Testpage4:修订间差异

无编辑摘要 |

无编辑摘要 |

||

| (未显示另一用户的1个中间版本) | |||

| 第1行: | 第1行: | ||

<html> | |||

<head> | |||

<meta http-equiv="content-type" content="text/html; charset=UTF-8"> | |||

<title>Ask Al: Make money following Al Brooks?</title> | |||

</head> | |||

<body> | |||

<meta charset="utf-8"> | |||

<h1 class="entry-title" itemprop="headline" style="font-size: 3rem; | |||

margin: 0px 0px 10px; padding: 0px; text-decoration: none; | |||

font-family: "PT Serif Caption", serif; font-weight: | |||

300; line-height: 1.25; color: rgb(0, 104, 139); font-style: | |||

normal; font-variant-ligatures: normal; font-variant-caps: normal; | |||

letter-spacing: normal; orphans: 2; text-align: start; | |||

text-indent: 0px; text-transform: none; white-space: normal; | |||

widows: 2; word-spacing: 0px; -webkit-text-stroke-width: 0px; | |||

background-color: rgb(255, 255, 255);"><font size="-1">Ask Al: | |||

Make money following Al Brooks?</font></h1> | |||

<p><font size="-1"><br> | |||

</font> | |||

<meta charset="utf-8"> | |||

</p> | |||

<h2 style="margin: 0px 0px 10px; padding: 0px; text-decoration: | |||

none; box-sizing: border-box; font-family: "PT Serif | |||

Caption", serif; font-weight: 300; line-height: 1.25; | |||

font-size: 2.7rem; color: rgb(27, 128, 16); font-style: normal; | |||

font-variant-ligatures: normal; font-variant-caps: normal; | |||

letter-spacing: normal; orphans: 2; text-align: start; | |||

text-indent: 0px; text-transform: none; white-space: normal; | |||

widows: 2; word-spacing: 0px; -webkit-text-stroke-width: 0px; | |||

background-color: rgb(255, 255, 255);"><font size="-1">Make a | |||

living following Al’s trade suggestions?<br style="box-sizing: | |||

border-box;"> | |||

BPA trading room Q&A: February 29, 2016</font></h2> | |||

<p class="content-box-green" style="margin: 0px 0px 20px; padding: | |||

20px; text-decoration: none; box-sizing: border-box; overflow: | |||

hidden; background-color: rgb(217, 237, 194); border: 1px solid | |||

rgb(178, 206, 150); font-family: Verdana, sans-serif; color: | |||

rgb(0, 0, 0); font-size: 1.6rem; font-style: normal; | |||

font-variant-ligatures: normal; font-variant-caps: normal; | |||

font-weight: 400; letter-spacing: normal; orphans: 2; text-align: | |||

start; text-indent: 0px; text-transform: none; white-space: | |||

normal; widows: 2; word-spacing: 0px; -webkit-text-stroke-width: | |||

0px;"><font size="-1">Question: I’m still struggling to make | |||

money. If I just follow your trade suggestions, will I be able | |||

to make a living until I get good?<br> | |||

</font></p> | |||

<font size="-1"><span></span><br> | |||

</font> | |||

<h3 style="margin: 0px 0px 10px; padding: 0px; text-decoration: | |||

none; box-sizing: border-box; font-family: "PT Serif | |||

Caption", serif; font-weight: 300; line-height: 1.25; | |||

font-size: 2.4rem; color: rgb(245, 10, 10); font-style: normal; | |||

font-variant-ligatures: normal; font-variant-caps: normal; | |||

letter-spacing: normal; orphans: 2; text-align: start; | |||

text-indent: 0px; text-transform: none; white-space: normal; | |||

widows: 2; word-spacing: 0px; -webkit-text-stroke-width: 0px; | |||

background-color: rgb(255, 255, 255);"><font size="-1">Do not | |||

follow anyone</font></h3> | |||

<p style="margin: 0px 0px 20px; padding: 0px; text-decoration: none; | |||

box-sizing: border-box; font-family: Verdana, sans-serif; color: | |||

rgb(0, 0, 0); font-size: 1.6rem; font-style: normal; | |||

font-variant-ligatures: normal; font-variant-caps: normal; | |||

font-weight: 400; letter-spacing: normal; orphans: 2; text-align: | |||

start; text-indent: 0px; text-transform: none; white-space: | |||

normal; widows: 2; word-spacing: 0px; -webkit-text-stroke-width: | |||

0px; background-color: rgb(255, 255, 255);"><font size="-1"><a | |||

href="https://www.brookstradingcourse.com/wp-content/uploads/2016/10/ask-al-80-make-money-following-al-brooks.jpg" | |||

target="_blank" style="color: rgb(217, 28, 22); | |||

text-decoration: none; box-sizing: border-box;"><img | |||

decoding="async" loading="lazy" class="alignleft size-medium | |||

wp-image-59166" | |||

src="https://www.brookstradingcourse.com/wp-content/uploads/2016/10/ask-al-80-make-money-following-al-brooks-300x195.jpg" | |||

alt="Ask Al Brooks: Make Money Following Al Brooks" | |||

srcset="https://www.brookstradingcourse.com/wp-content/uploads/2016/10/ask-al-80-make-money-following-al-brooks-300x195.jpg | |||

300w, | |||

https://www.brookstradingcourse.com/wp-content/uploads/2016/10/ask-al-80-make-money-following-al-brooks-768x500.jpg | |||

768w, | |||

https://www.brookstradingcourse.com/wp-content/uploads/2016/10/ask-al-80-make-money-following-al-brooks-600x390.jpg | |||

600w, | |||

https://www.brookstradingcourse.com/wp-content/uploads/2016/10/ask-al-80-make-money-following-al-brooks.jpg | |||

