will have the first moving average gap bar setup (for example, in a strong bull trend, there is finally a pullback that has a bar with a high below the exponential moving average). This is usually followed by a test of the extreme and likely a new extreme[2]. Each pullback prior to the reversal is a with-trend entry, because each is a first pullback of one type or another (bar, minor trend line, moving average, moving average gap, or major trend line), and any type of first pullback is usually followed by at least a test of the extreme and usually a new extreme until after the major trend line is broken[3].

MAGB Often leads to the final leg of a trend before the market attempts a MTR[4]. Bar 13 in below chart is an example of bull MAGB, i.e. MAGBB. It is also a possible WB or WBLF. ➟ More about MAG

- MDB

- Micro Double Bottom ➟ More about MDB

- MDR

- Midday reversal is a reversal in the middle of the day, sometimes exactly at bar 40 or 41, and sometimes leads to opposite trend for rest of day. Note that the start of a MDR does NOT have to be HOD or LOD (though they often are), it can be a lower high for MDRD or higher low for MDRU. For e.g. on 20230922, bar 40-42 formed a LHMTR after the strong bear breakout 27-30 from the WT. ➟ More about MDR

- MDT

- Micro Double Top. 微型双顶。 ➟ More about MDT

- MG

- Measuring Gap, a gap of any kind that can lead to a measured move. Only certain in hindsight. ➟ More about MG

- MGA

- Magnet Above ➟ More about MGA

- MGB

- Magnet Below ➟ More about MGB

- MGN

- Magnet, also SR,磁力位。 ➟ More about MGN

- MM

- Measured Move,等距测量。通常作为摆动交易的止盈目标[5]。

- ↑ Al brooks, 3-30-2023 EOD review.

- ↑ i.e. trend resumption

- ↑ Book:CHAPTER 11 First Pullback Sequence: Bar, Minor Trend Line, Moving Average, Moving Average Gap, Major Trend Line

- ↑ 笔记:49A Swing Trading Examples

- ↑ 参考“区间”第7章。

- MP

- Midpoint ➟ More about MP

- MRV

- Minor Trend Reversal so trading range or pullback more likely than opposite trend. Wait or swing trade. Switch to scalp if disappointed by weak reversal. ➟ More about MRV

- MTR

- Major trend reversal, note that though being one of the best swing set up, MTR are more often followed by trading ranges instead of trends in the opposite direction[1]. See more on Strategy:Trade MTR。 ➟ More about MTR

- MW

- Micro Wedge, a wedge formed by only 3 - 4 bars. Micro wedge is a type of parabolic wedge[2]. The word "Micro" here is same as the "Micro" in micro channel. ➟ More about MW

- NL

- NeckLine ➟ More about NL

- NW

- Nested Wedge, 3rd leg is smaller wedge, or final leg subdivides into smaller wedge. ➟ More about NW

- OB

- Outside bar, the high is at or above the high of the prior bar and the low is at or below the low.

Outside bars are expanding triangle patterns on lower time frames. Both IB and OB are variants of trading ranges that form on a micro scale that are summarized into one or two bars on higher time frame. ➟ More about OB

- OD

- Outside down bar, which means its high is at or above the high of the prior bar and its low is at or below the low of the prior bar and its close is below the open

外包阴线 的意思是它的最高价与前一根K线的最高价相同或更高,最低价与前一根K线的最低价相同或更低,而且它的收盘价低于开盘价。

Outside Down Day[3] ➟ More about OD

- ODD

- Outside Down Day, which means a reversal down from above yesterdays high to below yesterdays low. 70% of outside down days close in lower 1/3 of the range, only 20% close above middlepoint[4].

外包下跌日,意味着从昨天的高点反转下行到低于昨天的低点。70%的外包下跌日收盘在区间的下部1/3内,只有20%的收盘价在中间点以上。

- OO

- Consecutive outside bars, Breakout Mode, so both Buy and Sell signal. In a bull trend, it can be top or bull flag. In a bear trend, it can be bottom or bear flag ➟ More about OO

- OOD

- Open of Day,每天的开盘位,日内的重要SR之一。 ➟ More about OOD

- ORV

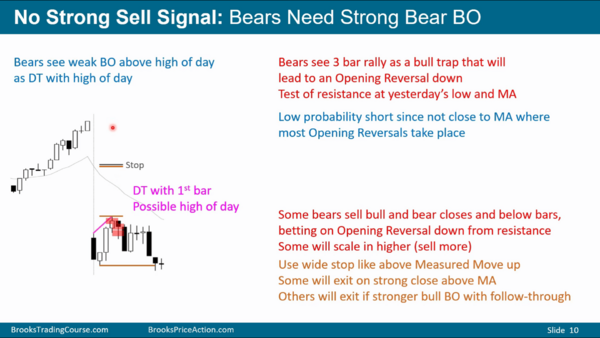

- Opening Reversal,开盘反转。Opening reversal is an early reversal at SR, since the turn is usually at some key point (MSR) like:

- a moving average (MA, where most Opening Reversals take place[1])

- a test of the high or low of yesterday

- a swing high or low of yesterday or today

- a breakout of a trading range of yesterday or today

- a trend line or trend channel line

- or any of the above on a different time frame chart or on the Globex chart.

Most traders should work hard to become experts at spotting and trading the best opening reversals, and make these swing trades the cornerstone of their trading[2]. See more about how to trade ORV on Strategy:Trade ORV.

- ORVD

- Opening Reversal Down. See more in ORV. ➟ More about ORVD

- ORVU

- Opening Reversal Up. See more in ORV. ➟ More about ORVU

- OU

- Outside up bar, which means its high is at or above the high of the prior bar and its low is at or below the low of the prior bar and its close is above the open ➟ More about OU

- OUD

- Outside Up Day, which means a reversal up from below yesterdays low to above yesterdays high ➟ More about OUD

- OW

- Open of Week ➟ More about OW

- P

- Probability ➟ More about P

- PB

- Pullback. ➟ More about PB

- PBX

- Parabolic Buy Climax.

- If PBX is followed by PSX, it is a BDBU pattern, expect more TRPA. Vice versa. Example 20231128.

See also PSX. ➟ More about PBX

- PH

- Possible High of day or swing high, reasonable sell setup. Since it is a reversal trade, it is not high probability so it is a swing setup ➟ More about PH

- PL

- Possible Low of day or swing low, reasonable buy setup. Since it is a reversal trade, it is not high probability so it is a swing setup

可能是当日最低点或者波段最低点,合理的买入机会。由于这是一个反转交易,所以概率不高,因此是一个摆动交易机会。 ➟ More about PL

- PSX

- Parabolic Sell Climax, for e.g. a parabolic wedge bottom.

- If PBX is followed by PSX, it is a BDBU pattern, expect more TRPA. Vice versa. Example 20231128.

See more on PBX. ➟ More about PSX

- PT

- Profit Target, or Profit taking. ➟ More about PT

- PTG

- Profit Taking ➟ More about PTG

- PW

- Parabolic wedge, a reversal pattern. In below chart, bar 49-61 is a typical example of PW.

- RB

- Reversal Bar. A bar with tail on top and close below midpoint is bear reversal bar. A bar with tail below and close above midpoint is bull reversal bar.

A good looking bull reversal bar after a BGD is always a good trade for a scalp at least[1], vice versa for a good looking bear reversal bar after a BGU, especially when the context is right, for e.g. HTF like daily chart is in trading range and the gap is at the top/bottom of the range.

Also note that a doji before a reversal bar greatly weakens the signal[2].

- REV

- Reversal or reversals ➟ More about REV

- REVD

- Reversal Down ➟ More about REVD

- REVU

- Reversal Up ➟ More about REVU

- RR

- Risk Reward, or Risk Reward Ratio, most easily thought of as the size of your stop compared to the size of your profit target ➟ More about RR

- RS

- Resistance ➟ More about RS

- S

- Sell or Short, depending on context ➟ More about S

- SA

- Sellers Above, or probably sellers at the high of the bar and scaling in higher ➟ More about SA

- SB

- Signal bar. Normally a trader would want a good signal bar to enter any trade, especially when trading a reversal, but when market is already clearly trending, good signal bar is relatively less important than the overall pattern (for e.g. H2 or A2 buy), in fact, a strong trend usually doesn't give a good signal bar, like bar 36 on 20230125, market wants to make more buyers chase it up.

