Category:BBLCH:修订间差异

无编辑摘要 |

无编辑摘要 |

||

| (未显示同一用户的7个中间版本) | |||

| 第1行: | 第1行: | ||

<onlyinclude>'''Broad bull channel.''' Should be traded same as trading range.</onlyinclude> | |||

== Key features of | Note that by the time traders are confident of broad bull channel, usually not much time left for more swing up, ''so better choice is to look for short''. | ||

* '''Legs up and down lasting mostly 5 to 10 or more bars'''. Some time 10 - 20 bars, usually not enough time to form channel in one day on 5 mins chart. | *Often contain trading ranges separated by brief BO ([[MG|Measuring Gap]]). | ||

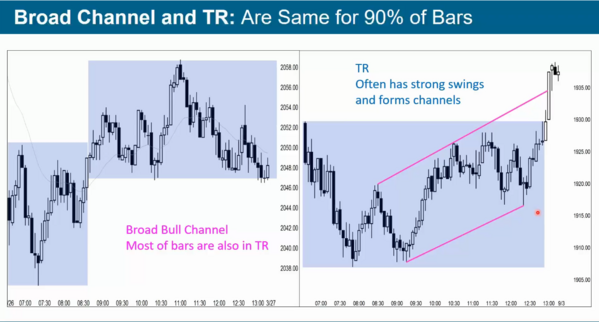

* '''Size of average leg is at least 3 times bigger than [[Smallest Scalp]]'''. | *Most(90%) bars are also in TR. From TR perspective, it often has strong swings<ref>for stop order traders to make money.</ref> and forms channels. Also since it is forming HL and HH, traders know it is also in a trend. | ||

* '''Size of leg is at least 2 - 3 times the size of average bar.''' | *BBLCH often last several days (2 or 3 days). | ||

* One or more selloffs strong enough for many traders to see as AIS. (but as in TR, bulls will buy when market is close to AIS) | *Broad bull channel is usually tight bull channel on higher time frame, if looking to buy and hold, better to just manage the trade on higher time frame chart. This is because traders should only be trading charts with about 100 bars on the screen, but it needs 200+ bars to see the broad bull channel<ref>BTC 45A.</ref>. Since a 5 mins chart only has 81 bars, usually it is not clear to see the BBLCH on a 5 mins chart. Actually BBLCH are much more common on hourly, daily, weekly and monthly charts. | ||

* '''PBs often falls more than 50% and sometimes 90%, and usually overlaps BO point.''' No gaps means bears can make money in bull trend by betting BO will soon reverse enough for scalp, for e.g. selling prior high and scale in higher. | *Usually need 3 legs up and 3 legs down to tell market is in BBLCH. | ||

* '''Bulls and bears can make money using stop entries.''' | *Sometime hard to tell it is in TR or in broad channel | ||

[[File:Broad bull channel.png|none|thumb| | *Price will fall far enough for stop order bears to make money, vice versa. | ||

*When a BBLCH is on 5 mins chart within one day, it is usually a wedge top or a trending TR day. | |||

*Most would trade as a trending TR day, bull BO from bottom TR to upper TR were brief. | |||

===Key features of Broad Bull Channel=== | |||

*'''Legs up and down lasting mostly 5 to 10 or more bars'''. Some time 10 - 20 bars, usually not enough time to form channel in one day on 5 mins chart. | |||

*'''Size of average leg is at least 3 times bigger than [[Smallest Scalp]]'''. | |||

*'''Size of leg is at least 2 - 3 times the size of average bar.''' | |||

*One or more selloffs strong enough for many traders to see as AIS. (but as in TR, bulls will buy when market is close to AIS) | |||

*'''PBs often falls more than 50% and sometimes 90%, and usually overlaps BO point.''' No gaps means bears can make money in bull trend by betting BO will soon reverse enough for scalp, for e.g. selling prior high and scale in higher. | |||

*'''Bulls and bears can make money using stop entries.''' | |||

[[File:Broad bull channel.png|none|thumb|599x599px|Broad bull channel|link=https://www.papals.live//index.php%3Ftitle=File:Broad_bull_channel.png]] | |||

===Usually a wedge top on 5mins chart if within a day=== | |||

[[File:Usually a wedge top on 5 mins chart.png|none|thumb|601x601px|Usually a wedge top on 5 mins chart|link=https://www.papals.live//index.php%3Ftitle=File:Usually_a_wedge_top_on_5_mins_chart.png]] | |||

[[Category:BLCH]] | |||

[[Category: | |||

2023年9月27日 (三) 20:08的最新版本

Broad bull channel. Should be traded same as trading range.

Note that by the time traders are confident of broad bull channel, usually not much time left for more swing up, so better choice is to look for short.

- Often contain trading ranges separated by brief BO (Measuring Gap).

- Most(90%) bars are also in TR. From TR perspective, it often has strong swings[1] and forms channels. Also since it is forming HL and HH, traders know it is also in a trend.

- BBLCH often last several days (2 or 3 days).

- Broad bull channel is usually tight bull channel on higher time frame, if looking to buy and hold, better to just manage the trade on higher time frame chart. This is because traders should only be trading charts with about 100 bars on the screen, but it needs 200+ bars to see the broad bull channel[2]. Since a 5 mins chart only has 81 bars, usually it is not clear to see the BBLCH on a 5 mins chart. Actually BBLCH are much more common on hourly, daily, weekly and monthly charts.

- Usually need 3 legs up and 3 legs down to tell market is in BBLCH.

- Sometime hard to tell it is in TR or in broad channel

- Price will fall far enough for stop order bears to make money, vice versa.

- When a BBLCH is on 5 mins chart within one day, it is usually a wedge top or a trending TR day.

- Most would trade as a trending TR day, bull BO from bottom TR to upper TR were brief.

Key features of Broad Bull Channel[编辑 | 编辑源代码]

- Legs up and down lasting mostly 5 to 10 or more bars. Some time 10 - 20 bars, usually not enough time to form channel in one day on 5 mins chart.

- Size of average leg is at least 3 times bigger than Smallest Scalp.

- Size of leg is at least 2 - 3 times the size of average bar.

- One or more selloffs strong enough for many traders to see as AIS. (but as in TR, bulls will buy when market is close to AIS)

- PBs often falls more than 50% and sometimes 90%, and usually overlaps BO point. No gaps means bears can make money in bull trend by betting BO will soon reverse enough for scalp, for e.g. selling prior high and scale in higher.

- Bulls and bears can make money using stop entries.