交易手册:价格行为是遗传基因决定的吗?:修订间差异

无编辑摘要 |

无编辑摘要 |

||

| 第1行: | 第1行: | ||

https://www.brookstradingcourse.com/how-to-trade-manual/price-action-genetically-based/ | |||

=== 价格行为是遗传基因决定的吗? === | === 价格行为是遗传基因决定的吗? === | ||

| 第141行: | 第141行: | ||

[[分类:Al Brooks Articles]] | [[分类:Al Brooks Articles]] | ||

<references /> | <references /> | ||

[[分类: | [[分类: 已 发布]] | ||

2023年6月3日 (六) 19:56的最新版本

https://www.brookstradingcourse.com/how-to-trade-manual/price-action-genetically-based/

价格行为是遗传基因决定的吗?[编辑 | 编辑源代码]

现在的图表与100年前的一样吗?Charts are the same as 100 years ago[编辑 | 编辑源代码]

随着计算机占据了交易的主导地位并且市场变得越来越国际化,一个常见的讨论话题是市场行为是否发生了变化。图表上的价格行为被认为是人类行为的一种反映。和所有的行为一样,价格行为也具有遗传基础。人们一直都希望赚钱,而我们通过交易来实现这一目标。例如,当你去商店购买一个苹果时,你实际上也是在做交易。

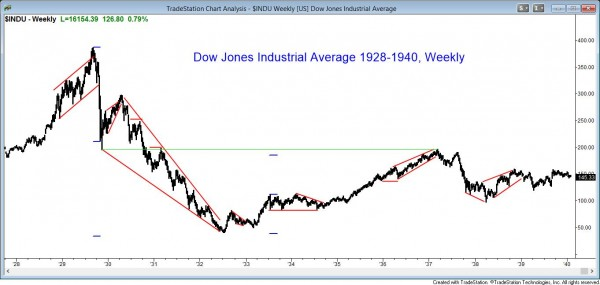

我从1987年已经开始交易。我还查看过100年的历史图表。如果我去掉图表上的标签,我就无法确定这张图表是来自1910年还是2010年,也无法确定它是一个5分钟的外汇图表还是道琼斯工业平均指数的月线图表。

Now that computers dominate trading and markets are international, a common topic is whether the behavior of markets has changed. The movement on charts is called price action and it is a reflection of human behavior. Like all behavior, it is genetically based. People have always wanted to make money and we all do it by trading all day long. For example, when you go to the store, you trade money to get an apple.

I have looked at charts going back 100 years and I have traded since 1987. If I remove the labels from the charts, I cannot tell if the chart is from 1910 or 2010, and I cannot tell if the chart is a 5 minute Forex chart or a monthly chart of the Dow Jones Industrial Average.

计算机并没有改变价格行为 Computers have not changed price action[编辑 | 编辑源代码]

尽管计算机的出现使交易更加自动化和高速化,但我认为程序演算只是寻找更加合乎逻辑的模式,然后构建能够获得数学优势的交易。这正是所有交易者自有市场以来所做的事情。因此,虽然计算机在交易中扮演了更重要的角色,但它们并没有改变价格行为的本质。价格行为仍然是人类行为的反映,也就是说,它们仍然遵循着相同的市场规律和趋势。

How can computers not have affected the price action? It clearly has some effect, but I believe that algorithms simply look for logical patterns and then structure trades where there is a mathematical edge. That is exactly what all traders have done in all markets since the beginning of time.

交易具有一定的基因基础 Trading is genetically based[编辑 | 编辑源代码]

在人类文明的历史长河中,交易一直扮演着重要的角色,是人类生存和发展不可或缺的一部分。因此,能够胜任交易的人具有更强的适应能力,而这些人的基因在长达数万年的自然选择过程中逐渐得到了优化,相比那些不擅长交易的人更具有竞争优势。

因此,可以说交易能力在一定程度上基于个体的基因,而随着计算机技术的进步,交易能力得以不断提高,趋于更加完善。正因如此,即使是100年前的图表与现在的图表也没有什么差别,所有市场和时间周期的图表看起来都类似,这种趋势也将一直持续下去。

因此,可以说所有价格行为都有基因基础,即使是由计算机进行的交易也不例外。对于经验丰富的价格行为交易者来说,他们可以理解市场在每一个tick的运动情况。他们可以洞悉市场运动的规律,进而做出更为准确的交易决策。

Trading has always been part of civilization and crucial to survival. This means that the more fit traders have an advantage and that their genes have been naturally selected over those of incompetent traders for tens of thousands of years.

