Category:PWT-O:修订间差异

无编辑摘要 |

无编辑摘要 |

||

| (未显示同一用户的11个中间版本) | |||

| 第1行: | 第1行: | ||

''Parabolic wedge top | ''Parabolic wedge top at the open, a type of BXFO, look for ORVD.'' '''Typically''' in a PWT opening reversal, if it is to reverse successfully, it usually goes down in a '''fairly tight channel for 5 - 10 bars ⚠️''' <ref>49A, slide 11</ref>, if instead it goes '''5 or 6 bars''' and '''sideways''' or '''bounces''' ("a little breakout"<ref>[[笔记:49A Swing Trading Examples]]</ref>, ''for e.g. 3 consecutive bull bars with reasonable size'', this little breakout will increase the chance of trend resumption up''')''', then it is probably '''NOT''' going to be a PWT followed by a strong bear trend (like the one below).[[文件:ES-49A-6.png|thumb|course ES-49A|700x700px|居中]]''Below is an example of '''failed''' PWTFO, notice that after the PWT, market went '''sideways''' instead of a tight bear channel for 5 - 10 bars like the chart above.'' '''This reduces the probability of a top, and increases the probability of a trend resumption up ⚠️'''.[[文件:ES-49A-11.png|thumb|course ES-49A|700x700px|居中]]A lot of times, when you get a parabolic wedge '''selloff''' after the buy climax (PWTFO) (''when this happens it is also a BDBU pattern at the same time'') and it get to LOD, you do get a '''big reversal up (''bounce'')''', market is deciding whether to go for a MM based on the height of the buy climax from the open, or instead either go sideways or bounce in a bull channel (BLCH).[[文件:ES-49A-7.png|thumb|course ES-49A|700x700px|居中]] | ||

[[分类:PWT]] | [[分类:PWT]] | ||

[[分类:PWT]] | [[分类:PWT]] | ||

[[分类:ORVD]] | [[分类:ORVD]] | ||

[[分类:BXFO]] | [[分类:BXFO]] | ||

<references /> | |||

[[分类:FO]] | |||

[[分类:O]] | |||

2024年2月1日 (四) 16:34的最新版本

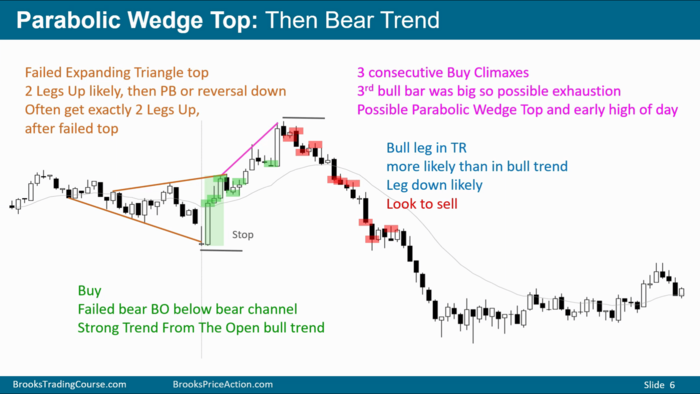

Parabolic wedge top at the open, a type of BXFO, look for ORVD. Typically in a PWT opening reversal, if it is to reverse successfully, it usually goes down in a fairly tight channel for 5 - 10 bars ⚠️ [1], if instead it goes 5 or 6 bars and sideways or bounces ("a little breakout"[2], for e.g. 3 consecutive bull bars with reasonable size, this little breakout will increase the chance of trend resumption up), then it is probably NOT going to be a PWT followed by a strong bear trend (like the one below).

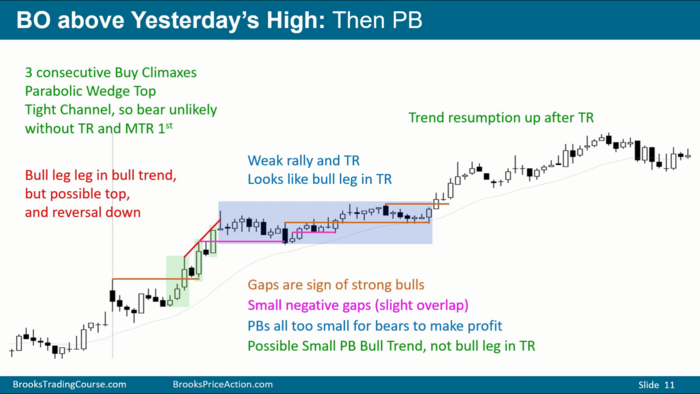

Below is an example of failed PWTFO, notice that after the PWT, market went sideways instead of a tight bear channel for 5 - 10 bars like the chart above. This reduces the probability of a top, and increases the probability of a trend resumption up ⚠️.

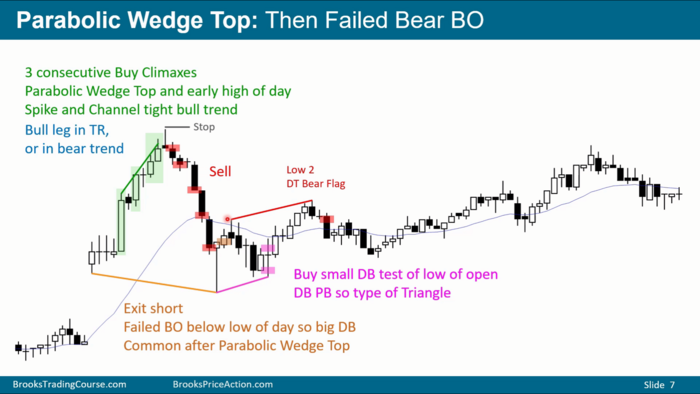

A lot of times, when you get a parabolic wedge selloff after the buy climax (PWTFO) (when this happens it is also a BDBU pattern at the same time) and it get to LOD, you do get a big reversal up (bounce), market is deciding whether to go for a MM based on the height of the buy climax from the open, or instead either go sideways or bounce in a bull channel (BLCH).

- ↑ 49A, slide 11

- ↑ 笔记:49A Swing Trading Examples