Bad signal bar[编辑 | 编辑源代码]

Bad signal bar lowers the probability of a setup, especially when there are consecutive bad signal bars, making the setup less reliable. Below, bar 4 and bar 8 formed a possible GD DT pattern, but bar 4 is a bad SB for L1 and bar 8 is another bad SB for L2, hence consecutive bad SB, this increases the chance of a TRBRL than start of a strong BRT.

- SBL

- Scale in Bulls ➟ More about SBL

- SBR

- Scale in Bears ➟ More about SBR

- SCB

- Spike and Channel Bottom ➟ More about SCB

- SCT

- Spike and Channel trend. It is a breakout followed by a pullback and then at least 2 more legs in a channel, which often has a wedge shape. SC trend is the most common type of trend and is present in some form almost every day and in every trend. ➟ More about SCT

- SH

- Swing High ➟ More about SH

- SL

- Swing Low ➟ More about SL

- SP

- Selling pressure. ➟ More about SP

- SSB

- Strong SB. ➟ More about SSB

- STC

- Sell The Close bear trend so traders will sell the close of bear bar closing near its low or sell below bear bar that closes near its low. When there are consecutive bear bars closing near their lows and below EMA with 2nd body completely below EMA, it is a better STC for possible MM down, see example on 20230203 bar 41/42, or 20230216 bar 66/67. See more details on BTC. ➟ More about STC

- SVT

- Sell Vacuum test of support. ➟ More about SVT

- SX

- Sell Climax, one or more big bear bars closing near their lows. Sell climax that needs 2 attempts to reverse up is a H2 bottom, if the bottoms are at about the same level and about 10 or more bars apart, call it a Double Bottom. ➟ More about SX

- TBTL

- TBTL, ten bar two legs. Approximately Ten Bar correction with at least Two Legs. Obviously, not every pullback is a TBTL correction, for e.g. the pullback during the early stage of a strong trend usually has very small pullbacks. Traders should expect TBTL correction when the trend has gone for a while, or late in the trade, where more bulls are either taking profit or only looking for scalping profit, and more bears are will to short, i.e. more TRPA, instead of a hoping for TBTL during the early stage of a trend, for e.g. the BO phase. TBTL can be used in either in a reversal trade or with-trend trade. ➟ More about TBTL

- TE

- Traders Equation (need chance of success times the reward greater than chance of loss times the risk). ➟ More about TE

- TGA

- Target Above ➟ More about TGA

- TGB

- Target Below ➟ More about TGB

- TL

- Trendline,趋势线。 ➟ More about TL

- TR

- Trading Range. 盘整区间,或者“交易区间”。 ➟ More about TR

- TRD

- Trading Range Day. ➟ More about TRD

- TRES

- Trend Resumption ➟ More about TRES

- TRESD

- Trend Resumption Down ➟ More about TRESD

- TRESU

- Trend Resumption Up ➟ More about TRESU

- TREV

- Trend Reversal ➟ More about TREV

- TREVD

- Trend Reversal Down ➟ More about TREVD

- TREVU

- Trend Reversal Up ➟ More about TREVU

- TRI

- Triangle,三角形。Triangle means trading range with 5 or more reversals with either 2 higher lows and 1 lower high or 1 higher low and 2 lower highs. 50% chance breakout up or down, and 50% chance 1st breakout fails, Breakout Mode. 三角意味着交易区间至少有5根及以上的反转k线,有2个更高的低点和一个更低的高点,或者1个更高的的低点和2个更低的高点。50%机率向上或向下突破,50%机率第一次突破失败。属于突破模型。

Facts:

- Whenever you have a triangle late in the bull trend, it is often a FF[1], which means if you get a strong breakout, market will try to get back to the apex of the triangle. ⚠️

- ↑ 48H

- TRO

- Trading Range Open so mostly a limit order market and Breakout Mode. The bulls will look for a double bottom or wedge bottom and then a swing up. The bears want a double top or wedge top and then a swing down. If there are Early Trading Range price action after Trading Range yesterday, Chances are we’ll have at least an hour or two of Trading Range price action today[1].

When the day opens with a clear trading range presented by multiple legs, there is a very good chance that any trend attempt away from it will at least attempt to turn back into the range due to the magnetic effect of the consolidation, this is similar to the case that market tends to test the apex of the triangle at certain time after the BO, if there is a BO. Often, the trend will reverse exactly at the measured move of the opening range as shown on 20230206.

If the reversal is successful, market will attempt to take out the other extreme of the day. On this example https://ninetrans.blogspot.com/2012/01/measured-move-of-opening-range.html, a successful reversal attempt to take out the other extreme of the day (b29) and can result in a trend in the new direction. When the breakout attempt is during lunch hour, the pullback could be complex and drawn out (b29-46). The fewer the bars the pullback has, the higher the chances of a successful reversal.

When the opening range is relative small, traders will expect a MM up or down breakout of the OR at certain time, for e.g. 20230523.

See also SBPO or SSPO. ➟ More about TRO

- TTR

- Tight trading range, sometime called barbwire (BW). LOM, bad for scalping with stop orders, most traders should wait. ➟ More about TTR

- TTRD

- TTR Day ➟ More about TTRD

- TTRDD

- Category:TTRDD ➟ More about TTRDD

- TTRDU

- Category:TTRDU ➟ More about TTRDU

- TW

- Truncated Wedge. ➟ More about TW

- W

- Wedge or anything similar, like any 3 push pattern. ➟ More about W

- 100M

- 100 bar simple moving average, institutions watch 50, 100, 150, and 200 day and week simple moving averages ➟ More about 100M

- 100MA

- 100 bar simple moving average, institutions watch 50, 100, 150, and 200 day and week simple moving averages ➟ More about 100MA

- 100MD

- 100 day simple moving average ➟ More about 100MD

- 10M

- Middle third of the day from 9:30 or 10 am PST to 11:30 often enters tight trading range ➟ More about 10M

- 13T

13 Tick Trap. Trader entering with stop order usually needs 14 ticks to make 3 points. Stopping at 13 ticks traps traders just shy of goal. Many will exit, sometimes creating reversal. ➟ More about 13T

- 150M

- 150 bar simple moving average, institutions watch 50, 100, 150, and 200 day and week simple moving averages ➟ More about 150M

- 150MA

- 150 bar simple moving average, institutions watch 50, 100, 150, and 200 day and week simple moving averages ➟ More about 150MA

- 150MD

- 150 day simple moving average ➟ More about 150MD

- 15M

- 15 Minute bar or chart ➟ More about 15M

- 15MA

- 15 minute 20 bar moving average plotted on 5 minute chart ➟ More about 15MA

- 16T

- 16 Ticks, which can be a trap for limit order entries ➟ More about 16T

- 18B

- 18 Bar range. Used to be called 18B in Al's term. Breakout Below 18 bar range so 80% chance will not rally to new high of day, and 90% chance if range is big。See also 10RBO.向下突破18根k线形成的区间,有80%的机率不会上涨到新的日高,90%的概率形成宽幅的交易区间。 ➟ More about 18B

- 18BD

- REDIRECT ➟ More about 18BD

- 18BO

- Category:18BO ➟ More about 18BO

- 18BOD

- Category:18BOD ➟ More about 18BOD

- 18BODF

- Failed breakout below the low of the 1st 18 bars, Always In bears should exit, but probably only minor reversal up, only 20% chance of new high of day。若第一个18根k线的低点突破失败,那么空头就应该离场,但也可能形成的只是小的向上反弹,只有20%的机率形成新高。 ➟ More about 18BODF

- 18BOU

- Category:18BOU ➟ More about 18BOU

- 18BOUF

- Failed breakout above the high of the 1st 18 bars, Always In Bulls should exit, but probably only minor reversal down, only 20% chance of new low of day。若第一个18根k线的高点突破失败,那么多头就应该离场,但也可能形成的只是小的向下反弹,只有20%的机率形成当日新低。 ➟ More about 18BOUF

- 18BU

- REDIRECT ➟ More about 18BU

- 18T

- 18 Ticks ➟ More about 18T

- 1BFF

- One Bar Final Flag ➟ More about 1BFF

- 1H

- 1 Hour ➟ More about 1H

- 1LD

- First Leg Down ➟ More about 1LD

- 1LU

- First Leg Up ➟ More about 1LU

- 1MLD

- strong enough bear breakout for at least One More small Leg Down ➟ More about 1MLD

- 1MLU

- strong enough bull breakout for at least One More small Leg Up ➟ More about 1MLU

- 1P

- The first pullback (1P) in the first trend attempt that can give you a good trader's equation.