The result is that trading is genetically based, and computers simply move trading closer to perfection. This is why the charts are the same as they were 100 years ago and why the charts of all markets and all time frames look the same and always will.

All price action is genetically based, even if the trading is done by computer. A very experienced price action trader can understand what the market is doing during every tick during the day.

所有市场和时间周期的图表价格行为都是相同的。Charts are the same in all markets and time frames[编辑 | 编辑源代码]

举个例子,看一下上面的三张图表。我隐藏了它们的时间和价格轴,以说明它们的相似之处。你能分辨出哪一个是黄金期货图表、哪一个是EURUSD外汇图表,哪一个是通用电气的图表吗?此外,你能辨认出哪个是1987年股市崩盘期间的日线图、哪个是1分钟图,哪个是5分钟图吗?[1]

For example, look at the three charts below. I hid the time and price axes to illustrate this point. Can you tell which is a gold futures chart, a EURUSD Forex foreign exchange chart, and a chart of GE? Also, which is a daily chart during the 1987 stock market crash, a 1 minute chart, and a 5 minute chart?

所有时间周期都有相同的价格行为 All time frames have the same price action[编辑 | 编辑源代码]

很多交易者不能整天观察市场,而是使用60分钟或日线图进行交易。虽然我课程中的大多数例子都是基于5分钟图的,但也有很多使用日线、周线和月线图表的例子。

例如,请看我在网站上发布的https://www.brookstradingcourse.com/free-sample-price-action-trading-videos/,其中有详细的例子展示如何在周线外汇市场进行价格行为交易。

价格行为交易者应该相信市场是分形的(Price action traders believe that markets are fractal. ),这是指更大的时间周期级别的图表形态由一系列更小的时间周期的图表形态组成,无论您检查多么小级别的图表,您都会看到与月线图表上相同的模式。也就是说,市场中的价格行为是相似的,这意味着价格行为的交易策略可以应用于各种时间周期,从而提供了更广泛的交易机会。

如果您看到一个类似上方图表,没有右侧价格轴和底部时间轴的图表,您就无法确定它是5分钟、60分钟、日线、周线还是月线图表,也无法确定它是由多少个交易或股票组成的。这是因为图表反映的是人类行为,而人类行为是基于基因的。不同的时间框架只是对人类行为的不同聚合方式。更高时间框架的图表仅仅是更大规模的人类行为集合,而不是完全不同的行为类型。因此,没有时间和价格轴的图表只能表达出人类行为的模式,而无法确定其具体的时间和规模。

Many traders cannot watch the market all day long and instead trade using 60 minute or daily charts. Although most of the examples in my course involve 5 minute charts, there are many that use daily, weekly, and monthly charts as well.

For example, look at Module 43, which I have posted on the site in its entirety for free. There is a detailed example of how to trade a price action trade in the weekly Forex foreign exchange market.

Price action traders believe that markets are fractal. This means that bigger patterns are composed of a collection of smaller patterns, and no matter how tiny a chart you examine, you will still see the same patterns that you see on monthly charts.

If you look a chart like the ones above where there is no price axis on the right and no time axis below, you would not be able to tell if it was a 5 minute, 60 minute, daily, weekly, or monthly chart, or a chart made of 1,000 ticks or 50,000 shares. Why is that? Because charts simply represent human behavior, which is genetically based, and a higher time frame chart is just a bigger collection of behavior.

在所有市场和时间框架中采取相同的交易策略 Trade all markets and time frames the same[编辑 | 编辑源代码]

大多数价格行为交易者会以相同的方式交易所有的图表(显然会根据他们对于任何一笔交易的最大风险进行调整仓位大小、风险和奖励),在你学会如何交易之后,你很可能也会这样做。"

你经常在电视上看到这种情况。专家会展示日线、周线和月线图表,并使用相同的术语来描述它们。他们寻找趋势、交易区间、支撑和阻力,而不考虑时间框架。

当我交易60分钟或日线图表时,我使用与5分钟图表相同的分析方法。但是,当我需要持有的交易仓位长达数天或数周时,通常会使用期权来减少(限制)我的风险。

Most price action traders trade all charts the same way (obviously adjusting position size, risk, and reward, based on their usual maximum risk for any trade), and you probably will as well after you learn how to trade.

You see this on television all the time. An expert will show daily, weekly, and monthly charts and use the same words to describe them. He looks for trends, trading ranges, support, and resistance, and does not care what the time frame is.

