Category:ORV SBLT:修订间差异

无编辑摘要 |

无编辑摘要 |

||

| 第1行: | 第1行: | ||

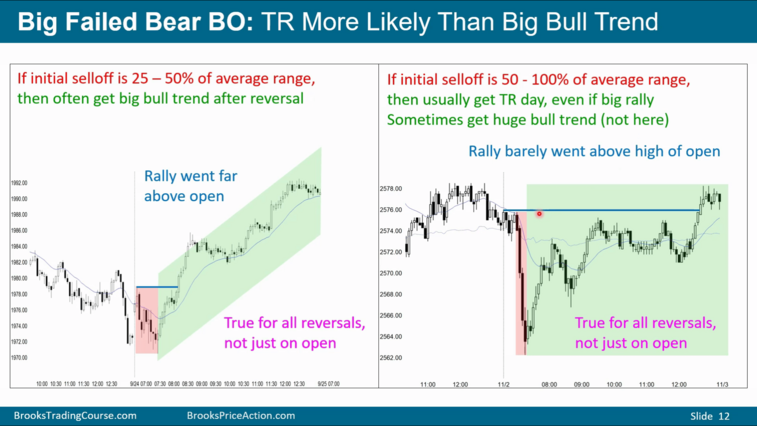

''[[ORV]], then evolved into [[SBLT]]. Note that the initial range matters.'' If initial selloff is 25% - 50% of average range, then often get big bull trend after reversal. If initial selloff is 50% - 100% of average range, then usually get TR day, the rally barely went above high of open.[[文件:ES-48A-12.png|thumb|course ES-48A|757x757px|居中]]''Questions:'' | ''[[ORV]], then evolved into [[SBLT]]. Note that the initial range matters.'' If initial selloff is 25% - 50% of average range, then often get big bull trend after reversal. If initial selloff is 50% - 100% of average range, then usually get TR day, the rally barely went above high of open.[[文件:ES-48A-12.png|thumb|[[笔记:48A Trading the Open|course ES-48A]]|757x757px|居中]]''Questions:'' | ||

* ''How often market will evolve into TR after pulling back to EMA?'' | * ''How often market will evolve into TR after pulling back to EMA?'' | ||

2023年8月7日 (一) 10:56的最新版本

ORV, then evolved into SBLT. Note that the initial range matters. If initial selloff is 25% - 50% of average range, then often get big bull trend after reversal. If initial selloff is 50% - 100% of average range, then usually get TR day, the rally barely went above high of open.

Questions:

- How often market will evolve into TR after pulling back to EMA?

- How often the bull trend will resume after pulling back to EMA?