Four Trades off Nine Transitions:修订间差异

(创建页面,内容为“== Four trades off nine transitions == The market could be moving in only three directions at any time: '''up, down or flat'''. From there, it could transition to any other or have a continuation in the existing direction. '''Therefore there are nine possible transitions''' the price could take. An up to up after a failed down or horizontal move is a trend continuation, an up to down is a trend reversal, the flat to up is a breakout and so on. There is a ki…”) |

(没有差异)

|

2023年3月25日 (六) 23:44的版本

Four trades off nine transitions[编辑 | 编辑源代码]

The market could be moving in only three directions at any time: up, down or flat. From there, it could transition to any other or have a continuation in the existing direction.

Therefore there are nine possible transitions the price could take.

An up to up after a failed down or horizontal move is a trend continuation, an up to down is a trend reversal, the flat to up is a breakout and so on. There is a kind of trade you can enter

at each transition, if you could spot it in time.

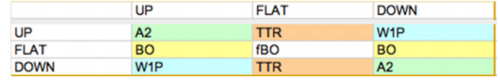

The complete set would look something like this:

As you can see, when a trending market flattens out, you need to exit your positions and stay out. Many traders make the mistake of also reversing their positions, but that can only be done when the reversal is clear such as a wedge reversal or a failed breakout of the previous extreme after a trend line break.

This means there are only four kinds of trades: Reversals, continuations, breakouts and failed breakouts. If you can master detecting and trading these transitions, you are already on your way to success.

Continuations: Most trending days have two or more continuations. Most continuations are A2, which is a 2 legged pullback to the ema. The simplest way to look at an A2 is the second attempt to end the pullback. As long as any of the bars that make up the pullback are near the ema giving an entry slightly above or below it, you can consider it an A2. Another way to define this is two failed attempts to reverse the trend, i.e. failed L2. Note that if your A2 entry is very far from the ema, you may get a 3rd push which turns into a W pullback to the ema. These should be taken just like they were an A2. In a strong trend, you may have H1s and L1s that work, but new traders should just stick to A2.

Reversals: Obvious reversals are rarer on a given day, but the Wedge reversal is likely to be the most successful. The most important requirement of a Wedge reversal is an obvious overshoot (more than 2t) and especially a second overshoot. It takes some experience to correctly read a good Wedge reversal, but the following signs increase the probability of a W reversal:

1. A second overshoot

2. A strong reversal bar or a up/down bar that has no overlap with previous bars or

overlap with the previous swing point

3. A strong entry bar (shaved or small tailed trend bar)

4. The entry bar low is not taken out by more than 1t

5. A one legged move to ema. (A close above the ema may end up giving an A2 long or

short instead of W1P)

If at least three of the above are present, you can take the first higher low for bullish W or first lower high for bear W since that becomes a W1P. If the reversal bar was weak or W entry or W1P signal looks suspicious for example because its a doji or an overlap or large bar, sometimes you get a two legged W1P.

The following decrease the chances of a successful W1P.

1. Overshoot is small (a tick or two) and there is only a single overshoot

2. There is an overshoot but it does not look like extreme behavior (W are extreme

behaviors)

3. W signal and entry bars are weak

The above signs of weakness may imply trend termination into trading range or a pullback and resumption.

Breakouts and failed Breakouts: Breakouts from a trading range are complex and are the hardest to read correctly, especially because most breakouts fail. However, there are certain signs of impending breakouts:

1. A double bottom pullback at the bottom of the range generally means the market may breakout at the top of the range. Similarly a DP at the top implies market will breakout at the bottom.

2. A breakout failure at one end of the trading range may breakout into a trend on the other end of the range, often giving a breakout pullback on the other end.

3. A W move and breakout to one end of the trading range may give a failed breakout, which in turn breaks out from the other end of the range.

In general, its best to trade a breakout pullback after the breakout is successful. If a breakout does not fail after two or three bars then its more likely to give a breakout pullback. If you are a new trader, I suggest concentrating only on A2 till you have mastered it then move to W1P and then to breakouts and failed breakouts.

An exhaustive description of all the above require their own blog posts and I hope to put them here soon.