- The first pullback occurs only after three or more bars of breaking out[2].

- The first pullback lasts only one or two bars, and it follows a bar that is not a strong bear reversal bar.

- The first pullback does not reach the breakout point and does not hit a breakeven stop (the entry price).

From NineTransitions, 1P is more specific. The minimal requirements for the setup to work are:

- There is a solid trending attempt on the open.

- The PB is 2-legged and gives a good RR. ➟ More about 1P

- 1T

- 1 Tick ➟ More about 1T

- 200M

- 200 bar simple moving average, institutions watch 50, 100, 150, and 200 day and week simple moving averages ➟ More about 200M

- 200MA

- 200 bar simple moving average, institutions watch 50, 100, 150, and 200 day and week simple moving averages ➟ More about 200MA

- 200MD

- 200 day simple moving average ➟ More about 200MD

- 20DM

- Category:20DM ➟ More about 20DM

- 20DMA

- Category:20DMA ➟ More about 20DMA

- 20GB50BL

- No pullback to EMA in 1st 50 bars so expect at least 3 bars will low below EMA by around 11 am PST and then test of high of day ➟ More about 20GB50BL

- 20GB50BR

- No pullback to EMA in 1st 50 bars so expect at least 3 bars will high above EMA by around 11 am PST and then test of low of day ➟ More about 20GB50BR

- 20GBB

- 20 Gap Bar Buy setup. After about 20 or more bars above EMA, bulls will look to buy the first pullback to EMA. There will be around 75% chance of testing high of the day. Buy above bull bar closing near its high[1]. ➟ More about 20GBB

- 20GBS

- 20 Gap Bar Sell setup. After about 20 or more bars below the exponential moving average bears will look to sell a pullback to the exponential moving average

20根K线缺口做空建仓形态。在经过约 20 根或更多根低于EMA均线的 K 线后,空头将寻找机会在回撤至指数移动平均线时卖出。 ➟ More about 20GBS

- 20MM

- Category:20MM ➟ More about 20MM

- 20MMA

- Category:20MMA ➟ More about 20MMA

- 20WM

- Category:20WM ➟ More about 20WM

- 20WMA

- Category:20WMA ➟ More about 20WMA

- 21T

- Category:21T ➟ More about 21T

- 2BR

- Two Bar Reversal. Note that consecutive 2BR can also be an indication of stronger fighting between bulls and bears for controlling of the market, at certain time, one side give up, suddenly or gradually, resulting in one-sided trading that forms a swing up or down. ➟ More about 2BR

- 2E

- Second Entry ➟ More about 2E

- 2EB

- Second buy signal or strong Enough bull to breakout to Buy ➟ More about 2EB

- 2ES

- Second sell signal or strong Enough bear to breakout to Sell

第二个卖出信号或强大到足以突破卖出 ➟ More about 2ES

- 2FMA

- Category:2FMA ➟ More about 2FMA

- 2H

- 2 Hour ➟ More about 2H

- 2HM

- Two hours from moving average ➟ More about 2HM

- 2LBLTP

2nd Leg Bull Trap. BLTP2 is a strong bull breakout with little or no FT, and quickly reverses down, trapping bulls who hoped for bull trend to continue. After BLTP2, market will either be in trading range (more likely) or bear trend reversal (less likely). It is also a type of bull FBO.

- BLTP2 usually does not BO far beyond TR. One of most common mistakes is believing that another leg is likely after a strong leg, however It is only likely if the BO is clearly above TR, especially if already a 2nd Leg Up within the TR[2]. A lot of times, it is Not obvious unless you think possible.

- BLTP2 usually comes in a trading range day and usually leads to more TRPA[3]

- BLTP2 is more common when 1st leg up is a wedge[4] (for e.g. 20210412)

- BLTP2 often leads to big selloff but usually not strong bear trend[5]

See also BRTP2. ➟ More about 2LBLTP

- 2LBRTP

2nd Leg Bear Trap (Failed Bear BO). 2nd leg trap usually comes in a trading range and usually leads to more trading range (TRPA)[6]. See more on BLTP2. ➟ More about 2LBRTP

- 2LD

- Two Legs Down or Second Leg Down ➟ More about 2LD

- 2LS

- 2nd leg was sideways ➟ More about 2LS

- 2LSD

- Two Legs Sideways or Down ➟ More about 2LSD

- 2LSU

- Two Legs Sideways or Up ➟ More about 2LSU

- 2LSW

- 2nd leg was sideways ➟ More about 2LSW

- 2LT

- Second Leg Trap so possible failed breakout and reversal ➟ More about 2LT

- 2LTP

- Category:2LTP ➟ More about 2LTP

- 2LU

- Two Legs Up or Second Leg Up. ➟ More about 2LU

- 2MA

- Category:2MA ➟ More about 2MA

- 2MAF

- Category:2MAF ➟ More about 2MAF

- 2S

- Second Signal ➟ More about 2S

- 2SB

- Second Signal Buy ➟ More about 2SB

- 2SS

- Second Signal Sell ➟ More about 2SS

- 2T

- 2 Ticks ➟ More about 2T

- 3EB

- Third Entry Buy ➟ More about 3EB

- 3ES

- Third Entry Sell ➟ More about 3ES

- 3H

- 3 Hour ➟ More about 3H

- 3LD

- Third Leg Down so possible wedge bottom ➟ More about 3LD

- 3LU

- Third Leg Up so possible wedge top ➟ More about 3LU

- 3T

- 3 Ticks ➟ More about 3T

- 40M

- Bars 40 and 41 are middle of day and there is often a reversal or a breakout around 40 or 41 ➟ More about 40M

- 40R

- Category:40R ➟ More about 40R

- 41M

- Bars 40 and 41 are middle of day and there is often a reversal or a breakout around 40 or 41 ➟ More about 41M

- 41R

- Category:41R ➟ More about 41R

- 4D

- Four consecutive bear bars and is therefore too strong for a long ➟ More about 4D

- 4H

- 4 Hour ➟ More about 4H

- 4T

- 4 Ticks ➟ More about 4T

- 4U

- Four consecutive bull bars and is therefore too strong for a short ➟ More about 4U

- 50M

- 50 bar simple moving average, institutions watch 50, 100, 150, and 200 day and week simple moving averages ➟ More about 50M

- 50MA

- 50 bar simple moving average, institutions watch 50, 100, 150, and 200 day and week simple moving averages ➟ More about 50MA

- 50MD

- 50 day simple moving average ➟ More about 50MD

- 50P

- 50% Pullback ➟ More about 50P

- 5H

- 5 Hour ➟ More about 5H

- 60M

- 60 minute bar or chart ➟ More about 60M

- 60MA

- 60 minute 20 bar Exponential Moving Average ➟ More about 60MA

- 60MC

- 60 Minute Chart ➟ More about 60MC

- 6H

- 6 Hour ➟ More about 6H

- 6T

- 6 Ticks ➟ More about 6T

- 99BL

- 99.5% chance of at least 3 bars with low at least 1 tick below Moving Average at some point today, and then usually soon afterwards get buy signal and new high of day.今天某个时间点,有99.5%的机率至少有3根K线的低点低于移动平均线至少1个刻度,然后通常很快就会出现买入信号和形成新高 ➟ More about 99BL

- 99BR

- 99.5% chance of at least 3 bars with high at least 1 tick above Moving Average at some point today, and then usually soon afterwards get sell signal and new low of day ➟ More about 99BR

- A1D

- At least One more small leg Down ➟ More about A1D

- A1U

- At least One more small leg Up ➟ More about A1U

- A2

- A two legged pullback to the EMA in a trend, A2 is a subset of Al Brooks' term H2 and L2. See more on Trade A2. ➟ More about A2

- A22

- A second entry in a two legged Pullback to the Exponential Moving Average in a trend ➟ More about A22