916w" sizes="(max-width: 300px) 100vw, 300px" style="border: | |||

none; max-width: 100%; height: auto; box-sizing: border-box; | |||

float: left; margin: 0px 15px 10px 0px; display: inline;" | |||

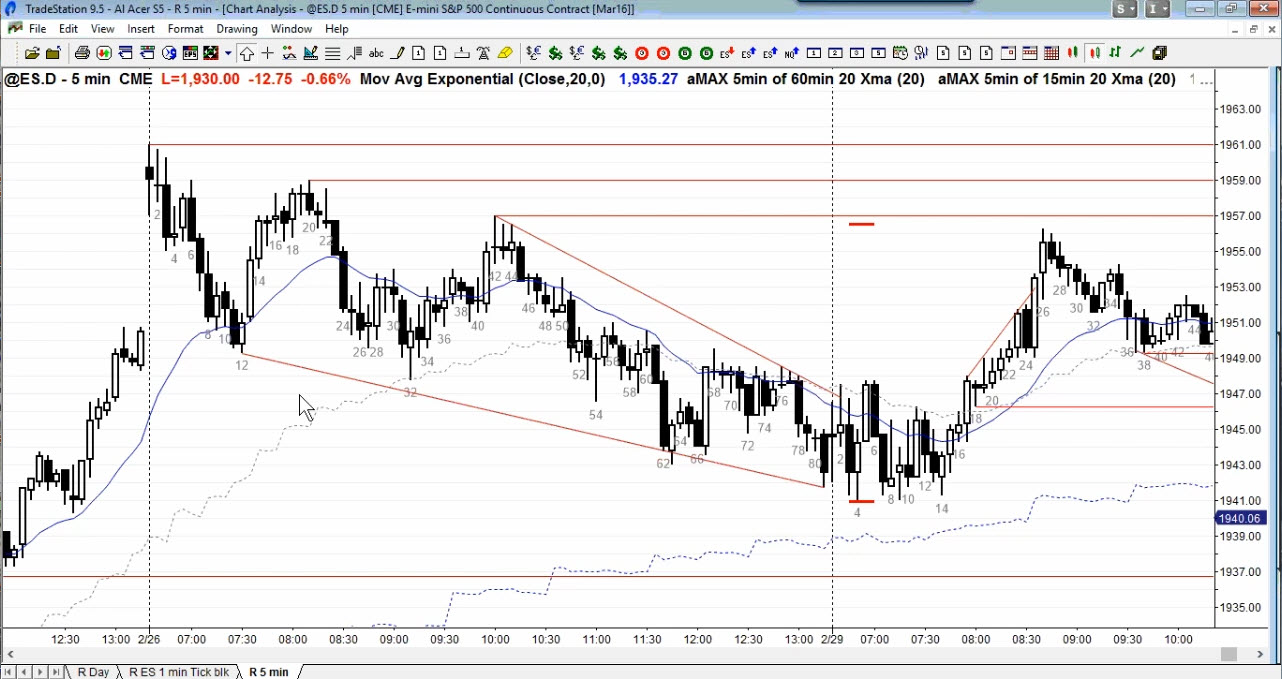

height="195" width="300"></a>I would strongly recommend not | |||

listening to me or not listening to anyone. I think that’s | |||

a really costly mistake because, unless — at some point once I | |||

finish all the course and all the other projects I’ve got going | |||

on, I probably will talk more — you heard me say 14 is probably | |||

a swing buy, good for at least four points, stuff like | |||

that. That’s okay because it’s clear: You buy above | |||

14, you put a stop below 14, and you place a limit order to get | |||

out four points higher. So that’s pretty good.</font></p> | |||

<p style="margin: 0px 0px 20px; padding: 0px; text-decoration: none; | |||

box-sizing: border-box; font-family: Verdana, sans-serif; color: | |||

rgb(0, 0, 0); font-size: 1.6rem; font-style: normal; | |||

font-variant-ligatures: normal; font-variant-caps: normal; | |||

font-weight: 400; letter-spacing: normal; orphans: 2; text-align: | |||

start; text-indent: 0px; text-transform: none; white-space: | |||

normal; widows: 2; word-spacing: 0px; -webkit-text-stroke-width: | |||

0px; background-color: rgb(255, 255, 255);"><font size="-1">But a | |||

lot of times, I’m just taking little scalps all day long — | |||

selling above 32; selling above 37. Through here I did several | |||

little trades in here. And I’m not telling you all the | |||

details. I’m not saying, “Oh, I’m putting a stop here and | |||

I’m not going to let the stop get hit. I’m going to scale | |||

in in this particular case.” I’m not saying any of that.</font></p> | |||

<h3 style="margin: 0px 0px 10px; padding: 0px; text-decoration: | |||

none; box-sizing: border-box; font-family: "PT Serif | |||

Caption", serif; font-weight: 300; line-height: 1.25; | |||

font-size: 2.4rem; color: rgb(245, 10, 10); font-style: normal; | |||

font-variant-ligatures: normal; font-variant-caps: normal; | |||

letter-spacing: normal; orphans: 2; text-align: start; | |||

text-indent: 0px; text-transform: none; white-space: normal; | |||

widows: 2; word-spacing: 0px; -webkit-text-stroke-width: 0px; | |||

background-color: rgb(255, 255, 255);"><font size="-1">Wasting | |||

money</font></h3> | |||

<p style="margin: 0px 0px 20px; padding: 0px; text-decoration: none; | |||

box-sizing: border-box; font-family: Verdana, sans-serif; color: | |||

rgb(0, 0, 0); font-size: 1.6rem; font-style: normal; | |||

font-variant-ligatures: normal; font-variant-caps: normal; | |||

font-weight: 400; letter-spacing: normal; orphans: 2; text-align: | |||

start; text-indent: 0px; text-transform: none; white-space: | |||

normal; widows: 2; word-spacing: 0px; -webkit-text-stroke-width: | |||

0px; background-color: rgb(255, 255, 255);"><font size="-1"><img | |||

decoding="async" loading="lazy" class="alignleft size-full | |||

wp-image-59167" | |||

src="https://www.brookstradingcourse.com/wp-content/uploads/2016/10/trading-clown.jpg" | |||

alt="Make Money Trading Clown" | |||

srcset="https://www.brookstradingcourse.com/wp-content/uploads/2016/10/trading-clown.jpg | |||

300w, | |||

https://www.brookstradingcourse.com/wp-content/uploads/2016/10/trading-clown-150x150.jpg | |||

150w" sizes="(max-width: 300px) 100vw, 300px" style="border: | |||

0px; max-width: 100%; height: auto; box-sizing: border-box; | |||

float: left; margin: 0px 15px 10px 0px; display: inline;" | |||

height="300" width="300">I remember years ago — I forget the | |||

name of the company; maybe it was Essex Trading — I paid them | |||

$3,000 for formulas. I used to subscribe to all kinds of | |||

guru newsletters and hotlines, and a lot of it is just a total | |||

waste of money, right?</font></p> | |||

<p style="margin: 0px 0px 20px; padding: 0px; text-decoration: none; | |||

box-sizing: border-box; font-family: Verdana, sans-serif; color: | |||

rgb(0, 0, 0); font-size: 1.6rem; font-style: normal; | |||

font-variant-ligatures: normal; font-variant-caps: normal; | |||

font-weight: 400; letter-spacing: normal; orphans: 2; text-align: | |||

start; text-indent: 0px; text-transform: none; white-space: | |||

normal; widows: 2; word-spacing: 0px; -webkit-text-stroke-width: | |||

0px; background-color: rgb(255, 255, 255);"><font size="-1">If you | |||

see some clown on television saying, “Gold is going up,” or | |||

“Crude oil is going down,” or “The stock market is going up,” | |||

you cannot make money off of that because you hear me say this | |||

pretty regularly: About 10 percent of the time you can | |||

only make money buying or only make money selling. 90 | |||

percent of the time, you can buy or sell at any point and make | |||

money, if you<span> </span><a | |||

href="https://www.brookstradingcourse.com/how-to-trade-manual/trade-management/" | |||

