Category:BLTP:修订间差异

无编辑摘要 |

无编辑摘要 |

||

| (未显示同一用户的12个中间版本) | |||

| 第1行: | 第1行: | ||

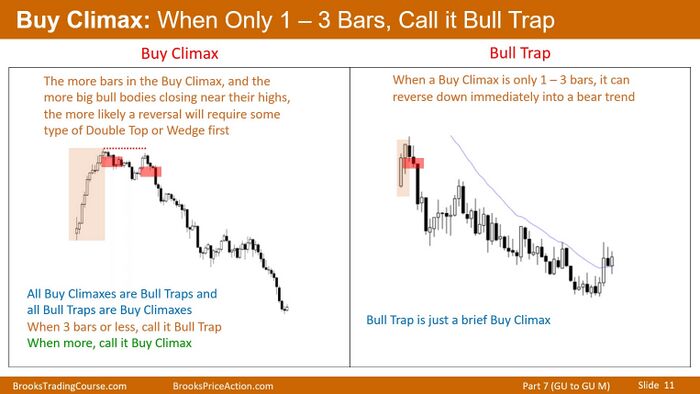

Bull Trap, failed bull breakout. ''Watch out for possible bull traps when:'' | <onlyinclude>Bull Trap, a '''failed bull breakout''', also a small or brief '''buy climax'''<ref>''which is why it can trap bears.''</ref>. All buy climaxes are bull traps and all bull traps are buy climaxes. When 3 bars or less, call it BLTP, when more than 3 bars, call it [[BX]]. </onlyinclude>[[文件:PART7-GU-GU_M-11.jpeg|thumb|PART7-GU-GU_M|700x700像素|居中]]''Watch out for possible bull traps when:'' | ||

* '''''Price is around important [[SR]]''' like EMA or HOY, even sometime there is a strong rally rushing to the SR in 2 or 3 good looking trend bars after gap down, it can be a trap, example of [[20230124]]; another example [[20230322]] bar 10-12;'' | * '''''Price is around important [[SR]]''' like EMA or HOY, even sometime there is a strong rally rushing to the SR in 2 or 3 good looking trend bars after gap down, it can be a trap, example of [[20230124]]; another example [[20230322]] bar 10-12;'' | ||

* ''CCBLB that looks very bullish on the surface, but bars have '''prominent tails and overlaps''', e.g. [[20230124]] 3-5'' | * ''CCBLB that looks very bullish on the surface, but bars have '''prominent tails and overlaps''', e.g. [[20230124]] 3-5'' | ||

* '''''Market reverse quickly right after the stop order is filled''' by 1 or 2 ticks above the | * '''''Market reverse quickly right after the stop order is filled''' by 1 or 2 ticks above the breakout bar(s).'' | ||

''Expect a [[MM]] in opposite direction after the BLTP is confirmed, especially if the day is a trend day or becoming a strong reversal day (e.g. [[20230323]] BLTP 3-20).'' | ''Expect a [[MM]] in opposite direction after the BLTP is confirmed, especially if the day is a trend day or becoming a strong reversal day (e.g. [[20230323]] BLTP 3-20).'' | ||

== ''Examples of Common bull traps'' == | == ''Examples of Common bull traps'' == | ||

=== '' | === ''BLTP on the open at EMA'' === | ||

''In below example of [[20230124]], yesterday had a [[BLTFO]] and a selloff in the afternoon, today morning market had a gap down, followed by a strong bull reversal attempt in 3 good CCBLB from bar 3-5, then bar 6 became a huge BRBCL by just going 1 tick above 5. Notice that bears sold aggressively not far above EMA,'' ''bar'' ''3-5'' ''have'' ''prominent'' ''tails'' ''('''especially bar 2''')'' ''and overlapps,'' ''even'' ''though'' ''they'' ''look like 3 good CCBLB on the surface. If'' ''3/4/5 all only have small tails, hence gaps, 5 will be a better'' ''BTC.'' | ''In below example of [[20230124]], yesterday had a [[BLTFO]] and a selloff in the afternoon, today morning market had a gap down, followed by a strong bull reversal attempt in 3 good CCBLB from bar 3-5, then bar 6 became a huge BRBCL by just going 1 tick above 5. Notice that bears sold aggressively not far above EMA,'' ''bar'' ''3-5'' ''have'' ''prominent'' ''tails'' ''('''especially bar 2''')'' ''and overlapps,'' ''even'' ''though'' ''they'' ''look like 3 good CCBLB on the surface. If'' ''3/4/5 all only have small tails, hence gaps, 5 will be a better'' ''BTC.'' | ||

''if bought above 5 for BTC, the stop should be below 5 at least for half of the position, especially when seeing market quickly reverse down by going 1 tick above 5, that is a good sign of possible BLTP. '''As a general rule, traders should put the stop right below the signal bar no matter where he entered, at least for half of the position, because if things like bar 6 happens in short amount of time, it is likely that market is doing the opposite of what traders want.''''' | ''if bought above 5 for BTC, the stop should be below 5 at least for half of the position, especially when seeing market quickly reverse down by going 1 tick above 5, that is a good sign of possible BLTP. '''As a general rule, traders should put the stop right below the signal bar no matter where he entered, at least for half of the position, because if things like bar 6 happens in short amount of time, it is likely that market is doing the opposite of what traders want.''''' | ||