- AI

- Always In ➟ More about AI

- AIA

- Always In Aggressive trader, takes every reversal, about 10 per day ➟ More about AIA

- AIBL

- Always In long Bulls ➟ More about AIBL

- AIBLB

- Always In Bulls Buy again above bull bar closing near its high ➟ More about AIBLB

- AIBLBA

- Always In Bulls Buy again above bull bar closing near its high ➟ More about AIBLBA

- AIBLE

- Always In Bulls can Exit below bear bar closing below its midpoint, if they are concerned about risk, and buy again above bull bar. 始终处于牛市中,如果熊市阳线收盘价在其中点以下,可以选择退出,以降低风险,待再次有牛市阳线出现后再次买入。 ➟ More about AIBLE

- AIBLE4

- Always In Bulls can Exit about 4 ticks or half an average bar range below any bar or 1 tick below bear bar closing below its midpoint if concerned about risk. Can always buy again above next bull bar closing near its high. ➟ More about AIBLE4

- AIBR

- Always In short Bears ➟ More about AIBR

- AIBRE

- Always In Bears can Exit above bull bar closing above its midpoint, if they are concerned about risk, and sell again below bear bar ➟ More about AIBRE

- AIBRE4

- Always In Bears can Exit about 4 ticks or half of an average bar range above any bar or 1 tick above bull bar closing above its midpoint if concerned about risk. Can always sell again below next bear bar closing near its low. ➟ More about AIBRE4

- AIBRS

- Always In Bears Sell again below bear bar closing near its low ➟ More about AIBRS

- AIBRSA

- Always In Bears Sell again below bear bar closing near its low ➟ More about AIBRSA

- AIC

- Always In Conservative trader, only takes the strongest reversals, about 2-5 per day ➟ More about AIC

- AMPT

- Category:AMPT ➟ More about AMPT

- APSBL

- Average entry Price for Scale in BuLls ➟ More about APSBL

- APSBR

- Average entry Price for Scale in BeaRs ➟ More about APSBR

- AR

- Actual Risk ➟ More about AR

- ASPT

- At Some Point Today ➟ More about ASPT

- ATM

- At the Money option strike price ➟ More about ATM

- ATRI

- Apex of Triangle or trading range so Breakout Mode. ➟ More about ATRI

- ATRIMA

- Category:ATRIMA ➟ More about ATRIMA

- ATRIMB

- Category:ATRIMB ➟ More about ATRIMB

- AV

- Category:AV ➟ More about AV

- AVR

- Category:AVR ➟ More about AVR

- AVRD

- Category:AVRD ➟ More about AVRD

- AVRM

- Category:AVRM ➟ More about AVRM

- AVRW

- Category:AVRW ➟ More about AVRW

- B18

- Market often get Breakout or reversal between bars 16 to 18. At b18, around 80% chance we have seen LOD or HOD. Al Brooks: “There is nothing magical about 18 bars. I could have picked 16 or 23. The idea is that if the market has been in a range for about 20 bars and it breaks out, there is only a 20% chance that there will be a breakout of the opposite side of the range by the end of the day. Also, if the range is about half of the average recent daily ranges, traders will look for the day’s range to approximately double.”

According to Carpet's analysis, after 1:00 PM ET (around B42), there is 95% chance that market have seen LOD/HOD. See additional research here: https://bpachat.com/studies/chanceseenhodlod ➟ More about B18

- B2

- Weak Trader's Equation so most should wait for higher probability, like 2nd buy signal or a couple consecutive big bull bars closing near their highs. Else need big reward to offset low probability. Some will use wide stop and scale in.

做多最好等会,胜率低,等二次信号,或者多根阳线高收,低胜率需要高盈亏比平衡。实在想入场也可以使用宽止损,后续再加仓。 ➟ More about B2

- BAG

- Breakaway Gap, the first gap of any kind after a trend reversal, only certain in hindsight ➟ More about BAG

- BB2

- Weak Trader's Equation so higher probability to wait for a 2nd buy signal or for a strong bull breakout, which means 2 or 3 bull bars closing near their highs; or, need wide stop and better if can scale in. ➟ More about BB2

- BBBL

- Better to Buy above Bull bar closing near its high ➟ More about BBBL

- BBBR

- Big Bar or Bars so Big Risk. If you take the trade, trade small enough position size so that the risk of the trade is no bigger than on any other trade. If in Tight TR, better to wait for breakout or 2nd signal since low probability, bad for stop entries. ➟ More about BBBR

- BBE

- Breakeven, which means exiting around entry price with small profit or loss ➟ More about BBE

- BBL

- Big Bull bar ➟ More about BBL

- BBLB

- Big bull bar. This is the parent category for all bars that can be classified as big bull bar. ➟ More about BBLB

- BBLB20

- Category:BBLB20 ➟ More about BBLB20

- BBLBC

- Big bull bar close on or around its high. ➟ More about BBLBC

- BBLBD

- Category:BBLBD ➟ More about BBLBD

- BBLBIR

- Big Bull Bar so Increased Risk ➟ More about BBLBIR

- BBLBL

- redirect ➟ More about BBLBL

- BBLBM

- Category:BBLBM ➟ More about BBLBM

- BBLBW

- Category:BBLBW ➟ More about BBLBW

- BBLC

- Big Bull Bar Closing near its high ➟ More about BBLC

- BBLCH

- Broad bull channel. Should be traded same as trading range. ➟ More about BBLCH

- BBLD

- Category:BBLD ➟ More about BBLD

- BBLDC

- Category:BBLDC ➟ More about BBLDC

- BBLL

- redirect ➟ More about BBLL

- BBLMC

- Bar Bull Micro Channel ➟ More about BBLMC

- BBLO

- Better to Buy with Limit Orders below bars than stop orders above ➟ More about BBLO

- BBLPT

- Bigger bull bar after about 4 Buy the Close bars will attract profit taking soon, so better to buy pullback instead of buying the close, else need wide stop ➟ More about BBLPT

- BBLT

- Big Bull bar so big risk, top of Tight trading range so lower probability and possibly sellers above ➟ More about BBLT

- BBLTD

- Category:BBLTD ➟ More about BBLTD

- BBP

- Better to Buy PullBack than to buy at the high since not strong bull trend. Or, need wide stop and trade small, and possibly scale in. ➟ More about BBP

- BBPB

- Better to Buy PullBack than to buy at the high since not strong bull trend. Or, need wide stop and trade small, and possibly scale in. ➟ More about BBPB

- BBR

- Big Bear bar ➟ More about BBR

- BBRB

- Big Bear Bar. This is the parent category for all bars that can be classified as big bear bar. ➟ More about BBRB

- BBRB20

- Category:BBRB20 ➟ More about BBRB20

- BBRBC

- Big Bear Bar Closing near its low ➟ More about BBRBC

- BBRBD

- Category:BBRBD ➟ More about BBRBD

- BBRBIR

- Big Bear Bar so increased risk ➟ More about BBRBIR

- BBRBL

- Bear Surprise Bar or Bars Late in bear trend so possible exhaustion gap. 60% chance this is end of sell climax, but 60% chance one more brief leg down before 2 legs up. Many bears will take profits and some bulls will buy the close for a scalp.

特大阴棒或空头趋势末端的多根阴线(趋势末端的极速)。有60%的机会这是空头趋势结束,但有60%的机会还会出现一次短暂的下降趋势,之后再上涨两次。许多空头将获利了结,而一些多头将在做多信号(BTC 阳线线高收)刮头皮。 ➟ More about BBRBL

- BBRBM

- Category:BBRBM ➟ More about BBRBM

- BBRBW

- Category:BBRBW ➟ More about BBRBW

- BBRC

- Big Bear Bar Closing near its low ➟ More about BBRC

- BBRCH

- Broad Bear Channel, should be traded same as trading range. See more about the pattern in BBLCH. ➟ More about BBRCH

- BBRD

- Category:BBRD ➟ More about BBRD

- BBRDC

- Category:BBRDC ➟ More about BBRDC

- BBRL

- Bear Surprise Bar or Bars Late in bear trend so possible exhaustion gap. 60% chance this is end of sell climax, but 60% chance one more brief leg down before 2 legs up. Many bears will take profits and some bulls will buy the close for a scalp. ➟ More about BBRL

- BBRMC

- Bar Bear Micro Channel ➟ More about BBRMC

- BBRPT

- Bigger bear bar after about 4 Sell the Close bars will attract profit taking soon so better to sell pullback instead of selling the close, else need wide stop ➟ More about BBRPT

- BBRT

- Big Bear bar so big risk, bottom of Tight trading range so lower probability and possibly buyers below ➟ More about BBRT

- BBRTD

- Category:BBRTD ➟ More about BBRTD

- BBS

- Bulls will scale in lower, bears will scale in higher ➟ More about BBS

- BBSA

- Buyers Below, Sellers Above ➟ More about BBSA

- BBSB

- Bad Buy Signal Bar, so some bears scale in higher, expecting pullback to below high of bar, which is magnet. Test of high can come hours later.