target="_blank" style="color: rgb(217, 28, 22); | |||

text-decoration: none; box-sizing: border-box;">manage your | |||

trade</a><span> </span>correctly. So 10 percent of | |||

the bars on the chart, the market’s doing this, you can only | |||

make money if you sell. But 90 percent of the bars on the chart | |||

the market’s doing this and you can make money buying or selling | |||

at any time.</font></p> | |||

<p style="margin: 0px 0px 20px; padding: 0px; text-decoration: none; | |||

box-sizing: border-box; font-family: Verdana, sans-serif; color: | |||

rgb(0, 0, 0); font-size: 1.6rem; font-style: normal; | |||

font-variant-ligatures: normal; font-variant-caps: normal; | |||

font-weight: 400; letter-spacing: normal; orphans: 2; text-align: | |||

start; text-indent: 0px; text-transform: none; white-space: | |||

normal; widows: 2; word-spacing: 0px; -webkit-text-stroke-width: | |||

0px; background-color: rgb(255, 255, 255);"><font size="-1">You | |||

know, today we had pretty good swings here and here, so maybe | |||

more than 10 percent is breakout. On a typical day, it’s | |||

like this — you can buy at any point; you can sell at any point | |||

if you use a wide enough stop, and scale in and manage your | |||

trade correctly. </font></p> | |||

<h3 style="margin: 0px 0px 10px; padding: 0px; text-decoration: | |||

none; box-sizing: border-box; font-family: "PT Serif | |||

Caption", serif; font-weight: 300; line-height: 1.25; | |||

font-size: 2.4rem; color: rgb(245, 10, 10); font-style: normal; | |||

font-variant-ligatures: normal; font-variant-caps: normal; | |||

letter-spacing: normal; orphans: 2; text-align: start; | |||

text-indent: 0px; text-transform: none; white-space: normal; | |||

widows: 2; word-spacing: 0px; -webkit-text-stroke-width: 0px; | |||

background-color: rgb(255, 255, 255);"><font size="-1">Teach a man | |||

to fish (trade)</font></h3> | |||

<p style="margin: 0px 0px 20px; padding: 0px; text-decoration: none; | |||

box-sizing: border-box; font-family: Verdana, sans-serif; color: | |||

rgb(0, 0, 0); font-size: 1.6rem; font-style: normal; | |||

font-variant-ligatures: normal; font-variant-caps: normal; | |||

font-weight: 400; letter-spacing: normal; orphans: 2; text-align: | |||

start; text-indent: 0px; text-transform: none; white-space: | |||

normal; widows: 2; word-spacing: 0px; -webkit-text-stroke-width: | |||

0px; background-color: rgb(255, 255, 255);"><font size="-1">So, I | |||

would not worry too much about what I say or about what anybody | |||

else says. You sometimes hear the adage, “You teach a man | |||

to fish. You don’t give him a fish,” and that’s true with | |||

trading, right? Until you’re completely comfortable taking full | |||

responsibility, it’s really hard to make a living. And | |||

everyone — especially if you’re starting out and your account is | |||

not big, it’s easier to say, “Oh my gosh, I am really | |||

desperate. I got to make money doing this. It took | |||

me so much time to save up this money. I don’t want to lose my | |||

other job while I start this job”. There’s just a lot of | |||

personal issues involved, and I can tell you that I believe it’s | |||

extremely difficult to make money, if you have to make money.</font></p> | |||

<h3 style="margin: 0px 0px 10px; padding: 0px; text-decoration: | |||

none; box-sizing: border-box; font-family: "PT Serif | |||

Caption", serif; font-weight: 300; line-height: 1.25; | |||

font-size: 2.4rem; color: rgb(245, 10, 10); font-style: normal; | |||

font-variant-ligatures: normal; font-variant-caps: normal; | |||

letter-spacing: normal; orphans: 2; text-align: start; | |||

text-indent: 0px; text-transform: none; white-space: normal; | |||

widows: 2; word-spacing: 0px; -webkit-text-stroke-width: 0px; | |||

background-color: rgb(255, 255, 255);"><font size="-1">Desperate | |||

to make money</font></h3> | |||

<p style="margin: 0px 0px 20px; padding: 0px; text-decoration: none; | |||

box-sizing: border-box; font-family: Verdana, sans-serif; color: | |||

rgb(0, 0, 0); font-size: 1.6rem; font-style: normal; | |||

font-variant-ligatures: normal; font-variant-caps: normal; | |||

font-weight: 400; letter-spacing: normal; orphans: 2; text-align: | |||

start; text-indent: 0px; text-transform: none; white-space: | |||

normal; widows: 2; word-spacing: 0px; -webkit-text-stroke-width: | |||

0px; background-color: rgb(255, 255, 255);"><font size="-1">If | |||

you’re really desperate to make money, it’s really hard to make | |||

money because you’re going to be miserable. You’re going to make | |||

mistakes, and you’re going be only worried about risk, and there | |||

are three variables —<span> </span><a | |||

href="http://www.investopedia.com/articles/stocks/11/calculating-risk-reward.asp" | |||

target="_blank" rel="noopener" style="color: rgb(217, 28, 22); | |||

text-decoration: none; box-sizing: border-box;">risk, reward, | |||

and probability</a>. A person who’s desperate to make | |||

money only sees one variable: Risk. “I can’t afford | |||

to lose,” right? One point, two points, “I — I got to get | |||

out,” right? Even though the market might call for a stop | |||

that’s five points above. So you sell the 58 close and you say, | |||

“I can only risk a point or two,” and then it starts to go up | |||

here and you get out, right? If you take – if you’re | |||

selling the 58 close, your stop is up there, period. | |||

That’s it, right? If you’re buying the 17 close, your stop | |||

may be down here. I think more around here. So | |||

that’s it; so if you take that trade, that’s where your stop is.</font></p> | |||

