Category:1REV:修订间差异

无编辑摘要 |

无编辑摘要 |

||

| (未显示同一用户的13个中间版本) | |||

| 第1行: | 第1行: | ||

''The first reversal of the day | ''The first reversal of the day, a type of [[ORV]]. 1Rev is the first Reversal setup on the day and it usually means there is already a trend (including a [[BGU]] or [[BGD]]) on the day.'' | ||

'' | == ''Bear case: BGU then [[1BRBCL]]'' == | ||

''When there is a BGU (larger than a recent day) and the '''first bar forms a strong reversal bar''' trying to reverse the gap, it can be considered a 1REV.'' ''When there is some doubt as to whether a reversal bar is worth taking, it sometimes helps to see the first five bars of a 1 minute chart. If the 1st five 1 mins bar forms a [[TBRC]] or [[BRMC]], it is sign of strong [[SP]], then it is much more worth taking the 1REV below bar 1 than the case if the first five 1 mins bars are form a TR or [[BBRCH]]. See [https://ninetrans.blogspot.com/2010/12/first-reversal.html more here].'' | |||

== After Initial climactic move == | |||

''The simplest to read kind of first reversal is''<ref>''or the ideal 1REV setup''</ref><ref>https://ninetrans.blogspot.com/2012/03/ideal-first-reversal.html</ref>'':'' | |||

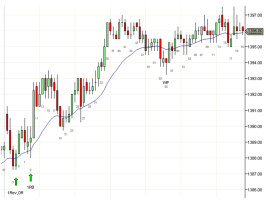

* ''a trend move from open consisting entirely of trend bars that penetrates a | * ''a trend move from open consisting entirely of trend bars that penetrates a [[MSR]] such as [[LOY]], [[HOY]], [[COY]] or EMA ([[20120315]] was both C of prior and EMA)'' <ref>this initial strong move indicates some kind of vacuum test or exhaustive move.</ref>[[文件:20120315ninetrans.png|缩略图|266x266px|''An ideal 1REV''|居中]] | ||

* ''a good reversal signal. If the reversal signal is weak (for example, it has a large entry side tail or is a bar of the wrong color), it is likely to take out the low and try a second time.'' | * ''a good reversal signal. If the reversal signal is weak (for example, it has a large entry side tail or is a bar of the wrong color), it is likely to take out the low and try a second time.'' | ||

''Such a | ''Such a 1REV is often the low of the day and will close near its high so its a good candidate for a day long swing. In practice, if you get a very sharp move (for e.g. b31-35 on [[20120315]]) that looks like an overshoot and gives a decent profit, its a good practice to take some or all off and wait for more price action.'' | ||

[[Category:NINETRANS]] | [[Category:NINETRANS]] | ||

<references /> | |||

[[分类:Case Study]] | |||

2023年4月6日 (四) 01:56的最新版本

The first reversal of the day, a type of ORV. 1Rev is the first Reversal setup on the day and it usually means there is already a trend (including a BGU or BGD) on the day.

Bear case: BGU then 1BRBCL[编辑 | 编辑源代码]

When there is a BGU (larger than a recent day) and the first bar forms a strong reversal bar trying to reverse the gap, it can be considered a 1REV. When there is some doubt as to whether a reversal bar is worth taking, it sometimes helps to see the first five bars of a 1 minute chart. If the 1st five 1 mins bar forms a TBRC or BRMC, it is sign of strong SP, then it is much more worth taking the 1REV below bar 1 than the case if the first five 1 mins bars are form a TR or BBRCH. See more here.

After Initial climactic move[编辑 | 编辑源代码]

The simplest to read kind of first reversal is[1][2]:

- a trend move from open consisting entirely of trend bars that penetrates a MSR such as LOY, HOY, COY or EMA (20120315 was both C of prior and EMA) [3]

- a good reversal signal. If the reversal signal is weak (for example, it has a large entry side tail or is a bar of the wrong color), it is likely to take out the low and try a second time.

Such a 1REV is often the low of the day and will close near its high so its a good candidate for a day long swing. In practice, if you get a very sharp move (for e.g. b31-35 on 20120315) that looks like an overshoot and gives a decent profit, its a good practice to take some or all off and wait for more price action.

- ↑ or the ideal 1REV setup

- ↑ https://ninetrans.blogspot.com/2012/03/ideal-first-reversal.html

- ↑ this initial strong move indicates some kind of vacuum test or exhaustive move.