Category:BGD:修订间差异

无编辑摘要 |

|||

| 第9行: | 第9行: | ||

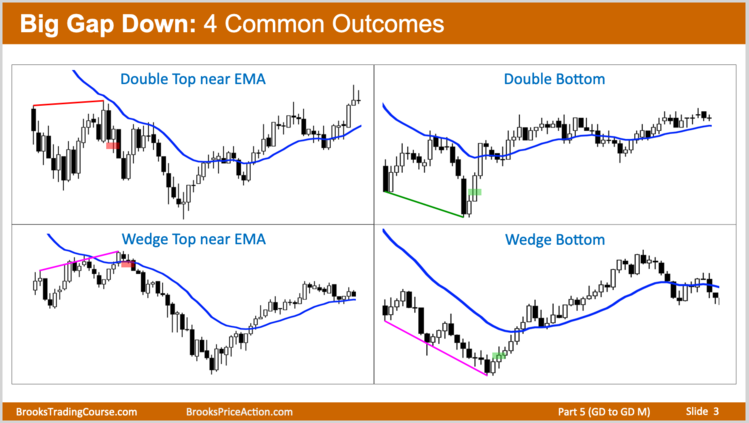

== 4 common outcomes == | == 4 common outcomes == | ||

[[File:BGD 4 Common Patterns.png|thumb|749x749px|alt=| | [[File:BGD 4 Common Patterns.png|thumb|749x749px|alt=| 居中]] | ||

[[Category:Trends]] | [[Category:Trends]] | ||

[[Category:Work In Progress]] | [[Category:Work In Progress]] | ||

2023年5月9日 (二) 13:34的版本

Big Gap Down, should be looked as a big BRBCL, i.e. a strong bear BO. 80% chance of at least one reversal in the first hour. The bears want a double top or wedge top on a pullback to near the EMA. The bulls want a double bottom or wedge bottom for an early low of the day.

When there is BGD, odds favor bears:

- 80%: 85% chance of PB in first 2 hours. 80% chance of at least one reversal attempt in the first hour. (i.e. some kind of TR on the open).

- 70%: 75% chance trending TR day. 70% chance swing down after 1pm ET.

- 60%: 65% chance the gap will not close today. 60% chance of swing down in 1st hour.

- if instead it is going up, often pulls back 50% in wedge bull channel.

Worth to mention, if the gap down is overly big, i.e. a HGD, it increases chance of TRO that lasts a couple hours since it might take that long to get near EMA[1]. Generally, a big gap is a gap that is around the half of the daily range, a huge gap is a gap that is bigger than the daily range.