<h3 style="margin: 0px 0px 10px; padding: 0px; text-decoration: | |||

none; box-sizing: border-box; font-family: "PT Serif | |||

Caption", serif; font-weight: 300; line-height: 1.25; | |||

font-size: 2.4rem; color: rgb(245, 10, 10); font-style: normal; | |||

font-variant-ligatures: normal; font-variant-caps: normal; | |||

letter-spacing: normal; orphans: 2; text-align: start; | |||

text-indent: 0px; text-transform: none; white-space: normal; | |||

widows: 2; word-spacing: 0px; -webkit-text-stroke-width: 0px; | |||

background-color: rgb(255, 255, 255);"><font size="-1">Thinking | |||

risk only</font></h3> | |||

<p style="margin: 0px 0px 20px; padding: 0px; text-decoration: none; | |||

box-sizing: border-box; font-family: Verdana, sans-serif; color: | |||

rgb(0, 0, 0); font-size: 1.6rem; font-style: normal; | |||

font-variant-ligatures: normal; font-variant-caps: normal; | |||

font-weight: 400; letter-spacing: normal; orphans: 2; text-align: | |||

start; text-indent: 0px; text-transform: none; white-space: | |||

normal; widows: 2; word-spacing: 0px; -webkit-text-stroke-width: | |||

0px; background-color: rgb(255, 255, 255);"><font size="-1">And if | |||

a person’s only thinking about risk, they’re saying, “Well, I | |||

know that’s where Al says that’s where the stop goes, but maybe | |||

I’ll buy the 17 close and take a chance that it will just go | |||

straight up and I’ll put a one-point stop in.” Then you get | |||

stopped on 18, and you lost money buying. You made a | |||

really smart trade; you know, you bought the market that’s | |||

probably going up, but you managed it wrong because all you saw | |||

was risk and you did not want to lose more than a point.</font></p> | |||

<h3 style="margin: 0px 0px 10px; padding: 0px; text-decoration: | |||

none; box-sizing: border-box; font-family: "PT Serif | |||

Caption", serif; font-weight: 300; line-height: 1.25; | |||

font-size: 2.4rem; color: rgb(245, 10, 10); font-style: normal; | |||

font-variant-ligatures: normal; font-variant-caps: normal; | |||

letter-spacing: normal; orphans: 2; text-align: start; | |||

text-indent: 0px; text-transform: none; white-space: normal; | |||

widows: 2; word-spacing: 0px; -webkit-text-stroke-width: 0px; | |||

background-color: rgb(255, 255, 255);"><font size="-1">Talking | |||

costs money</font></h3> | |||

<p style="margin: 0px 0px 20px; padding: 0px; text-decoration: none; | |||

box-sizing: border-box; font-family: Verdana, sans-serif; color: | |||

rgb(0, 0, 0); font-size: 1.6rem; font-style: normal; | |||

font-variant-ligatures: normal; font-variant-caps: normal; | |||

font-weight: 400; letter-spacing: normal; orphans: 2; text-align: | |||

start; text-indent: 0px; text-transform: none; white-space: | |||

normal; widows: 2; word-spacing: 0px; -webkit-text-stroke-width: | |||

0px; background-color: rgb(255, 255, 255);"><font size="-1">But | |||

going back to your question. I think it’s really impossible to | |||

make money listening to somebody else unless they’re saying | |||

every little thing that they’re doing. And I — I can’t do it | |||

because I take so many trades during the day, and if I’m talking | |||

as I’m trying to make a decision about “Do I move the stop | |||

here? Do I get out there? Do I just get out with | |||

just two ticks? Do I try to hold for two points?” you | |||

know, I cannot do both. It will cost me too much money.</font></p> | |||

<p style="margin: 0px 0px 20px; padding: 0px; text-decoration: none; | |||

box-sizing: border-box; font-family: Verdana, sans-serif; color: | |||

rgb(0, 0, 0); font-size: 1.6rem; font-style: normal; | |||

font-variant-ligatures: normal; font-variant-caps: normal; | |||

font-weight: 400; letter-spacing: normal; orphans: 2; text-align: | |||

start; text-indent: 0px; text-transform: none; white-space: | |||

normal; widows: 2; word-spacing: 0px; -webkit-text-stroke-width: | |||

0px; background-color: rgb(255, 255, 255);"><font size="-1">Sometimes, | |||

you get bars like 14 or even 27 that, you can just say, you buy | |||

above 14, stop above low 14, and hold for 4 points. Or you sell | |||

below 27, stop above 27, and you get out at the 24 or 25 low. | |||

Those things you can say because you said the whole package; you | |||

said where the stop is, you said where the limit order is, you | |||

said where the entry is. But most of the trades I take | |||

during the day, that’s not what I’m trying to do; I’m trying to | |||

get out with one point or two points.</font></p> | |||

<h3 style="margin: 0px 0px 10px; padding: 0px; text-decoration: | |||

none; box-sizing: border-box; font-family: "PT Serif | |||

Caption", serif; font-weight: 300; line-height: 1.25; | |||

font-size: 2.4rem; color: rgb(245, 10, 10); font-style: normal; | |||

font-variant-ligatures: normal; font-variant-caps: normal; | |||

letter-spacing: normal; orphans: 2; text-align: start; | |||

text-indent: 0px; text-transform: none; white-space: normal; | |||

widows: 2; word-spacing: 0px; -webkit-text-stroke-width: 0px; | |||

background-color: rgb(255, 255, 255);"><font size="-1">Small risk, | |||

big reward</font></h3> | |||

<p style="margin: 0px 0px 20px; padding: 0px; text-decoration: none; | |||

box-sizing: border-box; font-family: Verdana, sans-serif; color: | |||

rgb(0, 0, 0); font-size: 1.6rem; font-style: normal; | |||

font-variant-ligatures: normal; font-variant-caps: normal; | |||

font-weight: 400; letter-spacing: normal; orphans: 2; text-align: | |||

start; text-indent: 0px; text-transform: none; white-space: | |||

normal; widows: 2; word-spacing: 0px; -webkit-text-stroke-width: | |||

0px; background-color: rgb(255, 255, 255);"><font size="-1">Sometimes | |||

I’ll take finesse trades where there’s some unusual situation | |||

where the risk is really not all that big and the reward is big. | |||

Or the actual risk is not big, the initial risk is big. I’m | |||

using a wide stop, but I’m never going to let the stop be | |||

hit. In terms of actual risk, the actual risk is small and | |||

the reward is big. So I don’t know. I hope I’m answering | |||

your question, but I really think looking for a God or savior to | |||

protect you, so that you don’t lose money is not going do it. | |||

That’s not what you need. What you need is practice and | |||

you got to get a lot of trades under your belt before you start | |||

feeling comfortable that you can do this. And depending on | |||

someone else to hold your hand as you do it, that’s just not | |||

going to work.</font></p> | |||

<h3 style="margin: 0px 0px 10px; padding: 0px; text-decoration: | |||

none; box-sizing: border-box; font-family: "PT Serif | |||

Caption", serif; font-weight: 300; line-height: 1.25; | |||

font-size: 2.4rem; color: rgb(245, 10, 10); font-style: normal; | |||

font-variant-ligatures: normal; font-variant-caps: normal; | |||

letter-spacing: normal; orphans: 2; text-align: start; | |||

text-indent: 0px; text-transform: none; white-space: normal; | |||

widows: 2; word-spacing: 0px; -webkit-text-stroke-width: 0px; | |||

background-color: rgb(255, 255, 255);"><font size="-1">Not just | |||

about setups</font></h3> | |||

<p style="margin: 0px 0px 20px; padding: 0px; text-decoration: none; | |||

box-sizing: border-box; font-family: Verdana, sans-serif; color: | |||

rgb(0, 0, 0); font-size: 1.6rem; font-style: normal; | |||

font-variant-ligatures: normal; font-variant-caps: normal; | |||

font-weight: 400; letter-spacing: normal; orphans: 2; text-align: | |||

start; text-indent: 0px; text-transform: none; white-space: | |||

normal; widows: 2; word-spacing: 0px; -webkit-text-stroke-width: | |||

0px; background-color: rgb(255, 255, 255);"><font size="-1">I | |||

remember I once hired a tutor. The guy, I still see him out | |||

there, every now and then, at the shows. I think he’s a | |||