差的做多信号K线,因此一些空头在高位加仓,期望回调至该棒的高点以下,该点是磁铁。高点的测试可能会在几个小时后进行。 ➟ More about BBSB

- BBSBH

- Category:BBSBH ➟ More about BBSBH

- BC

- Broad Channel ➟ More about BC

- BD

- Bars Down ➟ More about BD

- BDBUTR

- Big Down, Big Up creates big confusion and usually leads to more trading range. When confused, traders BLSH, take quick profits. ➟ More about BDBUTR

- BDG

- Body Gap, less reliable than true gap (where there is no price overlap at all) but can still be important when context is right. ➟ More about BDG

- BDGD

- Body Gap Down, Gap above highest body of this pullback and lowest body of the breakout point ➟ More about BDGD

- BDGDC

- The body of this reversal up bar overlaps the body of the lowest body of the breakout point. The body gap down is now closed. The bear trend has probably ended and the chart is now either in a trading range or a bull trend. ➟ More about BDGDC

- BDGU

- Body Gap Up, Gap below lowest body of this pullback and highest body of the breakout point ➟ More about BDGU

- BDGUC

- The body of this reversal down bar overlaps the body of the highest body of the breakout point. The body gap up is now closed. The bull trend has probably ended and the chart is now either in a trading range or a bear trend. ➟ More about BDGUC

- BDU

- Category:BDU ➟ More about BDU

- BDUC

- Big Down, big Up, big Confusion so trading range likely ➟ More about BDUC

- BDUDC

- Big Down, big Up, big Confusion so trading range likely ➟ More about BDUDC

- BE

- Breakeven, which means exiting around entry price with small profit or loss ➟ More about BE

- BELO

- Better to Enter with Limit Order ➟ More about BELO

- BFD

- Strong Bear Breakout and Follow-through so more Down ➟ More about BFD

- BFF

- Bar Final Flag ➟ More about BFF

- BFT

- Bad follow through. ➟ More about BFT

- BFTD

- Category:BFTD ➟ More about BFTD

- BFTU

- Category:BFTU ➟ More about BFTU

- BFU

- Strong Bull Breakout and Follow-through so more Up ➟ More about BFU

- BG

- Big gap. Generally, a BG is a gap that is around 50% - 100% of ADR5, a HG is a gap that is much bigger than 100% of ADR5.

Facts[编辑 | 编辑源代码]

- A BG increase the odds of a trend, while a HG increase the odds of TR.

- According to Ali, there is 85% chance the day will be TRD after a HG[7].

- According to Al Brooks, TR after a BGU or HGU has 60% chance of bullish bias, i.e. a BBLCH, vice versa[8]. ➟ More about BG

- BGD

- Big Gap Down, should be looked as a big BRBCL, i.e. a strong bear BO, hence, it increases the chance of a trend day, but note that the trend can be up or down. The bears want a double top or wedge top on a pullback to near the EMA. The bulls want a double bottom or wedge bottom for an early low of the day. ➟ More about BGD

- BGDC

- Body Gap Down Closed. The body of this reversal up bar overlaps the body of the lowest body of the breakout point. The body gap down is now closed. The bear trend has probably ended and the chart is now either in a trading range or a bull trend. ➟ More about BGDC

- BGP

- Buying Pressure ➟ More about BGP

- BGU

- See more details on 分类:GU. ➟ More about BGU

- BGUC

- Body Gap Up Closed. The body of this reversal down bar overlaps the body of the highest body of the breakout point. The body gap up is now closed. The bull trend has probably ended and the chart is now either in a trading range or a bear trend. ➟ More about BGUC

- BIGBSB

- Category:BIGBSB ➟ More about BIGBSB

- BIGSBS

- Category:BIGSBS ➟ More about BIGSBS

- BKE

- Breakeven, which means exiting around entry price with small profit or loss ➟ More about BKE

- BL

- Bull or Bulls ➟ More about BL

- BL2

- Category:BL2 ➟ More about BL2

- BLB

- Bull Body ➟ More about BLB

- BLBC

- Bull Bar Closing near its high ➟ More about BLBC

- BLBCH

- Category:BLBCH ➟ More about BLBCH

- BLBCHMA

- Category:BLBCHMA ➟ More about BLBCHMA

- BLBD

- Category:BLBD ➟ More about BLBD

- BLBM

- Category:BLBM ➟ More about BLBM

- BLBO

- Bull Breakout ➟ More about BLBO

- BLBOM

- Bull breakout but probably minor, which means probably a scalp lasting 1 - 5 bars ➟ More about BLBOM

- BLBS

- Bull Bars ➟ More about BLBS

- BLBW

- Category:BLBW ➟ More about BLBW

- BLC

- Category:BLC ➟ More about BLC

- BLCH

- Bull channel. Bull Channel is a weaker bull trend[9] and it has at least a couple higher lows and higher highs. It is also a tilted trading range, but the key difference is that price in BLCH tends to stay above EMA, i.e bulls keep buying around EMA or a couple of bars below EMA, making EMA a strong support. 上升通道,或“上涨通道”。See also BRCH. ➟ More about BLCH

- BLCHM

- Category:BLCHM ➟ More about BLCHM

- BLCHMA

- Category:BLCHMA ➟ More about BLCHMA

- BLD

- Category:BLD ➟ More about BLD

- BLDD

- Category:BLDD ➟ More about BLDD

- BLE

- Bulls exit below, even if not a strong sell signal

多头在K线下方退出,即使不是个强做空信号 ➟ More about BLE

- BLE2

- Category:BLE2 ➟ More about BLE2

- BLE4

- Category:BLE4 ➟ More about BLE4

- BLEB

- Category:BLEB ➟ More about BLEB

- BLEH

- Category:BLEH ➟ More about BLEH

- BLF

- Bull Flag. ➟ More about BLF

- BLFT

- Category:BLFT ➟ More about BLFT

- BLGU

- Category:BLGU ➟ More about BLGU

- BLMC

- Bull Micro Channel, every low at or above low of prior bar. In BLMC, "the micro trend line is a trend line on any time frame that is drawn across from 2 to about 10 bars where most of the bars touch or are close to the trend line, and the bars usually are relatively small[10]".

Breakout or climax?[编辑 | 编辑源代码]

- BLN1

- Category:BLN1 ➟ More about BLN1

- BLNM

- Category:BLNM ➟ More about BLNM

- BLNMM

- Category:BLNMM ➟ More about BLNMM

- BLO

- In tight trading range or tight channel, Better to enter with Limit Orders ➟ More about BLO

- BLR

- Bull Reversal ➟ More about BLR

- BLRB

- Category:BLRB ➟ More about BLRB

- BLRVD

- Bull Reversal Day, which is a day that sold off and then reversed up and closed near its high ➟ More about BLRVD

- BLSC

- Bull Scalpers ➟ More about BLSC

- BLSH

- Buy Low Sell High ➟ More about BLSH

- BLT

- Bull Trend. ➟ More about BLT

- BLTD

- Bull Trend Day ➟ More about BLTD

- BLTL

- Category:BLTL ➟ More about BLTL

- BLTP

- Bull Trap, a failed bull breakout, also a small or brief buy climax[1]. All buy climaxes are bull traps and all bull traps are buy climaxes. When 3 bars or less, call it BLTP, when more than 3 bars, call it BX. ➟ More about BLTP