[[File:20230124pa.png | [[File:20230124pa.png|thumb|799x799px|居中]] | ||

=== ''BLTP in strong bear trend'' === | |||

''Strong bull bar is actually common in strong bear trend, after a selloff, market can give a strong bull bar that BO through [[EMA]], making traders thinking a reversal is underway, but remember market has inertia, it is resistant to change, if it has been in strong bear trend for the day, more likely it will continue the trend. What usually happens in strong bear trend is that the strong bull bar will be sold aggressively at EMA by either profit taking scalping bulls or strong bears initiating new shorts, or both, the result is usually a strong bear bar like 31 on [[20230512]], or consecutive bear bars like bar 48-50, making the prior strong bull bar a bull trap.'' | |||

''Instead of going long, shorting a strong [[BRBCL]] after the strong [[BLBCH]] at EMA is a better choice. The short below 48 on [[20230512]] is a perfect example.'' | |||

[[Category:Traps]] | [[Category:Traps]] | ||

[[分类:Case Study]] | [[分类:Case Study]] | ||

2023年11月3日 (五) 14:02的最新版本

Bull Trap, a failed bull breakout, also a small or brief buy climax[1]. All buy climaxes are bull traps and all bull traps are buy climaxes. When 3 bars or less, call it BLTP, when more than 3 bars, call it BX.

Watch out for possible bull traps when:

- Price is around important SR like EMA or HOY, even sometime there is a strong rally rushing to the SR in 2 or 3 good looking trend bars after gap down, it can be a trap, example of 20230124; another example 20230322 bar 10-12;

- CCBLB that looks very bullish on the surface, but bars have prominent tails and overlaps, e.g. 20230124 3-5

- Market reverse quickly right after the stop order is filled by 1 or 2 ticks above the breakout bar(s).

Expect a MM in opposite direction after the BLTP is confirmed, especially if the day is a trend day or becoming a strong reversal day (e.g. 20230323 BLTP 3-20).

Examples of Common bull traps[编辑 | 编辑源代码]

BLTP on the open at EMA[编辑 | 编辑源代码]

In below example of 20230124, yesterday had a BLTFO and a selloff in the afternoon, today morning market had a gap down, followed by a strong bull reversal attempt in 3 good CCBLB from bar 3-5, then bar 6 became a huge BRBCL by just going 1 tick above 5. Notice that bears sold aggressively not far above EMA, bar 3-5 have prominent tails (especially bar 2) and overlapps, even though they look like 3 good CCBLB on the surface. If 3/4/5 all only have small tails, hence gaps, 5 will be a better BTC.

if bought above 5 for BTC, the stop should be below 5 at least for half of the position, especially when seeing market quickly reverse down by going 1 tick above 5, that is a good sign of possible BLTP. As a general rule, traders should put the stop right below the signal bar no matter where he entered, at least for half of the position, because if things like bar 6 happens in short amount of time, it is likely that market is doing the opposite of what traders want.

BLTP in strong bear trend[编辑 | 编辑源代码]

Strong bull bar is actually common in strong bear trend, after a selloff, market can give a strong bull bar that BO through EMA, making traders thinking a reversal is underway, but remember market has inertia, it is resistant to change, if it has been in strong bear trend for the day, more likely it will continue the trend. What usually happens in strong bear trend is that the strong bull bar will be sold aggressively at EMA by either profit taking scalping bulls or strong bears initiating new shorts, or both, the result is usually a strong bear bar like 31 on 20230512, or consecutive bear bars like bar 48-50, making the prior strong bull bar a bull trap.

Instead of going long, shorting a strong BRBCL after the strong BLBCH at EMA is a better choice. The short below 48 on 20230512 is a perfect example.

- ↑ which is why it can trap bears.

子分类

本分类有以下11个子分类,共有11个子分类。

分类“BLTP”中的页面

以下97个页面属于本分类,共97个页面。

2

- 20180101

- 20180116

- 20190109

- 20200221

- 20200303

- 20200311

- 20200312

- 20200313

- 20200320

- 20200407

- 20200513

- 20200519

- 20200522

- 20200708

- 20200811

- 20200812

- 20200819

- 20200911

- 20201013

- 20201028

- 20201106

- 20201111

- 20201117

- 20201118

- 20201123

- 20201207

- 20201209

- 20201211

- 20201214

- 20201228

- 20210222

- 20210303

- 20210310

- 20210312

- 20210318

- 20210329

- 20210512

- 20210609

- 20210624

- 20210629

- 20210716

- 20210728

- 20210804

- 20210806

- 20210818

- 20210825

- 20211026

- 20211109

- 20211119

- 20211203

- 20211214

- 20220106

- 20220120

- 20220124

- 20220207

- 20220211

- 20220217

- 20220302

- 20220311

- 20220414

- 20220422

- 20220426

- 20220429

- 20220517

- 20220525

- 20220606

- 20220616

- 20220628

- 20220630

- 20220705

- 20220706

- 20220718

- 20220810

- 20220830

- 20220915

- 20221007

- 20221012

- 20221019

- 20221115

- 20221129

- 20221207

- 20221209

- 20221216

- 20221219

- 20230124

- 20230130

- 20230221

- 20230222

- 20230322

- 20230323

- 20230512

- 20230911

- 20231012

- 20231016

- 20231023