total fraud, but he’s still out there and 25 years ago I paid | |||

him, like, $3,000 to come in for the day. And I lost $3,000 with | |||

him sitting by my side that day. So I paid him $3,000, I | |||

lost $3,000. And I started pressing him, “You’re here with | |||

me. You’re not trading. How many days do you go out | |||

and teach? How many days do you trade?” Anyway, what | |||

it came down to was he says he never trades, and so here he is | |||

teaching people how to trade and he’s not a trader. The | |||

guy, he was a fraud. The guy’s a fraud. He’s not in | |||

the game. I was desperate, willing to pay anything to get | |||

somebody to show me how to do it. But even if he showed me one | |||

or two things that day, that still would not have been enough | |||

because those two things would not be there tomorrow, or the | |||

next day, or the next day. There’s a lot more to a trade | |||

than just setups.</font></p> | |||

<h3 style="margin: 0px 0px 10px; padding: 0px; text-decoration: | |||

none; box-sizing: border-box; font-family: "PT Serif | |||

Caption", serif; font-weight: 300; line-height: 1.25; | |||

font-size: 2.4rem; color: rgb(245, 10, 10); font-style: normal; | |||

font-variant-ligatures: normal; font-variant-caps: normal; | |||

letter-spacing: normal; orphans: 2; text-align: start; | |||

text-indent: 0px; text-transform: none; white-space: normal; | |||

widows: 2; word-spacing: 0px; -webkit-text-stroke-width: 0px; | |||

background-color: rgb(255, 255, 255);"><font size="-1">Use correct | |||

stop and targets</font></h3> | |||

<p style="margin: 0px 0px 20px; padding: 0px; text-decoration: none; | |||

box-sizing: border-box; font-family: Verdana, sans-serif; color: | |||

rgb(0, 0, 0); font-size: 1.6rem; font-style: normal; | |||

font-variant-ligatures: normal; font-variant-caps: normal; | |||

font-weight: 400; letter-spacing: normal; orphans: 2; text-align: | |||

start; text-indent: 0px; text-transform: none; white-space: | |||

normal; widows: 2; word-spacing: 0px; -webkit-text-stroke-width: | |||

0px; background-color: rgb(255, 255, 255);"><font size="-1">In | |||

fact, you hear me regularly say — I’ve already said it a few | |||

minutes ago: most of the time, if you use a correct stop and a | |||

profit target, you can make money buying or selling. It’s | |||

obvious when the market is like this, right? You can buy | |||

or sell. You can buy below anything, sell above anything, and | |||

just keep scalping. But most of the time you can do that so you | |||

don’t need someone to say, “Oh Al, buy this,” or “Al, Al, sell | |||

that.” And the stops are always obvious as well, | |||

right? So if you’re buying anywhere in here, your stop is | |||

down here. If you’re selling anywhere in here, your stop | |||

is up there. After this breakout, if you’re selling | |||

anywhere below here, your stop is up here. </font></p> | |||

<h3 style="margin: 0px 0px 10px; padding: 0px; text-decoration: | |||

none; box-sizing: border-box; font-family: "PT Serif | |||

Caption", serif; font-weight: 300; line-height: 1.25; | |||

font-size: 2.4rem; color: rgb(245, 10, 10); font-style: normal; | |||

font-variant-ligatures: normal; font-variant-caps: normal; | |||

letter-spacing: normal; orphans: 2; text-align: start; | |||

text-indent: 0px; text-transform: none; white-space: normal; | |||

widows: 2; word-spacing: 0px; -webkit-text-stroke-width: 0px; | |||

background-color: rgb(255, 255, 255);"><font size="-1">Starting | |||

out</font></h3> | |||

<p style="margin: 0px 0px 20px; padding: 0px; text-decoration: none; | |||

box-sizing: border-box; font-family: Verdana, sans-serif; color: | |||

rgb(0, 0, 0); font-size: 1.6rem; font-style: normal; | |||

font-variant-ligatures: normal; font-variant-caps: normal; | |||

font-weight: 400; letter-spacing: normal; orphans: 2; text-align: | |||

start; text-indent: 0px; text-transform: none; white-space: | |||

normal; widows: 2; word-spacing: 0px; -webkit-text-stroke-width: | |||

0px; background-color: rgb(255, 255, 255);"><font size="-1">So, | |||

any person starting out, they know where the stop is For the | |||

most part if the market’s trending, they see it’s going up and | |||

they know where the stop is, right? So when you buy, you | |||

put your stop, and then you wait until it’s not going up anymore | |||

here. Here, you know it’s going down, so you sell for any | |||

reason at any time. You put your stop up here, and buy back when | |||

it’s no longer going up — maybe above 60, maybe more likely | |||

above 71.</font></p> | |||

<p style="margin: 0px 0px 20px; padding: 0px; text-decoration: none; | |||

box-sizing: border-box; font-family: Verdana, sans-serif; color: | |||

rgb(0, 0, 0); font-size: 1.6rem; font-style: normal; | |||

font-variant-ligatures: normal; font-variant-caps: normal; | |||

font-weight: 400; letter-spacing: normal; orphans: 2; text-align: | |||

start; text-indent: 0px; text-transform: none; white-space: | |||

normal; widows: 2; word-spacing: 0px; -webkit-text-stroke-width: | |||

0px; background-color: rgb(255, 255, 255);"><font size="-1">But | |||

that’s pretty much the simplistic view of the trade, right, and | |||

not worry that somebody’s going to show me, tell me, “Al, move | |||

my stop. Al, move your profit target.” When you look | |||

at the chart, you know where the stop is, right? Now, if | |||

the market’s going up, you know you have to buy. If the | |||

market’s going down, you know you have to sell, and you know | |||

where the stop is. And if you’re going to take the trade, | |||

that’s what you do. When the market’s going up, you just buy and | |||

you put your stop there and just hold on. </font></p> | |||

<h3 style="margin: 0px 0px 10px; padding: 0px; text-decoration: | |||

none; box-sizing: border-box; font-family: "PT Serif | |||

Caption", serif; font-weight: 300; line-height: 1.25; | |||

font-size: 2.4rem; color: rgb(245, 10, 10); font-style: normal; | |||

font-variant-ligatures: normal; font-variant-caps: normal; | |||

letter-spacing: normal; orphans: 2; text-align: start; | |||

text-indent: 0px; text-transform: none; white-space: normal; | |||

widows: 2; word-spacing: 0px; -webkit-text-stroke-width: 0px; | |||

background-color: rgb(255, 255, 255);"><font size="-1">Scaling in</font></h3> | |||

<p style="margin: 0px 0px 20px; padding: 0px; text-decoration: none; | |||

box-sizing: border-box; font-family: Verdana, sans-serif; color: | |||

rgb(0, 0, 0); font-size: 1.6rem; font-style: normal; | |||

font-variant-ligatures: normal; font-variant-caps: normal; | |||

font-weight: 400; letter-spacing: normal; orphans: 2; text-align: | |||

start; text-indent: 0px; text-transform: none; white-space: | |||

normal; widows: 2; word-spacing: 0px; -webkit-text-stroke-width: | |||

0px; background-color: rgb(255, 255, 255);"><font size="-1"><a | |||

href="https://www.brookstradingcourse.com/wp-content/uploads/2016/10/ask-al-80-make-money-scaling-in.jpg" | |||

target="_blank" style="color: rgb(217, 28, 22); | |||

text-decoration: none; box-sizing: border-box;"><img | |||

decoding="async" loading="lazy" class="alignleft size-medium | |||

wp-image-59168" | |||

src="https://www.brookstradingcourse.com/wp-content/uploads/2016/10/ask-al-80-make-money-scaling-in-300x159.jpg" | |||

alt="Ask Al Brooks - Make Money Scaling In" | |||

srcset="https://www.brookstradingcourse.com/wp-content/uploads/2016/10/ask-al-80-make-money-scaling-in-300x159.jpg | |||

300w, | |||

https://www.brookstradingcourse.com/wp-content/uploads/2016/10/ask-al-80-make-money-scaling-in-768x407.jpg | |||

768w, | |||

https://www.brookstradingcourse.com/wp-content/uploads/2016/10/ask-al-80-make-money-scaling-in-600x318.jpg | |||

600w, | |||

https://www.brookstradingcourse.com/wp-content/uploads/2016/10/ask-al-80-make-money-scaling-in.jpg | |||