- BLTR

- Bull leg in Trading Range instead of bull trend. ➟ More about BLTR

- BLTRV

- Category:BLTRV ➟ More about BLTRV

- BNFB

- Category:BNFB ➟ More about BNFB

- BOA

- Category:BOA ➟ More about BOA

- BOB

- Category:BOB ➟ More about BOB

- BOF

- strong Break Out with good Follow-through ➟ More about BOF

- BOP

- Break Out Point, which is the price that the current breakout broke beyond ➟ More about BOP

- BOPBL

- Breakout Point for the current rally. The current rally had a bull breakout. That means it broke above a prior high, which is the breakout point. It often gets tested and is therefore a magnet below ➟ More about BOPBL

- BOPBR

- Breakout Point for the current selloff. The current selloff had a bear breakout. That means it broke below a prior low, which is the breakout point. It often gets tested and is therefore a magnet above ➟ More about BOPBR

- BOT

- Breakout Test, which is a pullback testing the breakout point, and traders are deciding if the breakout will succeed or fail. ➟ More about BOT

- BOUD

- Breakout Up or Down ➟ More about BOUD

- BPS

- Breakout Pullbacks ➟ More about BPS

- BR

- Bear or Bears ➟ More about BR

- BRA

- Probably buyers above ➟ More about BRA

- BRB

- Bear Body ➟ More about BRB

- BRBC

- Bear Bar Closing near its low ➟ More about BRBC

- BRBCL

- Category:BRBCL ➟ More about BRBCL

- BRBCLMA

- Category:BRBCLMA ➟ More about BRBCLMA

- BRBD

- Category:BRBD ➟ More about BRBD

- BRBM

- Category:BRBM ➟ More about BRBM

- BRBO

- Bear Breakout ➟ More about BRBO

- BRBOM

- Bear breakout but probably minor, which means probably a scalp lasting 1 - 5 bars ➟ More about BRBOM

- BRBS

- Bear Bars ➟ More about BRBS

- BRBW

- Category:BRBW ➟ More about BRBW

- BRC

- Category:BRC ➟ More about BRC

- BRCH

- Bear Channel, which is a weaker bear trend and it has at least a couple lower lows and lower highs. See more on BLCH.

下跌通道,或称“下降通道”。 ➟ More about BRCH

- BRCLM

- Category:BRCLM ➟ More about BRCLM

- BRCLMA

- Category:BRCLMA ➟ More about BRCLMA

- BRD

- Category:BRD ➟ More about BRD

- BRDD

- Category:BRDD ➟ More about BRDD

- BRE

- Bears exit above, even if not strong buy signal

空单在上方退出,即使不是强买入信号 ➟ More about BRE

- BRE2

- Bears can Exit about half of an average bar's range above any bar, or 1 tick above bull bar closing above its midpoint if disappointed. Can always sell again below next bear bar closing near its low.

空头可以在任意一根K线average bar(这里理解可能是平均大小的K线,因为有的时候bull signal bar 可能会很小)的一半范围内高点退出,或者在看跌的情况下,卖掉比看涨棒的中点高一个跳价以上。在下一个阴线低收时,可以再次卖出。 ➟ More about BRE2

- BRE4

- Category:BRE4 ➟ More about BRE4

- BREA

- Category:BREA ➟ More about BREA

- BREH

- Category:BREH ➟ More about BREH

- BRF

- Bear Flag. ➟ More about BRF

- BRFT

- Category:BRFT ➟ More about BRFT

- BRGU

- Category:BRGU ➟ More about BRGU

- BRMC

- ➟ More about BRMC

- BRN1

- Category:BRN1 ➟ More about BRN1

- BRNM

- Category:BRNM ➟ More about BRNM

- BRNMM

- Category:BRNMM ➟ More about BRNMM

- BRR

- Bear Reversal ➟ More about BRR

- BRRB

- Category:BRRB ➟ More about BRRB

- BRRVD

- Bear Reversal Day, which is a day that rallied, but sold off and closed bear its low ➟ More about BRRVD

- BRS

- Bear surprise. ➟ More about BRS

- BRSC

- Bear Scalpers ➟ More about BRSC

- BRT

- Bear Trend. ➟ More about BRT

- BRTD

- Bear Trend Day ➟ More about BRTD

- BRTL

- Category:BRTL ➟ More about BRTL

- BRTP

- Bear Trap, failed bear breakout. All bear traps are sell climaxes. Expect at least a MM up of the size of BRTP when market is trending up, vice versa, for e.g. 20230321 bar 50-54. ➟ More about BRTP

- BRTR

- Bear leg in Trading Range and not in bear trend. See also BLTR. ➟ More about BRTR

- BRTRV

- Category:BRTRV ➟ More about BRTRV

- BRVD

- Big Reversal Down so at least small 2nd leg down likely ➟ More about BRVD

- BRVU

- Big Reversal UP so at least small 2nd leg up likely ➟ More about BRVU

- BS

- Category:BS ➟ More about BS

- BSA

- Category:BSA ➟ More about BSA

- BSBC

- Category:BSBC ➟ More about BSBC

- BSBD

- Buy Signal Bar on Daily chart ➟ More about BSBD

- BSBM

- Buy Signal Bar on Monthly chart ➟ More about BSBM

- BSBR

- Better to Sell below Bear bar closing near its low ➟ More about BSBR

- BSBSL

- Category:BSBSL ➟ More about BSBSL

- BSBW

- Buy Signal Bar on Weekly chart ➟ More about BSBW

- BSLO

- Better to Sell with Limit Orders above bars than stop orders below ➟ More about BSLO

- BSP

- Better to Sell PullBack, which means a bounce, than to sell at the low since not strong bear trend. Or, need wide stop and trade small, and possibly scale in. ➟ More about BSP

- BSPB

- Better to Sell PullBack, which means a bounce, than to sell at the low since not strong bear trend. Or, need wide stop and trade small, and possibly scale in. ➟ More about BSPB

- BSSB

- Bad Sell Signal Bar, so some bulls scale in lower, expecting pullback to above low of bar, which is magnet. Test of low can come hours later. ➟ More about BSSB

- BTCBL

- Buy The Close Bulls ➟ More about BTCBL

- BTCE

- Buy the Close rally until the End of day ➟ More about BTCE

- BTH

- Buy The High bull trend is a series of bull bars closing near their highs, and bulls will buy with a stop 1 tick above the high of the prior bar, and exit below a bear bar closing below its midpoint or 1 - 2 points below any bar ➟ More about BTH

- BTM

- Category:BTM ➟ More about BTM

- BTS

- Category:BTS ➟ More about BTS

- BTTR

- Bar Tight Trading Range ➟ More about BTTR

- BTW

- Better To Wait for better combination of probability, risk, and reward ➟ More about BTW

- BU

- Bars Up ➟ More about BU

- BUBDTR

- Big Down, Big Up creates big confusion and usually leads to more trading range. When confused, traders BLSH, take quick profits. ➟ More about BUBDTR

- BUD

- Category:BUD ➟ More about BUD

- BUDC

- Big Up, Big Down, big Confusion so trading range likely

大起大落,让人困惑,所以很可能要进去区间TR ➟ More about BUDC

- BV

- Buy Vacuum test of resistance ➟ More about BV

- BW

- Tight trading range, sometime called barbwire (BW). LOM, bad for scalping with stop orders, most traders should wait. ➟ More about BW

- BWB

- Better to Wait for a Breakout ➟ More about BWB

- BWBLB

- Bar streak without bull bodies so strong bears and wait to buy ➟ More about BWBLB

- BWBOUD

- Better to wait for a breakout up or down ➟ More about BWBOUD

- BWBRB

- Bar streak without bear bodies so strong bulls and wait to sell ➟ More about BWBRB

- BWSS

- Only B if using a Wide Stop, and better if can scale in lower ➟ More about BWSS

- BWT

- Better Wait for Tomorrow ➟ More about BWT

- BXH

- Buy Climax High, high of buy climax bar or bars ➟ More about BXH

- BXL

- Buy Climax Low, Low of buy climax bar or bars ➟ More about BXL

- BXS

- Buy Climaxes ➟ More about BXS

- BZ

- Buy Zone, an area where traders will look to buy ➟ More about BZ

- CAM

- Close Above Midpoint of the bar ➟ More about CAM

- CAMP

- Close Above Midpoint of the bar ➟ More about CAMP

- CBM

- Close Below Midpoint of the bar ➟ More about CBM

- CBMP

- Close Below Midpoint of the bar ➟ More about CBMP

- CC

- This is the top category for all Consecutive patterns. ➟ More about CC

- CCAMA

- Category:CCAMA ➟ More about CCAMA

- CCB

- Consecutive Bars[2]. ➟ More about CCB

- CCBBLB

- Consecutive Big Bull Bars so higher probability for bears to wait for 2nd sell signal ➟ More about CCBBLB