When I trade the 60 minute chart or a daily chart, I use the exact same analysis that I use on a 5 minute chart. However, when I hold trades for days to weeks at a time, it is usually in the form of options because I want to contain my risk.

高频交易并不是问题。High frequency trading are not a problem[2][编辑 | 编辑源代码]

一些高频交易机构因其惊人的盈利能力而受到广泛关注,以至在交易者中开始出现使用越来越小的时间框架的趋势,而且我注意到一些人正在推广这些图表作为交易者赚钱的一种方式,但我强烈建议,如果交易者使用过小的时间框架,大多数交易者只会长期亏损而不是获利。我在课程中详细讲解了其中的原因,但其中最根本的一个原因是这些图表无法给交易者足够的时间清晰地思考,结果导致实际交易中犯了太多的错误。所以,从5分钟图表开始学习交易对初学者是个不错的选择,我建议交易者避免使用任何时间框架小于3分钟的图表。[3]

With High Frequency Trading firms getting so much press because some are incredibly profitable, there is a tendency among traders to move toward smaller and smaller time frame charts. I have noticed that there are several people promoting these charts as a way for traders to make money.

I strongly believe that most traders will only lose and never win long-term if they use very small time frames. I address the reasons in the course, but the most fundamental one is that these charts do not give traders enough time to think clearly and they end up making too many mistakes. A 5 minute chart is a good place to start, and I recommend avoiding any chart where there are more than 20 bars per hour.

季节性趋势 Seasonal tendencies[编辑 | 编辑源代码]

当谈到市场分析时,有一些季节性的趋势是可以用统计数据来证明的。[4]因此,当季节性趋势变得显著时,我有时会在交易室中提及它们。[5]

例如,在一月份,华尔街有一种传统,认为新年伊始所发生的事情具有重要意义。交易员喜欢将一月份视为一个股市晴雨表,并寻找关于新一年的涨跌的统计数据,基于一月份发生的情况来预测新一年的涨跌情况。虽然这些统计数据是有效的,但它们并不能帮助交易员构建良好的交易策略。

There are some seasonal tendencies that can be shown statistically. I sometimes bring them up in the trading room at the appropriate time of the year.

For example, during January, there is a tradition on Wall St. to find significance in what happens early in the year. Traders like to think of January as a barometer and look for statistics about whether the new year will be an up or down year based on what happens in January. Although the statistics are valid, they do not help in structuring trades.

我对一月份的观察清单 My list of January observations[编辑 | 编辑源代码]

每年的年线平均有67%的概率收盘价高于开盘价,只有33%的概率会下跌。如果1月份的前五个交易日的K线总体为上涨,那么1月月线上涨的概率为76%。然而,所有月份K线上涨的概率都为65%,因此这只是具有一个小幅的促进作用的开端(开局)。但如果它有一个良好的开局,整个年度上涨的概率更大也就有了合理的解释。

如果一月份前五个交易日K线总体为下跌,那么1月月线下跌的概率为60%,而不是35%。

如果1月价格总体上涨,则全年上涨的概率为82%,从二月到十二月的平均收益为8.5%。这是合理的,因为该年本来就有67%的机会上涨,这又是一个良好开端(开局)增加整个年度上涨概率的例子。

如果1月价格总体下跌,那么从二月到十二月的平均收益仅为1.7%,而全年价格总体下跌的机会为58%,而不是通常的33%。

- On average, every year has a 67% chance of closing above where it opened and only 33% chance of being down.

- If the 1st 5 days of January are up, January is up 76% of the time. However, all months are up 65% of the time, so this is only a small improvement. If it has a head start, it makes sense that the odds for the entire year being up are better.

- If the first 5 days are negative, Jan is down 60% of the time, instead of only 35%.

- If January is up, the year is up 82% of the time, and the average gain from February to December is 8.5%. This makes sense since the year has a 67% of being up anyway, and this is another example of a head start increasing the odds for the entire year.

- If January is down, the average gain from February to December is only 1.7%, and the year has a 58% chance of being down, instead of the usual 33%.

其他日期的趋势倾向 Other calendar tendencies[编辑 | 编辑源代码]

“Sell in May and go away”(五月平仓再远走高飞)是一句至今仍然可靠的谚语。股市大多数的收益都在十月到四月之间实现。

股市有一个“七月四日”上涨的倾向(即在美国国庆节),但这更可能是第二季度的结束所带来的影响。在6月26日至7月6日期间,历年有75%的时间出现了反弹行情,其中最佳的时间是6月30日至7月5日。

九月份是债券和标普指数最疲软的月份。然而,平均而言,九月份只比其他月份差1%,而这1%的跌幅可能会在一天内出现。这意味着大部分日子和全年其他时间一样。

市场往往会在劳动节前后反弹,特别是从8月30日至9月5日。

Sell in May and go away” is an adage that is still reliable. The stock market makes most of its gains from October through April.