1282w" sizes="(max-width: 300px) 100vw, 300px" | |||

style="border: none; max-width: 100%; height: auto; | |||

box-sizing: border-box; float: left; margin: 0px 15px 10px | |||

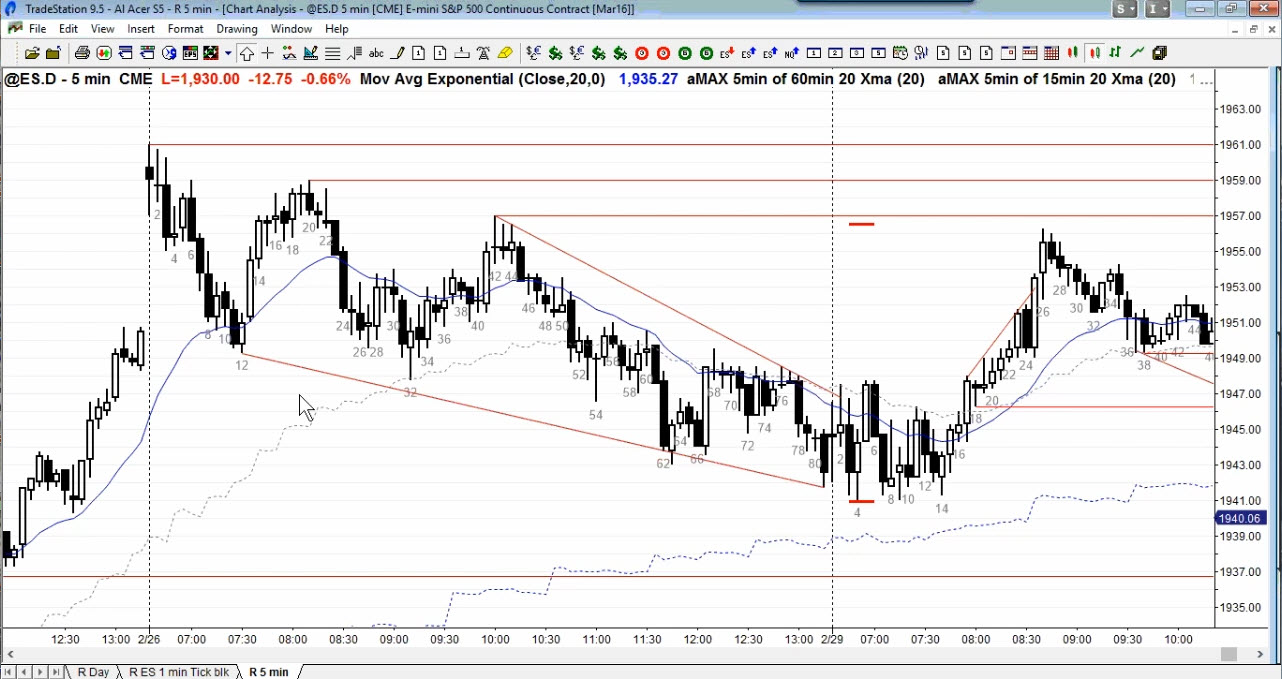

0px; display: inline;" height="159" width="300"></a>It’s | |||

much better if you can scale in, so you buy and you scale in | |||

lower, right, if it goes down, that’s good. I would not | |||

buy up here. I think there’s too much risk of that being | |||

the end. Here, we’re probably going down. We stop at | |||

that high. Theoretically, if you sold anywhere down here — | |||

let’s say you did not get out above 12, which you should have, | |||

right, your stop is up here and you look to scale in as soon as | |||

you get a bear bar to sell more. </font></p> | |||

<p style="margin: 0px 0px 20px; padding: 0px; text-decoration: none; | |||

box-sizing: border-box; font-family: Verdana, sans-serif; color: | |||

rgb(0, 0, 0); font-size: 1.6rem; font-style: normal; | |||

font-variant-ligatures: normal; font-variant-caps: normal; | |||

font-weight: 400; letter-spacing: normal; orphans: 2; text-align: | |||

start; text-indent: 0px; text-transform: none; white-space: | |||

normal; widows: 2; word-spacing: 0px; -webkit-text-stroke-width: | |||

0px; background-color: rgb(255, 255, 255);"><font size="-1">Trading | |||

up through here and you’re buying. This is an example of one of | |||

those Buy The Close bars, and you get disappointed You got to | |||

get out here. But if you sell on the way down, sell here, | |||

sell there, right? Stop goes up here, and you just hold on | |||

until it’s no longer going down. Get out above 62, maybe | |||

get out above 60? – excuse me, 63 – above 64, 66. </font></p> | |||

<h3 style="margin: 0px 0px 10px; padding: 0px; text-decoration: | |||

none; box-sizing: border-box; font-family: "PT Serif | |||

Caption", serif; font-weight: 300; line-height: 1.25; | |||

font-size: 2.4rem; color: rgb(245, 10, 10); font-style: normal; | |||

font-variant-ligatures: normal; font-variant-caps: normal; | |||

letter-spacing: normal; orphans: 2; text-align: start; | |||

text-indent: 0px; text-transform: none; white-space: normal; | |||

widows: 2; word-spacing: 0px; -webkit-text-stroke-width: 0px; | |||

background-color: rgb(255, 255, 255);"><font size="-1">Trading is | |||

easy, really!</font></h3> | |||

<p style="margin: 0px 0px 20px; padding: 0px; text-decoration: none; | |||

box-sizing: border-box; font-family: Verdana, sans-serif; color: | |||

rgb(0, 0, 0); font-size: 1.6rem; font-style: normal; | |||

font-variant-ligatures: normal; font-variant-caps: normal; | |||

font-weight: 400; letter-spacing: normal; orphans: 2; text-align: | |||

start; text-indent: 0px; text-transform: none; white-space: | |||

normal; widows: 2; word-spacing: 0px; -webkit-text-stroke-width: | |||

0px; background-color: rgb(255, 255, 255);"><font size="-1">Trading | |||

is really not that complicated and I think traders learn — if | |||

you just listen to me during the day, I’m telling you the stop | |||

goes here, and you say, “Well, I don’t want to risk that | |||

much.” Well, don’t take the trade, but if you’re going to | |||

take the trade, that’s where the stop goes. And if at the | |||

end of the day you sit down and listen to what I’m saying, | |||

you’ll say, “Hey, wait a minute, what Al said made sense. | |||

You know, if I did buy there and if I did put that stop there or | |||

if I did sell there and I did put that stop there, I would have | |||

made money.” I have to risk more than I wanted to risk, | |||

but I would have made money. So if you can trade small | |||

enough, you can do it. It’s much easier to make money if | |||

you can trade small, and use the correct stops, and not worry | |||

about losing.</font></p> | |||

<h3 style="margin: 0px 0px 10px; padding: 0px; text-decoration: | |||

none; box-sizing: border-box; font-family: "PT Serif | |||

Caption", serif; font-weight: 300; line-height: 1.25; | |||

font-size: 2.4rem; color: rgb(245, 10, 10); font-style: normal; | |||

font-variant-ligatures: normal; font-variant-caps: normal; | |||

letter-spacing: normal; orphans: 2; text-align: start; | |||

text-indent: 0px; text-transform: none; white-space: normal; | |||

widows: 2; word-spacing: 0px; -webkit-text-stroke-width: 0px; | |||

background-color: rgb(255, 255, 255);"><font size="-1">End of day | |||

review</font></h3> | |||

<p style="margin: 0px 0px 20px; padding: 0px; text-decoration: none; | |||

box-sizing: border-box; font-family: Verdana, sans-serif; color: | |||

rgb(0, 0, 0); font-size: 1.6rem; font-style: normal; | |||

font-variant-ligatures: normal; font-variant-caps: normal; | |||

font-weight: 400; letter-spacing: normal; orphans: 2; text-align: | |||

start; text-indent: 0px; text-transform: none; white-space: | |||

normal; widows: 2; word-spacing: 0px; -webkit-text-stroke-width: | |||

0px; background-color: rgb(255, 255, 255);"><font size="-1"><a | |||

href="https://www.brookstradingcourse.com/wp-content/uploads/2016/10/ask-al-80-make-money-daily-chart-review.jpg" | |||

target="_blank" style="color: rgb(217, 28, 22); | |||

text-decoration: none; box-sizing: border-box;"><img | |||

decoding="async" loading="lazy" class="alignleft size-medium | |||

wp-image-59169" | |||

src="https://www.brookstradingcourse.com/wp-content/uploads/2016/10/ask-al-80-make-money-daily-chart-review-300x159.jpg" | |||

alt="Ask Al Brooks - Make Money Daily Chart Review" | |||

srcset="https://www.brookstradingcourse.com/wp-content/uploads/2016/10/ask-al-80-make-money-daily-chart-review-300x159.jpg | |||

300w, | |||

https://www.brookstradingcourse.com/wp-content/uploads/2016/10/ask-al-80-make-money-daily-chart-review-768x408.jpg | |||

768w, | |||

https://www.brookstradingcourse.com/wp-content/uploads/2016/10/ask-al-80-make-money-daily-chart-review-600x319.jpg | |||

600w, | |||

https://www.brookstradingcourse.com/wp-content/uploads/2016/10/ask-al-80-make-money-daily-chart-review.jpg | |||

1275w" sizes="(max-width: 300px) 100vw, 300px" | |||

style="border: none; max-width: 100%; height: auto; | |||

box-sizing: border-box; float: left; margin: 0px 15px 10px | |||

0px; display: inline;" height="159" width="300"></a>Anyway, | |||

I’m talking too much and I’m losing my voice. Okay, I hope | |||

everybody has a good night. This is I think an exhaustive | |||

sell climax. This is huge. I think, even though on the | |||

daily chart today is a pretty good entry bar for the bears, I | |||

still think it’s going to be a two or three-day pullback, and | |||

that in March, in the first week or two, we’ll get above here. | |||

But I think there’ll be sellers up there. A lot of bulls | |||

are looking at this and they’re selling, but some of those bulls | |||

are using stops way, way up here thinking that we may go up a | |||

little higher. I still think the odds are we’re going to | |||

go above Friday’s high. But I would not be surprised if we did | |||

not, but I still think we’ll get one more push up. And that will | |||

probably be it, maybe a wedge, bear flag, one push, two pushes, | |||

pullback, and then three pushes. Two or three weeks from now, | |||

and that will probably be it.</font></p> | |||

<p style="margin: 0px 0px 20px; padding: 0px; text-decoration: none; | |||

box-sizing: border-box; font-family: Verdana, sans-serif; color: | |||

rgb(0, 0, 0); font-size: 1.6rem; font-style: normal; | |||

font-variant-ligatures: normal; font-variant-caps: normal; | |||

font-weight: 400; letter-spacing: normal; orphans: 2; text-align: | |||

start; text-indent: 0px; text-transform: none; white-space: | |||

normal; widows: 2; word-spacing: 0px; -webkit-text-stroke-width: | |||

0px; background-color: rgb(255, 255, 255);"><font size="-1">Okay, | |||

hope everybody has a good night.</font></p> | |||

<p style="margin: 0px 0px 20px; padding: 0px; text-decoration: none; | |||

box-sizing: border-box; font-family: Verdana, sans-serif; color: | |||

rgb(0, 0, 0); font-size: 1.6rem; font-style: normal; | |||

font-variant-ligatures: normal; font-variant-caps: normal; | |||

font-weight: 400; letter-spacing: normal; orphans: 2; text-align: | |||

start; text-indent: 0px; text-transform: none; white-space: | |||

normal; widows: 2; word-spacing: 0px; -webkit-text-stroke-width: | |||

0px; background-color: rgb(255, 255, 255);"><font size="-1"><em | |||

style="box-sizing: border-box;">Al Brooks</em></font></p> | |||

<font size="-1"><br class="Apple-interchange-newline"> | |||

</font> | |||

</body> | |||

</html> | |||

[[Category:BUYING PRESSURE]] | [[Category:BUYING PRESSURE]] | ||

[[Category:SELLING PRESSURE]] | [[Category:SELLING PRESSURE]] | ||

2023年4月4日 (二) 12:58的最新版本

<html> <head>

<meta http-equiv="content-type" content="text/html; charset=UTF-8"> <title>Ask Al: Make money following Al Brooks?</title> </head> <body> <meta charset="utf-8">

Ask Al: Make money following Al Brooks?