- CCBBLBC

- Consecutive Big Bull Bars Closing near their highs makes at least a small 2nd leg up likely ➟ More about CCBBLBC

- CCBBLBCM

- Category:CCBBLBCM ➟ More about CCBBLBCM

- CCBBLBCMA

- Category:CCBBLBCMA ➟ More about CCBBLBCMA

- CCBBLC

- Consecutive Big Bull Bars Closing near their highs makes at least a small 2nd leg up likely ➟ More about CCBBLC

- CCBBRB

- Consecutive Big Bear Bars so higher probability for bulls to wait for 2nd buy signal ➟ More about CCBBRB

- CCBBRBC

- Consecutive Big Bear Bars Closing near their lows makes at least a small 2nd leg down likely ➟ More about CCBBRBC

- CCBBRBCM

- Category:CCBBRBCM ➟ More about CCBBRBCM

- CCBBRBCMA

- Category:CCBBRBCMA ➟ More about CCBBRBCMA

- CCBBRC

- Consecutive big bear bars closing near their lows and far below EMA. Lower prices likely. Always In Short and Sell The Close bear trend. ➟ More about CCBBRC

- CCBL

- Consecutive Bull Bars ➟ More about CCBL

- CCBL1C

- Consecutive Bull bars with one closing near its high and with a big bull body so probably Buy The Close and Always In Long ➟ More about CCBL1C

- CCBLB

- Consecutive Bull Bars, especially when closed on their highs (COH). ➟ More about CCBLB

- CCBLB1C

- Category:CCBLB1C ➟ More about CCBLB1C

- CCBLBC

- Consecutive Bull Bars Closing near their highs makes at least a small 2nd leg up likely ➟ More about CCBLBC

- CCBLBCH

- CCBLBCM

- Category:CCBLBCM ➟ More about CCBLBCM

- CCBLBCMA

- Category:CCBLBCMA ➟ More about CCBLBCMA

- CCBLC

- Consecutive Bull Bars Closing near their highs makes at least a small 2nd leg up likely ➟ More about CCBLC

- CCBLCMA

- Category:CCBLCMA ➟ More about CCBLCMA

- CCBLCMA2

- Category:CCBLCMA2 ➟ More about CCBLCMA2

- CCBMA

- Category:CCBMA ➟ More about CCBMA

- CCBR

- Consecutive Bear Bars ➟ More about CCBR

- CCBR1C

- Consecutive Bear bars with one closing near its low and with a big bear body so probably Sell The Close and Always In Short ➟ More about CCBR1C

- CCBRB

- Consecutive Bear Bars. 连续的阴线。 ➟ More about CCBRB

- CCBRB1C

- Consecutive bear bars(at least 2) with one closing near its low and with a big bear body so probably STC and AIS. Also see CCBRB1C BEMA or CCBLB1C. ➟ More about CCBRB1C

- CCBRBC

- Consecutive Bear Bars Closing near their lows makes at least a small 2nd leg down likely. ➟ More about CCBRBC

- CCBRBCL

- Category:CCBRBCL ➟ More about CCBRBCL

- CCBRBCM

- Category:CCBRBCM ➟ More about CCBRBCM

- CCBRBCMA

- Category:CCBRBCMA ➟ More about CCBRBCMA

- CCBRBCMA2

- Category:CCBRBCMA2 ➟ More about CCBRBCMA2

- CCBRC

- Consecutive Bear Bars Closing near their lows makes at least a small 2nd leg down likely ➟ More about CCBRC

- CCBRCMA

- Category:CCBRCMA ➟ More about CCBRCMA

- CCBWBLB

- Category:CCBWBLB ➟ More about CCBWBLB

- CCBWBRB

- Category:CCBWBRB ➟ More about CCBWBRB

- CCBX

- Consecutive buy climaxes. ➟ More about CCBX

- CCBXS

- Category:CCBXS ➟ More about CCBXS

- CCCAMA

- Category:CCCAMA ➟ More about CCCAMA

- CCCB

- Consecutive Complex Bottoms, which is a pair of bottoms where both have 2 or 3 legs down. Consecutive complex bottoms often form H4 buy setup, or H6 buy setup which is just a variation of H4. When a CCCB forms, 60% chance of 2 legs sideways to up. See example below. ➟ More about CCCB

- CCCBMA

- Category:CCCBMA ➟ More about CCCBMA

- CCCT

- Consecutive Complex Tops, which is a pair of tops where both have 2 or 3 legs up. Consecutive complex tops often form L4 sell setup, or L6 sell setup which is just a variation of L4. When a CCCT forms, 60% chance of 2 legs sideways to down. See more on 分类:CCCB. ➟ More about CCCT

- CCSX

- Consecutive sell climaxes means several big bear bars closing near their lows with one or more pauses, and it usually leads to profit taking and about 2 legs sideways to up. ➟ More about CCSX

- CCSXS

- Category:CCSXS ➟ More about CCSXS

- CCT

- Consecutive Tops ➟ More about CCT

- CCW

- Category:CCW ➟ More about CCW

- CCWB

- Category:CCWB ➟ More about CCWB

- CCWD

- Category:CCWD ➟ More about CCWD

- CCWT

- Category:CCWT ➟ More about CCWT

- CCWU

- Category:CCWU ➟ More about CCWU

- CD

- Closed ➟ More about CD

- CHB

- Cup and Handle Bottom. Cup is strong reversal up after sell climax. Should form higher low pullback for handle and get 2nd leg sideways to up. ➟ More about CHB

- CHD

- Cup and Handle Top. Cup is strong reversal down after buy climax. Should form lower high pullback for handle and get 2nd leg sideways to down. ➟ More about CHD

- CHT

- ➟ More about CHT

- CHU

- Cup and Handle Bottom. Cup is strong reversal up after sell climax. Should form higher low pullback for handle and get 2nd leg sideways to up. ➟ More about CHU

- CLM

- Close of Last Month ➟ More about CLM

- CLW

- Close of Last Week ➟ More about CLW

- CLY

- Close of Last Year ➟ More about CLY

- CM

- Close of Month ➟ More about CM

- CMB

- Confusion comes from there being both a reasonable reason to buy and to sell. Traders need more information, which means more bars so at least small trading range. Better to wait for 2nd signal up or down or for strong breakout. ➟ More about CMB

- CNH

- Close Near High of bar, which means the upper third of range of bar ➟ More about CNH

- CNL

- Close Near Low of bar, which means lower third of range of bar ➟ More about CNL

- COD

- Close of Day ➟ More about COD

- COH

- Close On or near High of bar ➟ More about COH

- COL

- Close On or near Low of bar ➟ More about COL

- COLM

- Close of Last Month ➟ More about COLM

- COLW

- Close of Last Week ➟ More about COLW

- COM

- Close of Month. ➟ More about COM

- CONTEXT

- Context. ➟ More about CONTEXT

- COT

- Close of Today ➟ More about COT

- COW

- Close of Week ➟ More about COW

- COY

- Close of Yesterday ➟ More about COY

- CS

- Closes ➟ More about CS

- CSX

- Consecutive sell climaxes means several big bear bars closing near their lows with one or more pauses, and it usually leads to profit taking and about 2 legs sideways to up. ➟ More about CSX

- CT

- Countertrend, against the trend of the past several bars or even of the entire day ➟ More about CT

- CUPD

- Cup and Handle Bear Flag, which is a pullback after bear reversal ➟ More about CUPD

- CUPH

- Cup and Handle is a reversal and then a pullback ➟ More about CUPH

- CUPHD

- Cup and Handle Bear Flag, which is a pullback after bear reversal ➟ More about CUPHD

- CUPHU

- Cup and Handle Bull Flag, which is a pullback after bull reversal ➟ More about CUPHU

- CUPU

- Cup and Handle Bull Flag, which is a pullback after bull reversal ➟ More about CUPU