There is tendency to get a rally at the 4th of July, which might be more due to the end of the 2nd quarter. The period between June 26 and July 6 has a rally 75% of the time, and the best is June 30 to July 5.

September is weakest month for bonds and S&P. However, on average, it is only 1% worse than other months, and that 1% can come in a single day. That means that most of the days are like those during the res of the year.

The market tends to rally around Labor day, especially from August 30 to September 5.

十月和第四季度 October and the 4th quarter[编辑 | 编辑源代码]

10月份有时会出现像1929年和1987年那样的大跌。不过,即使有剧烈的抛售,它通常也会有强劲的收盘表现。11月5日的收盘价在95%的时间里高于10月26日的收盘价。

这在一定程度上是因为这是公募基金的年底,基金会购买股票使其组合看起来更好。这被称为橱窗装饰。基金经理希望确保季度报告显示该基金在季末拥有所有最佳股票。

这使得他们有合理的推诿之词,因此当有人批评他们的业绩不佳时,他们可以声称他们拥有正确的股票,但是随机波动导致了他们的业绩不佳。

“感恩节属于空头,圣诞节属于多头”这句谚语是不可靠的。

在选举年份,即使只有国会选举,大部分涨幅都会在最后1,2周内出现,即从9月中旬开始。而一年中的大部分时间通常都处于一个交易区间。

October sometimes has big down moves like in 1929 and 1987. However, it usually closes strong, even if there is a sharp selloff. The close on November 5 is above the close of October 26 about 95% of the time.

This is in part because it is the end of the year for mutual funds and the funds buy stocks to make their portfolios look good. This is called window dressing. Fund managers want to make sure that the quarterly reports show that the funds owned all of the best stocks at the end of the quarter.

This gives them plausible deniability so that when someone criticizes their bad performance, they can claim that they had the right stocks, but random fluctuations created their bad performance.

The adage “Thanksgiving is owned by the bears and Christmas by the bulls” is not reliable at all.

In election years, even only congressional elections, most of the gains occur in the final 12 weeks, starting in mid-September, and most of the year is usually a trading range.

Dogs of the Dow(道指之犬)股息收益率最高的十个成分股通常被称为道指之犬[6][编辑 | 编辑源代码]

“Dogs of the Dow”理论认为,交易者应该购买去年股息最高的道琼斯工业指数的股票,这是一种价值投资。交易者押注最差的30支道琼斯股票会在今年追赶业绩表现最好的股票。但是,这并不可靠,(有一句古话叫做“一分钱一分货”)你所付出的代价就会对应你所获得的回报。如果你买入了一个遭受重创的股票,并付出较少的代价,那么你所获得的回报也会较少。[7]

The Dogs of the Dow theory says that traders should buy last year’s Dow stocks with the highest dividends. This is a value trade. Traders are betting that the worst Dow 30 stocks will catch up to the great performers this year. This is not reliable, and you get what you pay for. If you are paying little, buying a beaten down stock, you are getting little.

- ↑ 事实上,由于价格行为的本质相同,这些图表几乎无法区分。Charles

- ↑ 联系全文,我感觉这里翻译的并不好

- ↑ A 5 minute chart is a good place to start, and I recommend avoiding any chart where there are more than 20 bars per hour. 这里翻译卡壳了,有点转不过来,等待你们的意见

- ↑ 这些季节性趋势在不同的时间段会有所不同,例如,在某个季节股市可能表现更强劲,而在另一个季节商品市场可能更具优势。Charles

- ↑ 以便我们可以在交易决策中考虑这些趋势。Charles

- ↑ 这里是我去搜wikipedia后添加的。又通过其他网站了解到这个术语用于描述一种投资策略,即在每年的年初,选择前一年道琼斯指数表现最差的十支股票进行投资,认为它们在新的一年中有可能反弹。

- ↑ 另外,还有一句古诗可以形容这个道理,出自唐代诗人李商隐的《无题》:“莫道不消魂,帘卷西风,人比黄花瘦。”意思是说,不要说自己的心灵不为所动,就像黄花那样的瘦弱,只有花开得艳丽,才会有风来吹拂。这同样说明了,如果你所付出的代价很少,那么你所得到的回报也会很少,只有你不断地付出努力,才能换来更好的回报。