<meta charset="utf-8">

Make a

living following Al’s trade suggestions?

BPA trading room Q&A: February 29, 2016

Do not follow anyone

<a

href=" "

target="_blank" style="color: rgb(217, 28, 22);

text-decoration: none; box-sizing: border-box;"><img

decoding="async" loading="lazy" class="alignleft size-medium

wp-image-59166"

src="

"

target="_blank" style="color: rgb(217, 28, 22);

text-decoration: none; box-sizing: border-box;"><img

decoding="async" loading="lazy" class="alignleft size-medium

wp-image-59166"

src=" "

alt="Ask Al Brooks: Make Money Following Al Brooks"

srcset="

"

alt="Ask Al Brooks: Make Money Following Al Brooks"

srcset=" 300w,

300w,

768w,

768w,

600w,

600w,

916w" sizes="(max-width: 300px) 100vw, 300px" style="border:

none; max-width: 100%; height: auto; box-sizing: border-box;

float: left; margin: 0px 15px 10px 0px; display: inline;"

height="195" width="300"></a>I would strongly recommend not

listening to me or not listening to anyone. I think that’s

a really costly mistake because, unless — at some point once I

finish all the course and all the other projects I’ve got going

on, I probably will talk more — you heard me say 14 is probably

a swing buy, good for at least four points, stuff like

that. That’s okay because it’s clear: You buy above

14, you put a stop below 14, and you place a limit order to get

out four points higher. So that’s pretty good.

916w" sizes="(max-width: 300px) 100vw, 300px" style="border:

none; max-width: 100%; height: auto; box-sizing: border-box;

float: left; margin: 0px 15px 10px 0px; display: inline;"

height="195" width="300"></a>I would strongly recommend not

listening to me or not listening to anyone. I think that’s

a really costly mistake because, unless — at some point once I

finish all the course and all the other projects I’ve got going

on, I probably will talk more — you heard me say 14 is probably

a swing buy, good for at least four points, stuff like

that. That’s okay because it’s clear: You buy above

14, you put a stop below 14, and you place a limit order to get

out four points higher. So that’s pretty good.

But a lot of times, I’m just taking little scalps all day long — selling above 32; selling above 37. Through here I did several little trades in here. And I’m not telling you all the details. I’m not saying, “Oh, I’m putting a stop here and I’m not going to let the stop get hit. I’m going to scale in in this particular case.” I’m not saying any of that.

Wasting money

<img

decoding="async" loading="lazy" class="alignleft size-full

wp-image-59167"

src=" "

alt="Make Money Trading Clown"

srcset="

"

alt="Make Money Trading Clown"

srcset=" 300w,

300w,

150w" sizes="(max-width: 300px) 100vw, 300px" style="border:

0px; max-width: 100%; height: auto; box-sizing: border-box;

float: left; margin: 0px 15px 10px 0px; display: inline;"

height="300" width="300">I remember years ago — I forget the

name of the company; maybe it was Essex Trading — I paid them

$3,000 for formulas. I used to subscribe to all kinds of

guru newsletters and hotlines, and a lot of it is just a total

waste of money, right?

150w" sizes="(max-width: 300px) 100vw, 300px" style="border:

0px; max-width: 100%; height: auto; box-sizing: border-box;

float: left; margin: 0px 15px 10px 0px; display: inline;"

height="300" width="300">I remember years ago — I forget the

name of the company; maybe it was Essex Trading — I paid them

$3,000 for formulas. I used to subscribe to all kinds of

guru newsletters and hotlines, and a lot of it is just a total

waste of money, right?

If you see some clown on television saying, “Gold is going up,” or “Crude oil is going down,” or “The stock market is going up,” you cannot make money off of that because you hear me say this pretty regularly: About 10 percent of the time you can only make money buying or only make money selling. 90 percent of the time, you can buy or sell at any point and make money, if you <a href="https://www.brookstradingcourse.com/how-to-trade-manual/trade-management/" target="_blank" style="color: rgb(217, 28, 22); text-decoration: none; box-sizing: border-box;">manage your trade</a> correctly. So 10 percent of the bars on the chart, the market’s doing this, you can only make money if you sell. But 90 percent of the bars on the chart the market’s doing this and you can make money buying or selling at any time.

You know, today we had pretty good swings here and here, so maybe more than 10 percent is breakout. On a typical day, it’s like this — you can buy at any point; you can sell at any point if you use a wide enough stop, and scale in and manage your trade correctly.

Teach a man to fish (trade)

So, I would not worry too much about what I say or about what anybody else says. You sometimes hear the adage, “You teach a man to fish. You don’t give him a fish,” and that’s true with trading, right? Until you’re completely comfortable taking full responsibility, it’s really hard to make a living. And everyone — especially if you’re starting out and your account is not big, it’s easier to say, “Oh my gosh, I am really desperate. I got to make money doing this. It took me so much time to save up this money. I don’t want to lose my other job while I start this job”. There’s just a lot of personal issues involved, and I can tell you that I believe it’s extremely difficult to make money, if you have to make money.

Desperate to make money

If you’re really desperate to make money, it’s really hard to make money because you’re going to be miserable. You’re going to make mistakes, and you’re going be only worried about risk, and there are three variables — <a href="http://www.investopedia.com/articles/stocks/11/calculating-risk-reward.asp" target="_blank" rel="noopener" style="color: rgb(217, 28, 22); text-decoration: none; box-sizing: border-box;">risk, reward, and probability</a>. A person who’s desperate to make money only sees one variable: Risk. “I can’t afford to lose,” right? One point, two points, “I — I got to get out,” right? Even though the market might call for a stop that’s five points above. So you sell the 58 close and you say, “I can only risk a point or two,” and then it starts to go up here and you get out, right? If you take – if you’re selling the 58 close, your stop is up there, period. That’s it, right? If you’re buying the 17 close, your stop may be down here. I think more around here. So that’s it; so if you take that trade, that’s where your stop is.

Thinking risk only

And if a person’s only thinking about risk, they’re saying, “Well, I know that’s where Al says that’s where the stop goes, but maybe I’ll buy the 17 close and take a chance that it will just go straight up and I’ll put a one-point stop in.” Then you get stopped on 18, and you lost money buying. You made a really smart trade; you know, you bought the market that’s probably going up, but you managed it wrong because all you saw was risk and you did not want to lose more than a point.

Talking costs money

But going back to your question. I think it’s really impossible to make money listening to somebody else unless they’re saying every little thing that they’re doing. And I — I can’t do it because I take so many trades during the day, and if I’m talking as I’m trying to make a decision about “Do I move the stop here? Do I get out there? Do I just get out with just two ticks? Do I try to hold for two points?” you know, I cannot do both. It will cost me too much money.

Sometimes, you get bars like 14 or even 27 that, you can just say, you buy above 14, stop above low 14, and hold for 4 points. Or you sell below 27, stop above 27, and you get out at the 24 or 25 low. Those things you can say because you said the whole package; you said where the stop is, you said where the limit order is, you said where the entry is. But most of the trades I take during the day, that’s not what I’m trying to do; I’m trying to get out with one point or two points.

Small risk, big reward

Sometimes I’ll take finesse trades where there’s some unusual situation where the risk is really not all that big and the reward is big. Or the actual risk is not big, the initial risk is big. I’m using a wide stop, but I’m never going to let the stop be hit. In terms of actual risk, the actual risk is small and the reward is big. So I don’t know. I hope I’m answering your question, but I really think looking for a God or savior to protect you, so that you don’t lose money is not going do it. That’s not what you need. What you need is practice and you got to get a lot of trades under your belt before you start feeling comfortable that you can do this. And depending on someone else to hold your hand as you do it, that’s just not going to work.