- CW

- Close of Week ➟ More about CW

- CY

- Close of Yesterday ➟ More about CY

- DBBF

- Double Bottom Bull Flag, so when bull buy signal bar, there is a 40% chance of a breakout above the recent swing high, which is the neck line of the DB, and a measured move up. DBBLF usually happens at EMA area. When a DBBLF happens late in a bull trend, it is often a final BLF, especially when the rally is weak or part of one or more other reversal patterns[3]. For e.g. if bull trend is a relative broad bull channel and the setup is also a WT (or even part of NW), or at MM target[4]. ➟ More about DBBF

- DBBLF

- Double Bottom Bull Flag, so when bull buy signal bar, there is a 40% chance of a breakout above the recent swing high, which is the neck line of the DB, and a measured move up. DBBLF usually happens at EMA area. When a DBBLF happens late in a bull trend, it is often a final BLF, especially when the rally is weak or part of one or more other reversal patterns[5]. For e.g. if bull trend is a relative broad bull channel and the setup is also a WT (or even part of NW), or at MM target[6]. ➟ More about DBBLF

- DBHL

- Double Bottom Higher Low is a double bottom where the 2nd low is higher ➟ More about DBHL

- DBLE

- Bulls who bought are disappointed by the bar not closing near its high and might exit below ➟ More about DBLE

- DBLGU

- Category:DBLGU ➟ More about DBLGU

- DBLL

- Double Bottom Lower Low is a double bottom where the 2nd low is lower ➟ More about DBLL

- DBMTR

- Double Bottom Major Trend Reversal ➟ More about DBMTR

- DBPB

- Double Bottom Pullback means there is a pullback from a reversal up from a double bottom and bulls will buy above the pullback bar, especially if it closes near its high. ➟ More about DBPB

- DBRE

- Bears who sold are disappointed that the bar did not close near its low and might exit above ➟ More about DBRE

- DBRGU

- Category:DBRGU ➟ More about DBRGU

- DBS

- Double Bottoms, or two consecutive bars with identical lows ➟ More about DBS

- DBTC

- Disappointed Buy The Close Bulls ➟ More about DBTC

- DBTCBE

- Disappointed Buy The Close Bulls might sell their longs around the highest close to exit around breakeven ➟ More about DBTCBE

- DBTCBL

- Disappointed Buy The Close Bulls ➟ More about DBTCBL

- DBTCBLBE

- Disappointed Buy The Close Bulls might sell their longs around the highest close to exit around breakeven ➟ More about DBTCBLBE

- DBTCBLE

- Disappointed Buy The Close Bulls might sell their longs around the highest close to exit around breakeven ➟ More about DBTCBLE

- DD

- Doji, which is a bar with a small body and a close near the open. ➟ More about DD

- DDD

- Doji Day, which is a bar on the daily chart with a small body and a close near the open ➟ More about DDD

- DDIV

- Double Divergence ➟ More about DDIV

- DDM

- Doji Month, which is a bar on the monthly chart with a small body and a close near the open ➟ More about DDM

- DDW

- Doji Week, which is a bar on the weekly chart with a small body and a close near the open ➟ More about DDW

- DFD

- Dominant Feature Down is exceptionally strong selloff. I replaced the term with Major Bear Surprise. It will usually prevent a bull trend, even if there is a new high. It increases the chance of sideways to down for the rest of the day. ➟ More about DFD

- DFT

- Disappointing Follow-through so possible Trading range ➟ More about DFT

- DFU

- Dominant Feature Up is exceptionally strong rally. I replaced the term with Major Bull Surprise. It will usually prevent a bear trend, even if there is a new low. It increases the chance of sideways to up for the rest of the day. ➟ More about DFU

- DIV

- Divergence ➟ More about DIV

- DL

- Dueling Lines ➟ More about DL

- DP

- Double Top Pullback or Double Bottom Pull Back. ➟ More about DP

- DPS

- Double Top Pull Backs or Double Bottom Pull Backs ➟ More about DPS

- DSTC

- Disappointed Sell The Close Bears ➟ More about DSTC

- DSTCBE

- Disappointed Sell The Close Bears might buy back their shorts around the lowest close to exit around breakeven ➟ More about DSTCBE

- DSTCBR

- Disappointed Sell The Close Bears ➟ More about DSTCBR

- DSTCBRBE

- Disappointed Sell The Close Bears might buy back their shorts around the lowest close to exit around breakeven ➟ More about DSTCBRBE

- DSTCBRE

- Disappointed Sell The Close Bears might buy back their shorts around the lowest close to exit around breakeven ➟ More about DSTCBRE

- DTBF

- Double Top Bear Flag, so when bear sell signal bar, there is a 40% chance of a breakout below the recent swing low, which is the neck line of the double top, and a measured move down. ➟ More about DTBF

- DTBRF

- Double Top Bear Flag, more reliable especially when close to EMA. When there is a strong bear sell signal bar, there is a 40% chance of a breakout below the recent swing low, which is the neck line of the double top, and a measured move down. Note that traders should look for DTBRF at EMA area, when the bull leg that formed the 2nd top is also a wedge, plus a reasonable strong bear reversal bar not far above EMA, it will be a strong short setup. This type of setup is also called DTWBRF, see bar 8-19 on 20230103 for example[7]. ➟ More about DTBRF

- DTHH

- Double Top Higher High is a double top where the 2nd top is higher ➟ More about DTHH

- DTLH

- Double Top Lower High is a double top where the 2nd top is lower ➟ More about DTLH

- DTMTR

- Double Top Major Trend Reversal ➟ More about DTMTR

- DTPB

- Double Top Pullback means there is a reversal down from a double top and the bears will sell below the pullback bar, especially if it closes near its low ➟ More about DTPB

- DTR

- Category:DTR ➟ More about DTR

- DTS

- Double Tops ➟ More about DTS

- DTTR

- Category:DTTR ➟ More about DTTR

- EBL

- Category:EBL ➟ More about EBL

- EBLT

- End of day Bull Trap ➟ More about EBLT

- EBR

- Category:EBR ➟ More about EBR

- EBRT

- End of day Bear Trap ➟ More about EBRT

- EBS

- Entry Bars ➟ More about EBS

- EBTC

- End of day Buy The Close bull trend ➟ More about EBTC

- EBX

- ➟ More about EBX

- EGD

- Category:EGD ➟ More about EGD

- EGU

- Category:EGU ➟ More about EGU

- ELOM

- End of day Limit Order Market ➟ More about ELOM

- EOM

- End of Month ➟ More about EOM

- EOQ

- Category:EOQ ➟ More about EOQ

- EOW

- End of Week ➟ More about EOW

- EOY

- End Of Year ➟ More about EOY

- EP

- Endless Pullback. EPB means MRV grew into MTR without clear MTR pattern (for e.g. HLMTR). EPB also means the MRV is probably evolving into a small pullback trend (SPBRT or SPBLT) in opposite direction of the initial trend. ➟ More about EP

- EPB

- Endless Pullback. EPB means MRV grew into MTR without clear MTR pattern (for e.g. HLMTR). EPB also means the MRV is probably evolving into a small pullback trend (SPBRT or SPBLT) in opposite direction of the initial trend. ➟ More about EPB

- EPBD

- Endless Pullback in a bull trend is a tight bear channel that becomes a Small Pullback Bear Trend, which never looks very bearish but can continue for hours. If there are consecutive big bear bars, there is often a measured move down.

When a EPBD lasts more than 10 - 20 bars after a rally, watch for BRBO and accelerating down into bear trend reversal. At first the EPB looks like a BLF, but if there are consecutive big bear bars below EMA, it is then a BRBO below BLF, there is a 60% chance it is the start of a bear trend, example: 20230323, 20200619, 20230426 34-50. ➟ More about EPBD

- EPBU

- Endless Pullback in a bear trend is a tight bull channel that becomes a Small Pullback Bull Trend, which never looks very bullish but can continue for hours. If there are consecutive big bull bars, there is often a measured move up. The pullback from 26 on 20230502 is an example of EPBU after strong selloff. ➟ More about EPBU

- EPD

- Endless Pullback in a bull trend is a tight bear channel that never looks very bearish but can continue for hours ➟ More about EPD

- EPTG

- End of day Profit Taking so possible reversal ➟ More about EPTG

- EPU