Not just about setups

I remember I once hired a tutor. The guy, I still see him out there, every now and then, at the shows. I think he’s a total fraud, but he’s still out there and 25 years ago I paid him, like, $3,000 to come in for the day. And I lost $3,000 with him sitting by my side that day. So I paid him $3,000, I lost $3,000. And I started pressing him, “You’re here with me. You’re not trading. How many days do you go out and teach? How many days do you trade?” Anyway, what it came down to was he says he never trades, and so here he is teaching people how to trade and he’s not a trader. The guy, he was a fraud. The guy’s a fraud. He’s not in the game. I was desperate, willing to pay anything to get somebody to show me how to do it. But even if he showed me one or two things that day, that still would not have been enough because those two things would not be there tomorrow, or the next day, or the next day. There’s a lot more to a trade than just setups.

Use correct stop and targets

In fact, you hear me regularly say — I’ve already said it a few minutes ago: most of the time, if you use a correct stop and a profit target, you can make money buying or selling. It’s obvious when the market is like this, right? You can buy or sell. You can buy below anything, sell above anything, and just keep scalping. But most of the time you can do that so you don’t need someone to say, “Oh Al, buy this,” or “Al, Al, sell that.” And the stops are always obvious as well, right? So if you’re buying anywhere in here, your stop is down here. If you’re selling anywhere in here, your stop is up there. After this breakout, if you’re selling anywhere below here, your stop is up here.

Starting out

So, any person starting out, they know where the stop is For the most part if the market’s trending, they see it’s going up and they know where the stop is, right? So when you buy, you put your stop, and then you wait until it’s not going up anymore here. Here, you know it’s going down, so you sell for any reason at any time. You put your stop up here, and buy back when it’s no longer going up — maybe above 60, maybe more likely above 71.

But that’s pretty much the simplistic view of the trade, right, and not worry that somebody’s going to show me, tell me, “Al, move my stop. Al, move your profit target.” When you look at the chart, you know where the stop is, right? Now, if the market’s going up, you know you have to buy. If the market’s going down, you know you have to sell, and you know where the stop is. And if you’re going to take the trade, that’s what you do. When the market’s going up, you just buy and you put your stop there and just hold on.

Scaling in

<a

href=" "

target="_blank" style="color: rgb(217, 28, 22);

text-decoration: none; box-sizing: border-box;"><img

decoding="async" loading="lazy" class="alignleft size-medium

wp-image-59168"

src="

"

target="_blank" style="color: rgb(217, 28, 22);

text-decoration: none; box-sizing: border-box;"><img

decoding="async" loading="lazy" class="alignleft size-medium

wp-image-59168"

src=" "

alt="Ask Al Brooks - Make Money Scaling In"

srcset="

"

alt="Ask Al Brooks - Make Money Scaling In"

srcset=" 300w,

300w,

768w,

768w,

600w,

600w,

1282w" sizes="(max-width: 300px) 100vw, 300px"

style="border: none; max-width: 100%; height: auto;

box-sizing: border-box; float: left; margin: 0px 15px 10px

0px; display: inline;" height="159" width="300"></a>It’s

much better if you can scale in, so you buy and you scale in

lower, right, if it goes down, that’s good. I would not

buy up here. I think there’s too much risk of that being

the end. Here, we’re probably going down. We stop at

that high. Theoretically, if you sold anywhere down here —

let’s say you did not get out above 12, which you should have,

right, your stop is up here and you look to scale in as soon as

you get a bear bar to sell more.

1282w" sizes="(max-width: 300px) 100vw, 300px"

style="border: none; max-width: 100%; height: auto;

box-sizing: border-box; float: left; margin: 0px 15px 10px

0px; display: inline;" height="159" width="300"></a>It’s

much better if you can scale in, so you buy and you scale in

lower, right, if it goes down, that’s good. I would not

buy up here. I think there’s too much risk of that being

the end. Here, we’re probably going down. We stop at

that high. Theoretically, if you sold anywhere down here —

let’s say you did not get out above 12, which you should have,

right, your stop is up here and you look to scale in as soon as

you get a bear bar to sell more.

Trading up through here and you’re buying. This is an example of one of those Buy The Close bars, and you get disappointed You got to get out here. But if you sell on the way down, sell here, sell there, right? Stop goes up here, and you just hold on until it’s no longer going down. Get out above 62, maybe get out above 60? – excuse me, 63 – above 64, 66.

Trading is easy, really!

Trading is really not that complicated and I think traders learn — if you just listen to me during the day, I’m telling you the stop goes here, and you say, “Well, I don’t want to risk that much.” Well, don’t take the trade, but if you’re going to take the trade, that’s where the stop goes. And if at the end of the day you sit down and listen to what I’m saying, you’ll say, “Hey, wait a minute, what Al said made sense. You know, if I did buy there and if I did put that stop there or if I did sell there and I did put that stop there, I would have made money.” I have to risk more than I wanted to risk, but I would have made money. So if you can trade small enough, you can do it. It’s much easier to make money if you can trade small, and use the correct stops, and not worry about losing.

End of day review

<a

href=" "

target="_blank" style="color: rgb(217, 28, 22);

text-decoration: none; box-sizing: border-box;"><img

decoding="async" loading="lazy" class="alignleft size-medium

wp-image-59169"

src="

"

target="_blank" style="color: rgb(217, 28, 22);

text-decoration: none; box-sizing: border-box;"><img

decoding="async" loading="lazy" class="alignleft size-medium

wp-image-59169"

src=" "

alt="Ask Al Brooks - Make Money Daily Chart Review"

srcset="

"

alt="Ask Al Brooks - Make Money Daily Chart Review"

srcset=" 300w,

300w,

768w,

768w,

600w,

600w,

1275w" sizes="(max-width: 300px) 100vw, 300px"

style="border: none; max-width: 100%; height: auto;

box-sizing: border-box; float: left; margin: 0px 15px 10px

0px; display: inline;" height="159" width="300"></a>Anyway,

I’m talking too much and I’m losing my voice. Okay, I hope

everybody has a good night. This is I think an exhaustive

sell climax. This is huge. I think, even though on the

daily chart today is a pretty good entry bar for the bears, I

still think it’s going to be a two or three-day pullback, and

that in March, in the first week or two, we’ll get above here.

But I think there’ll be sellers up there. A lot of bulls

are looking at this and they’re selling, but some of those bulls

are using stops way, way up here thinking that we may go up a

little higher. I still think the odds are we’re going to

go above Friday’s high. But I would not be surprised if we did

not, but I still think we’ll get one more push up. And that will

probably be it, maybe a wedge, bear flag, one push, two pushes,

pullback, and then three pushes. Two or three weeks from now,

and that will probably be it.

1275w" sizes="(max-width: 300px) 100vw, 300px"

style="border: none; max-width: 100%; height: auto;

box-sizing: border-box; float: left; margin: 0px 15px 10px

0px; display: inline;" height="159" width="300"></a>Anyway,

I’m talking too much and I’m losing my voice. Okay, I hope

everybody has a good night. This is I think an exhaustive

sell climax. This is huge. I think, even though on the

daily chart today is a pretty good entry bar for the bears, I

still think it’s going to be a two or three-day pullback, and

that in March, in the first week or two, we’ll get above here.

But I think there’ll be sellers up there. A lot of bulls

are looking at this and they’re selling, but some of those bulls

are using stops way, way up here thinking that we may go up a

little higher. I still think the odds are we’re going to

go above Friday’s high. But I would not be surprised if we did

not, but I still think we’ll get one more push up. And that will

probably be it, maybe a wedge, bear flag, one push, two pushes,

pullback, and then three pushes. Two or three weeks from now,

and that will probably be it.

Okay, hope everybody has a good night.

Al Brooks

</body>

</html>